Redefining the income proposition

Woolwich Plan Managers, one of the major providers of structured investment products in the UK, has this month launched what we believe to be the next generation of income product.

The Global Distribution Bond’s primary objective is to provide an income yield of 7%, or 2.5% over UK base rates if they are higher; so at the launch date the target income level is 7.25%. The secondary objective is to produce capital growth. An important aspect of the product design is the asset mix in the underlying portfolio. Up to 60% of the portfolio will be invested in equities and the remaining 40% will be invested in bonds. This is a cautious asset mix. The portfolio construction means that, should the equity market fall by 1%, the capital value of the portfolio will fall by just 0.75%.

Investors in the Global Distribution Bond will receive the natural income from the equity and bond portfolio. The Global Distribution Bond also employs a covered call strategy to enhance the potential income that will be received from the portfolio. This strategy retains the possibility of capital growth. The portfolio is actively managed, both in the selection of the underlying assets and in the options overwriting program.

Woolwich Plan Managers’ analysis has shown that, under certain core assumptions the total return from the bond will only be negative if world equity markets fall by more than 10.5%. Not only is the bond less risky than an equity fund, but also it will lose value at a slower rate if markets do fall. The bond achieves this lower risk profile by:

• generating income – mostly by selling some of the upside potential of the market; and

• investing in a conservative portfolio.

The opportunity cost of this strategy is that the bond will not benefit as much from large rises in the equity market (should the equity market total return be more than 11.25%, then an equity fund will generate a higher total return than the bond). However, even with 0% growth, the 7% income target rate is achievable while at the same time preserving capital.

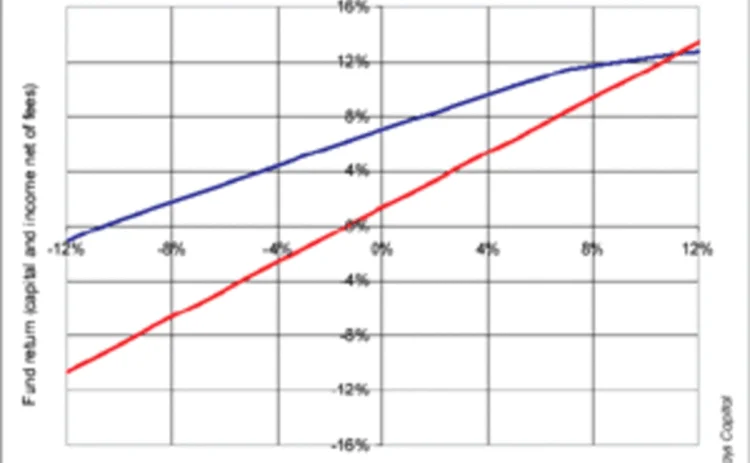

The chart highlights how we expect the bond to behave over a range of potential outcomes.

The key messages one should take from this are:

• if total return is expected to be in double digits, then equity returns will exceed those from the bond;

• if modest returns are expected, which seems to be the prevalent view at the moment, then the bond would be expected to generate a higher return for shareholders; and

• lastly, should the market fall, then the bond would be expected to fall, but by a lesser amount than an equity fund.

To summarise, the bond is expected to perform very well in a flat equity market, and to produce limited losses in a falling market. It will underperform an equity fund if equity returns are high. The bond is well suited to investors who have a strong preference for a high and stable income and some capital growth.

| Contact Colin Dickie, product manager, Woolwich Plan Managers Tel: 0800 085 7929 Email: info@woolwichplanmanagers.com For more information on the Global Distribution Bond, please refer to www.wpmdownloads.com. |

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net