A time for profiledstructured products

A new generation of risk-profiled solutions

Risk-profiled investments in their most basic form are often used in life insurance unit-linked policies and traditional fundmanagement and investment mandates.They consist of determining a particular asset allocation for the investment - ranging from conservative to aggressive - in order to match a performance target at a defined level of risk.This asset mix prevails until the investment matures.

However, in today's fast changing environment, it becomes increasingly difficult to stick with one single investment profile.

Cutting-edge profiled structured products perfectly address such market timing and asset allocation constraints. Linked to top-rated mutual funds or diversified index baskets, they enable investors to play complementary risk-profiled strategies and benefit from the highest performing allocation. They offer exposure to multi-asset class baskets and, therefore, efficient risk diversification, plus protection of capital.

Optimising asset allocation

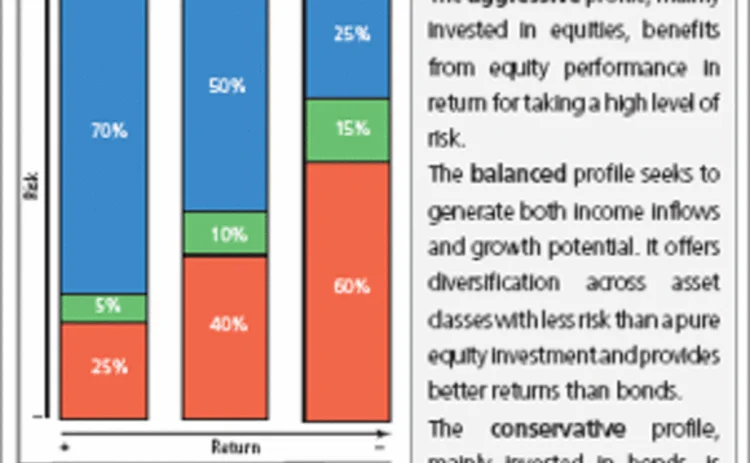

Profiled structured products are "all-in-one" solutions adapted to any investor style and market scenario. They usually give exposure to three risk-profiled baskets linked primarily to equities (aggressive), bonds (conservative) or a mix of both (balanced). Each basket may also comprise non-traditional asset classes, such as commodities, real estate or alternative assets.

These structures are intended as 'peace of mind' solutions. There is no need to choose one investment strategy beforehand or make long-term forecasts as the final return is usually determined by a best-of formula granting automatic exposure to the best performing basket at maturity, whether equity markets have been bullish, uncertain, or bearish.

Here are some of examples of successful best of profiled payoffs:

° Best of three baskets: at maturity, the structure yields the highest of the three profiles' basket performances since inception (averaged annually).

° Average of annual best baskets: each year, the highest performance among the three baskets since inception is retained. At maturity, the structure pays the average of these yearly performances.

° Best of with look-back: each year, the 'start to date' average performance of each basket is measured. The structure pays at maturity the best performance among the three baskets at any fixing date (i.e. the best investment profile at the best time).

Leveraging on innovation

To complete this range of increasingly popular payoffs, BNP Paribas has developed innovative solutions, called best of dynamic profiles, whereby exposure to risky assets within each profiled basket is automatically leveraged on the upside or de-leveraged on the downside throughout the investment time. At maturity, the structure yields the best of the three performances, averaged since inception.

BNP Pariba's new generation of dynamically managed profiled solutions allows investors to customise their own profile during the whole product's life by switching from one strategy to another, or by reshuffling the components of the baskets.These developments open a new era in structured investments because they combine high expertise in asset allocation, autonomy of management and a high level of capital protection.

| Contacts Christian Kwek, global head of structured products marketing. |

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net