Making life interesting

With volatilities and interest rates at historically low levels, banks must develop interesting and innovative structures on a range of underlyings in order to be successful, according to Rabobank’s YuChen Chan

Finding the right retail product that meets the needs of both distributors and retail clients is a challenge that banks face every day. A product with a short tenor, capital guarantee, conditional coupons and large upfront fees might appeal to a distributor, for example. But the same product might be unpopular with retail clients because of fiscal reasons or the complex payoff structure of the conditional coupons, which may be difficult to understand.

It is of the utmost importance to understand your target clients. Do they expect a capital-guaranteed structure or not? Are they looking for a product that pays annual coupons or growth at maturity? These are issues that need to be considered from the outset.

Clients can choose all sorts of underlyings as the basis for the structure – single stocks, stock indexes, mutual funds, hedge funds, fund of hedge funds, commodities, credit, currency or interest rates are just a few of the choices available. It is crucial to determine which underlying will best fit the client’s requirements at any particular time.

Furthermore, a structure in US dollars would be more attractive at present than a structure in Swiss francs, for example, because of the differences in interest rates. These differences offer opportunities to optimize certain structures when incorporating quanto-effects. It is also widely acknowledged that a 10-year structure will have more gearing than a similar structure with a two-year tenor.

The client’s fiscal background and approach to risk will determine whether they choose structures that are fully capital-guaranteed, partial capital-guaranteed or have no capital guarantee at all on growth or income products.

Private investors in Germany, for example, only differentiate between two structures – those with capital guarantees and those without. The difference is that a capital-guaranteed structure is fully taxed while the other is tax-free if the investor has held it for at least 12 months.

Partial or conditional capital guarantees can be offered in the form of buffers, or so-called airbags. In this case, I will limit myself to describing the examples below.

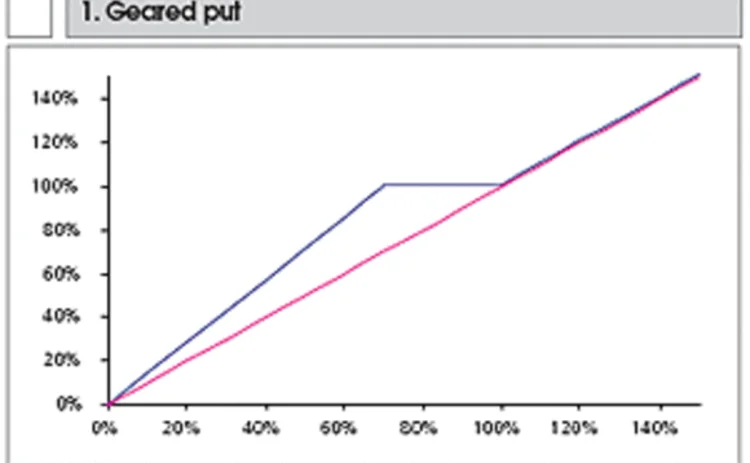

Geared put

As pictured in figure 1, this type of put offers the investor protection down until x level at maturity. After x, the investor participates in the losses with a gearing equal to 100/x calculated from the initial 100% at inception.

Digital airbag

This type of structure offers the investor protection down to x level at maturity. After x, the investor is exposed to the full downside risk.

Knock-in barrier

This type of structure (see figure 2) offers the investor protection until x level. After x, the investor is exposed once again to the full downside risk . The difference between the digital airbag and the knock-in barrier is that protection will disappear as soon as the protection barrier is breached during the lifetime of the product.

During the whole process it is crucial to keep a close eye on market conditions. As mentioned earlier, interest rates as well as volatilities play a key role in the structuring process. At present, interest rates in the eurozone are at extremely low levels, as is the volatility of the main European equity index, the Eurostoxx 50 (see figure 3).

We can illustrate this using the following example.

The product is a five-year Eurostoxx 50 capital-guaranteed note in euros. The five-year euro swap rate is around 3.08%, giving us a zero bond of around 85.90%. A five-year ATM Eurostoxx 50 call costs around 13.6%. This gives a five-year note with a 100% capital guarantee at 99.5%.

Let us assume that the five-year euro swap rate is 5%, as it was in mid-2002 (see figure 4). This will give us a zero bond of around 78.40%. Assuming that the volatility stays the same, we can offer a five-year note with a 100% capital guarantee at the same price of 99.5% with a gearing of 155% ((99.5 – 78.4)/13.6).

Now, let’s have a look at exactly the same structure, but this time denominated in Swiss francs and neglecting quanto effects. The

five-year Swiss franc swap rate is currently 1.88%, which gives us a zero bond of around 91.10%. Assuming that volatility stays the same, we can offer a five-year note in Swiss francs with a 100% capital guarantee at the same price of 99.5%, with a gearing of 61.7% ((99.5 – 91.1)/13.6).

Conclusion

Examples such as the simple Eurostoxx 50 structure above are proving extremely attractive at the moment, as are more tax-efficient structures such as outperformance with partial capital protection and exponential gearing on the upside for German private investors, as well as ladder structures with lock-in features and look-back structures.

This shows us that, with current volatilities and interest rates at such low levels, banks need to develop interesting structures on various underlyings in order to be successful. These structures must take present market conditions into account and provide payoffs that appeal to clients. Investors would be better off buying long-volatility products rather than short-volatility ones such as Altiplano or Magnum structures. Because of such conditions, the market has witnessed increased demand for mutual funds and fund of hedge funds to be used in structured products, in addition to the traditional equity derivative underlyings.

YuChen Chan is an associate director of institutional equity and fund derivatives sales, responsible for the German-speaking region, at Rabobank Securities in London. He can be contacted at Yuchen.Chan@rabobank.com

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…