This article was paid for by a contributing third party.More Information.

Forging a third way: Bringing efficiencies and standardisation to the non-cleared swaps market

Key points

- The introduction of margin requirements for non-cleared derivatives is widely believed to have increased costs and reduced liquidity in non-cleared derivatives.

- Market participants trading non-cleared derivatives would like to access the benefits of central clearing, but recognise that costs and risk considerations explain why clearing has not taken off in certain products, such as swaptions and cross-currency swaps, even where clearing is available.

- Dealers are concerned that it is more expensive to clear cross-currency swaps than keep the product non-cleared due to bilateral margin rules that exempt certain risk features of the product from initial margin.

- “There is always going to be a non-cleared market, so the real challenge is how to make this market more efficient and standardised,” says LCH SwapAgent’s Nathan Ondyak.

- SwapAgent offers market participants a third way, in which they access many of the benefits of clearing without having to novate to a CCP.

A survey conducted by Risk in association with LCH SwapAgent highlighted concerns about declining liquidity in non-cleared interest rate derivatives, with market participants calling for greater opportunities for standardisation and optimisation

The introduction of mandatory central clearing of over-the-counter (OTC) derivatives during the past decade has been one of the most sweeping structural changes in the industry’s history. It has significantly reduced counterparty risk and brought unprecedented efficiencies to post-trade processing and trade settlement.

Roughly 76% of notional outstanding volume in OTC interest rate swaps is now centrally cleared, according to estimates by the Bank for International Settlements, while LCH SwapClear regularly clears more than $1 trillion in notional per day. Despite this progress, a sizeable chunk of the market is still ineligible for central clearing, and therefore cannot access its risk benefits.

The bifurcation of the market into cleared and non-cleared contracts is an inevitable consequence of the attractions of central clearing, and the reality is that many products remain unsuited to clearing. While regulators have sought to shift as much volume as possible to clear through central counterparties (CCPs), products ineligible for central clearing have come to occupy their own subset of the market.

There is growing recognition of the need to bring the benefits of clearing to the non-cleared market, or risk the further decline of liquidity in certain products.

“There is always going to be a non-cleared market, so the real challenge is how to make it more efficient and standardised. What we’re hearing from members and their clients is definite demand for a third way to reap the benefits of clearing without having to novate to a CCP,” says Nathan Ondyak, global head of LCH SwapAgent.

Non-cleared market at breaking point

Regulators always recognised the impossibility of moving all OTC derivatives into a cleared environment, given that some products are not sufficiently liquid or standardised for central clearing. This led to a global regulatory initiative to introduce margin requirements for non-cleared derivatives, to ensure that counterparty risk would still be properly managed for products not eligible for clearing.

After years of preparation, the first phase of counterparties began posting initial margin (IM) and variation margin (VM) in September 2016, with the rest of the market being phased in gradually over a four-year period. But, despite the risk mitigation benefits of IM and VM, there are signs that all is still not well in the non-cleared market.

The introduction of margin requirements for non-centrally cleared products means that participants have had to renegotiate their credit support annexes (CSAs), which set out the legal terms for the exchange of collateral. That process is costly and time-consuming, and significant changes to back-office systems are required to enable the posting of margin.

In addition to the costs and resources associated with posting margin, cross-currency swaps and swaptions – which comprise the bulk of the non‑cleared rates market – tend to be capital‑intensive under Basel III. With rising costs on all sides, it should come as no surprise that these products are becoming less popular, and liquidity is widely reported to be in decline.

