Indian convertible bond issuance soars while rest of Asia slumps

Analysts attribute growth to a buoyant Indian equity market and improving fundamentals of leading corporates

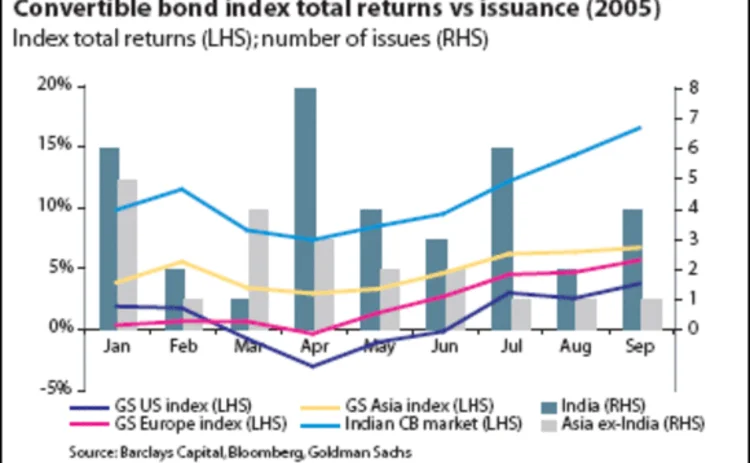

Indian foreign currency convertible bond primary issuance has taken the market by storm this year. Third-quarter issuance from the country exceeded that from the rest of Asia combined for the first time ever and so far this year India has been responsible for the largest single issue in the region.

According to Barclays Capital, Indian issuers launched $2.57 billion in convertible bonds (of at least $50 million in size) by the end of September, a figure that represents 38% of the Asian total. An Indian company, Housing Development Finance Corp, also issued the largest Asian convertible of the year in August, a $500 million bond led by ABN Amro, Barclays Capital, Citigroup and JPMorgan. "That is large for anywhere and it is a ground-breaking deal as it represented roughly a quarter of the total pre-existing Indian market," says Luke Olsen, in BarCap's convertibles research team in London.

India posted its strongest year of issuance in 2004 at $2.7 billion and forecasts for this year suggest the market could rise to between $3 billion and $5 billion. BarCap estimates the market's total capitalisation at $5.33 billion from 65 bonds. Although this pales in comparison with the US's $270 billion and Europe's $127 billion, the Indian market has grown twenty-fold since 2002.

A weak issuance environment in the rest of Asia has made Indian issuance levels stand out all the more. Volumes from Taiwan, one of the leading issuers of convertible bonds, have slowed due to an underperforming equity market, fears of interest rate hikes and the general trend of companies not requiring funding.

For Marcus Weston, senior convertible bond analyst at Nomura International in Hong Kong, this factor has worked in India's favour, driving the largest growth market within Asia. He mainly attributes the rise in issuance to the soaring performance of the Indian equity market, with the Sensex up 25% already in 2005 and up 180% over the course of the last four years.

An expanding economy is also benefiting issuers, as India posted 6.9% real GDP growth in full-year 2004 (end-March 2005) and could notch up another 7% in 2005, according to the Nomura economics team. Improving credit fundamentals and balance sheets of many Indian blue-chip firms have resulted in additional capacity to take on more debt and companies have looked to capitalise on the growing economy by increasing their capex requirements.

This has led to issuers looking at the convertible market as a means to fund expansion. "Issuers can achieve a very low coupon with convertible bonds, which are a great way to monetise the equity volatility," says BarCap's Olsen.

About 97% of Indian convertibles are US dollar denominated. One reason why Indian borrowers have tapped the dollar market is due to low interest rates compared with the local market where Indian rupee rates are higher for Treasuries and loans, explains Olsen. Also launching foreign currency convertibles is a straightforward route to overseas investors, a client base that has been on the hunt for yield in the credit markets this year.

Global convertible and pure credit funds have flocked to Indian paper, attracted by an upsurge in returns of 16% in the last 12 months versus a global average of just 5.3%. "The amount of international capital that can look at attractively priced convertible bonds is very significant and with companies looking to tap the market for low-cost funds, it is a great match," adds Olsen.

Nomura's Weston says that India offers investors scarcity value as the country is a relative newcomer to the market, and diversification potential into new sectors such as pharmaceuticals and auto companies. In addition, India has historically been less affected by global cycles than other economies in Asia, adding to its diversification benefit for global portfolios.

Hardeep Dhillon

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…