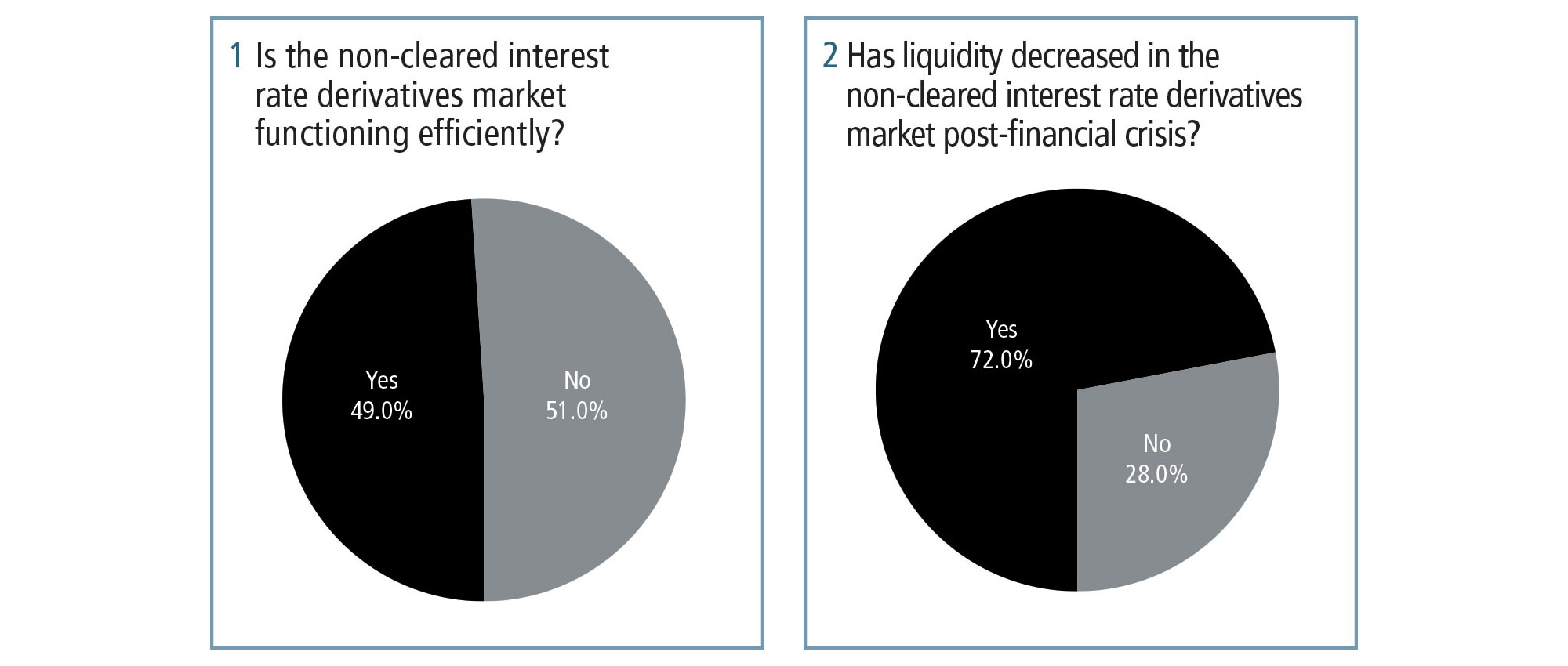

In a global survey of investment banks, asset managers and funds conducted by Risk.net and LCH SwapAgent earlier this year, more than half of respondents claimed the non-cleared interest rate derivatives market is not working efficiently, while 72% felt liquidity had declined since the financial crisis (see figures 1 and 2).

“There is overwhelming evidence from banks, buy-side firms and brokers that liquidity in cross-currency swaps has reduced. These products are very capital-intensive under Basel III, so there has been a natural decline in trading,” says LCH SwapAgent’s Ondyak.

Rising costs

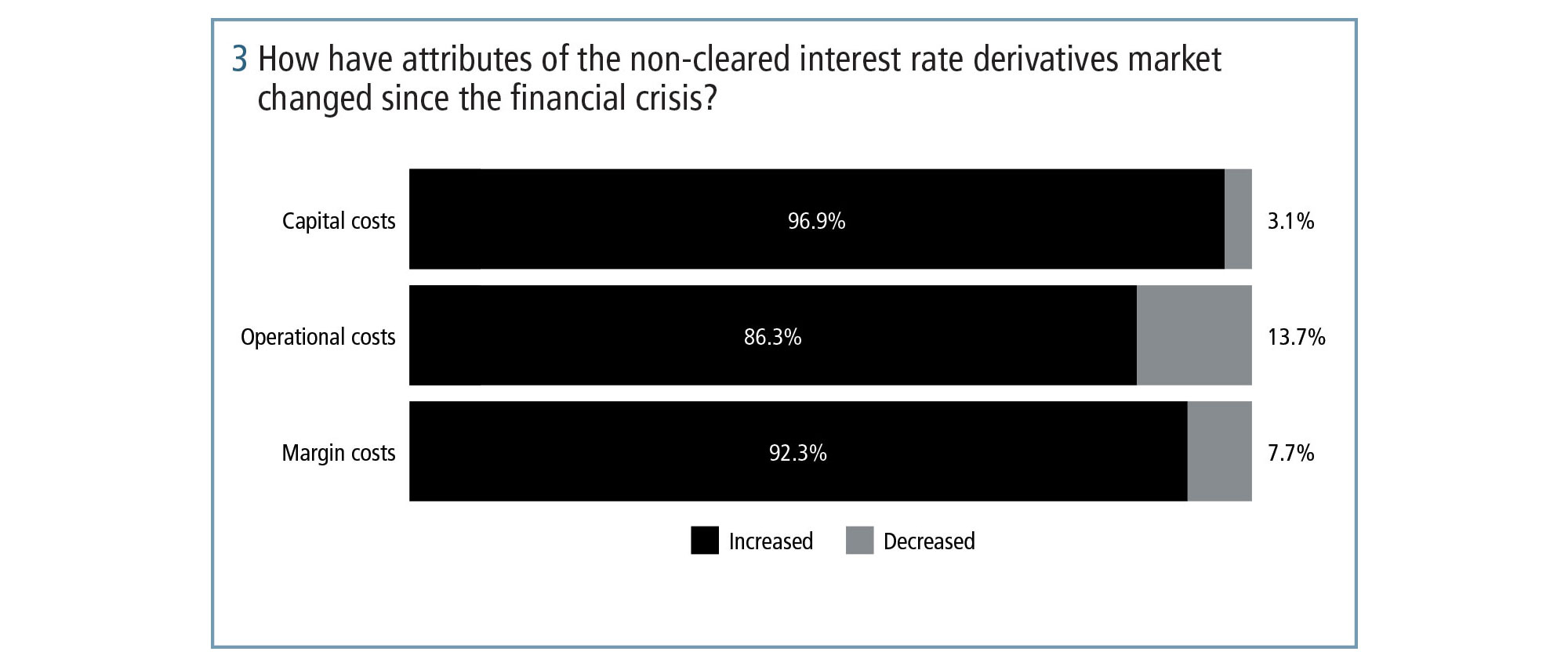

Capital costs have increased significantly under Basel III, driven by the leverage ratio. Cross-currency swaps in particular have been hit hard by the leverage ratio, as they are classified by many users as foreign exchange rather than interest rate products under Basel III, which results in a higher potential future exposure add-on. Given the effect of these charges, it is not surprising that 96.9% of respondents report capital costs for non-cleared interest rate derivatives have risen since the crisis (see figure 3).

Rapidly rising costs in the non-cleared market do not end with capital, however. With the introduction of mandatory IM and VM posting, operational costs of trading on a bilateral, non-cleared basis have also risen significantly. Redrafting CSAs, identifying and commissioning new systems and resolving disputes all add significantly to the cost and complexity of trading on a non-cleared basis.

In addition to the operational costs of exchanging margin, there is the inherent cost of the margin itself, which is likely to be very high for firms with a significant volume of non-cleared business. In response to the survey, 86.3% of firms said operational costs had increased for non-cleared interest rate derivatives, while an overwhelming 92.3% reported that margin costs had risen (see figure 3).

“Margin requirements are being phased in gradually, but are already costing market participants significant time, money and effort. Unfortunately, the bilateral negotiation of new CSAs results in even more complexity – moving away from the desired standardisation,” says Phil Atkinson, global head of membership sales and relationship management, LCH.

Dispute resolution in valuations is also a hidden operational overhead to factor in – which can prove costly. Collateral disputes between counterparties have long been a problem in the derivatives market, but is amplified by the introduction of mandatory margin requirements, as there is now a far larger pool of entities that may end up in dispute.

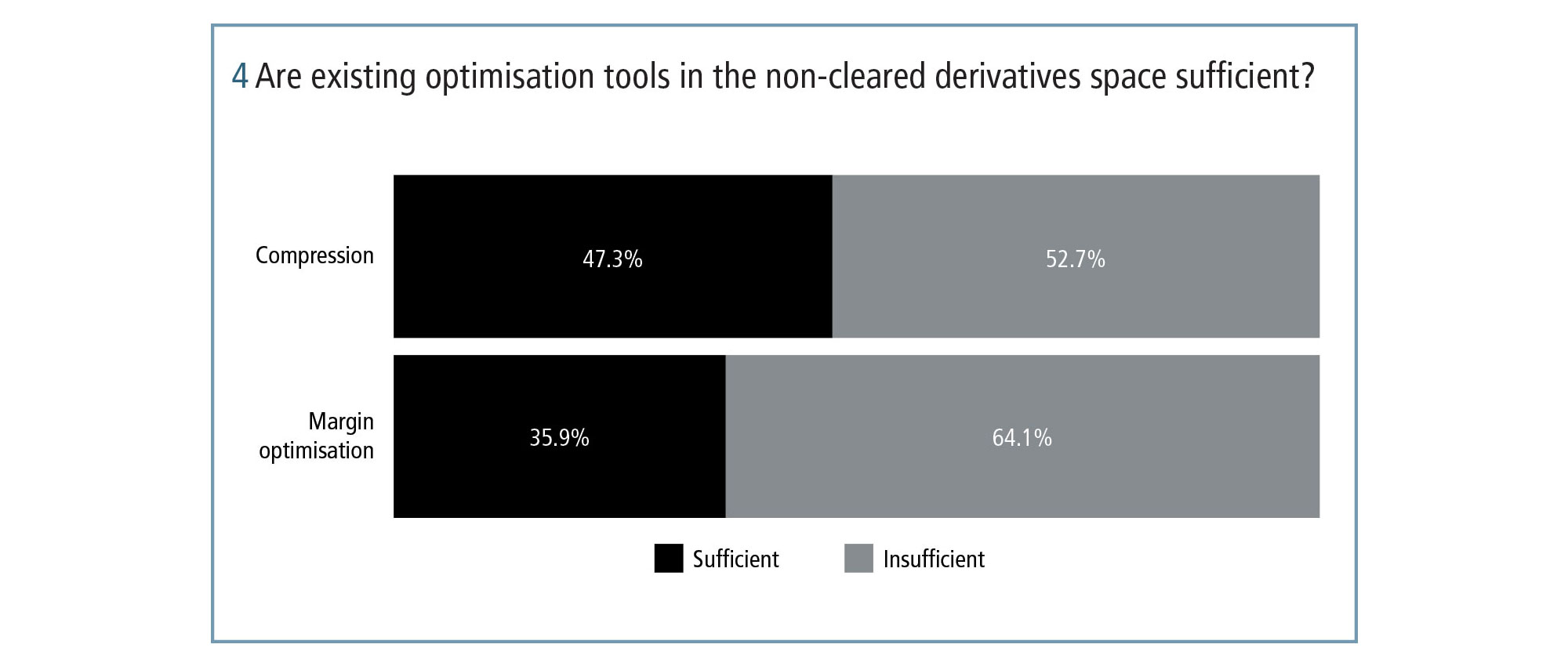

It is important to consider the benefits of portfolio compression, in which two or more counterparties terminate offsetting derivatives and replace them with another contract with a notional value that is less than that of the terminated trades. Compression has gained traction in the years since the crisis as a means of reducing notional outstanding value, thereby cutting associated capital requirements.

However, effective compression is enhanced by a certain level of contract standardisation that does not currently exist in the bilateral market. While there are compression services available for the non-cleared market, they are more challenging without a standard CSA. Reflecting this issue, 52.7% of survey respondents reported that existing compression services in the non-cleared market are insufficient, while 64.1% said that margin optimisation tools are also insufficient (see figure 4). One of the ways to unlock even more potential from optimisation services could be through the introduction of a standard CSA.

The clearing route

Given the multiple challenges facing participants in the non-cleared market, there are tangible incentives to central clearing – including contract standardisation, compression, independent valuation and dispute resolution. But without clearing services widely used for cross-currency swaps or swaptions at this time, the non-cleared market is at a crossroads and must choose between further decline and trialling new infrastructure to support trading in these products.

It is evident from the survey that market participants would like to bring more products into clearing. Perhaps the strongest evidence of this is that the majority of respondents said they would clear a product even if non-cleared IM was less than cleared IM. This hypothetical willingness to bear a rise in margin requirements reflects the gravity of the issues in the non-cleared market, as well as the need for a solution that brings the benefits of clearing to bear. However, there are significant liquidity, pricing and settlement risks that explain why these products have not yet been cleared.

“The market sees clearing as a panacea, but when we run simulations for dealers and they see the actual IM costs – particularly for cross-currency swaps – they begin to wonder if there is a third way,” says LCH SwapAgent’s Ondyak. “The forex risk of a cross-currency swap is exempt from bilateral IM requirements, making cross-currency swaps significantly more expensive in clearing for many participants.”

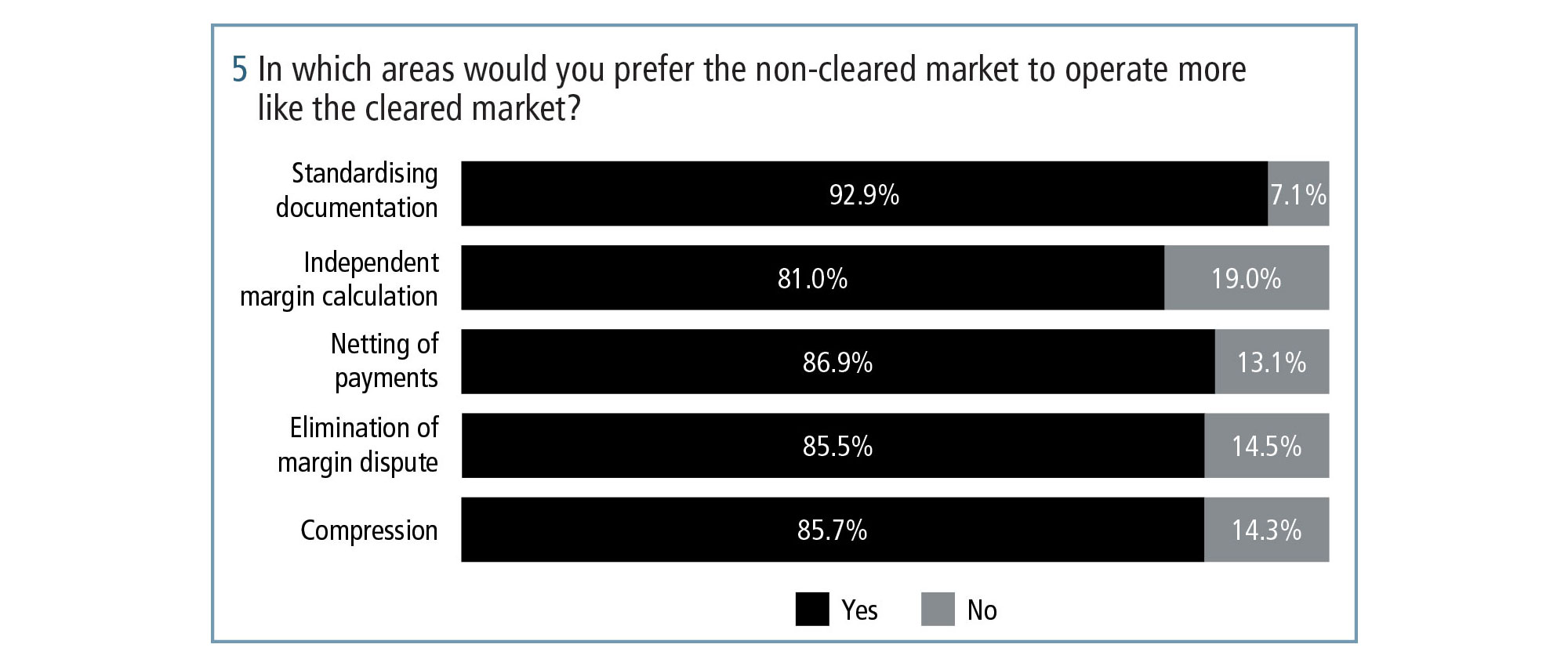

The survey results reveal that participants would like the non-cleared market to operate more like the cleared market in five core areas: standardising documentation, independent margin calculation, netting of payments, elimination of margin disputes, and risk and trade compression (see figure 5).

The LCH SwapAgent solution

LCH SwapAgent offers an alternative solution, using similar infrastructure to SwapClear, without the need to novate to a CCP. Transactions remain bilateral but benefit from many of the operational efficiencies of clearing, including independent valuation, standardised documentation, payment netting and compression.

“LCH SwapAgent acts as the calculation agent for margin requirements just as in clearing so that disputes do not arise. Greater standardisation from the service’s standard CSAs means we can more easily drive capital benefits through optimisation and trade compression,” says Atkinson.

There are multiple advantages to extending the clearing infrastructure to the bilateral market with a single one-stop-shop service, and evident support for doing so, but less immediately obvious benefits are also worth considering – including the netting of collateral and swap settlement payments.

In today’s bilaterally traded derivatives market, collateral and settlement payments are handled separately and not netted, which introduces additional settlement risk into the margining process. One of the benefits of LCH SwapAgent is that it will net those two payments in the same way a CCP would.

“The lack of netting in the non-cleared market is a growing concern as margin requirements are phased in and regulators are closely monitoring funding risk. LCH SwapAgent is one of the first services to net those collateral and settlement payments in any kind of scale outside clearing,” says Ondyak.

Survey methodology

LCH and Risk.net received 130 responses to the survey, which was conducted between May and June 2017. Respondents were drawn from banks, asset managers, funds and insurance firms in risk, front-office, trading and operations roles. Respondents were asked whether the non-cleared derivatives market is currently functioning efficiently, what has changed in the market since the financial crisis and what areas of the non-cleared market should operate more like the cleared market. The survey was marketed through Risk.net, and respondents drawn from North America (23.1%), Europe (53.1%), Asia-Pacific (20.8%), Middle East (1.5%) and Africa (1.5%).

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net