This article was paid for by a contributing third party.More Information.

Case study: helping a bank publicly report on its sustainable hedging activities

By CME Group

Client(s)

Banks/Firms

Challenge

Effectively measuring and reporting on sustainable hedging activities

Solution

Sustainable Clearing

Overview:

Banks increasingly have a mandate set out by their leadership to prioritize “Sustainable Hedging;” that is, derivatives trading that supports the financing of sustainable business projects. Some even have specific lines of credit set aside for this type of trading activity.

In addition, stakeholders and authorities also want to see how derivatives are supporting ESG focused business activity. Yet there was no solution that recognizes and reports on derivatives including products, such as carbon offsets, battery metals and bioenergy, as well as other hedging activity that flows through the Clearing and Settlement process.

In response to customer interest, CME Group is introducing Sustainable Clearing.

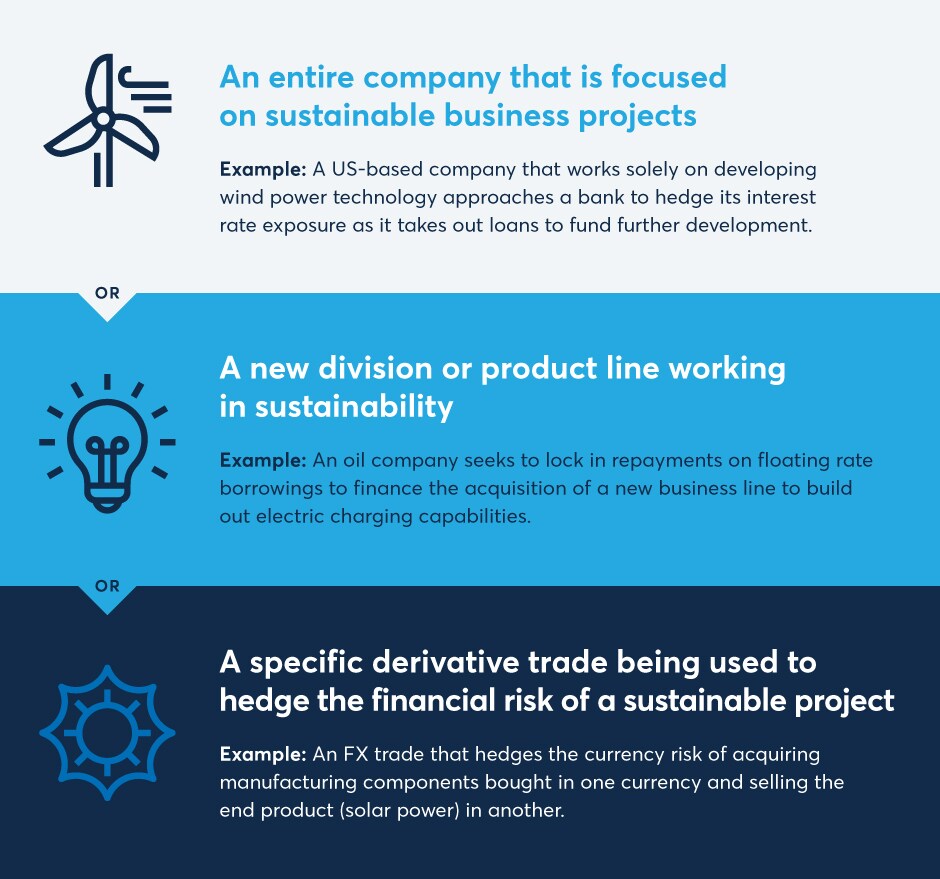

What is eligible for Sustainable Clearing?

Any on-exchange or OTC derivative trade that flows though CME Clearing, where the hedge is used to manage the risk of financing a Sustainable Business project.

What is a Sustainable Business Project?

An eligible trade must map to sustainability classifications published by a designated list of established and prominent industry bodies, such as the ICMA Social and Green Bond Principles.

How is Sustainable Clearing governed?

CME Group has developed strict eligibility criteria for sustainable trades, backed up by a Criteria Committee that oversees aspects of governance. This committee has representation from Futures Commission Merchants (FCMs).

Approach:

CME Group is launching Sustainable Clearing in partnership with some of its top tier clearing members. The solution is designed to be easy to implement, allowing firms to tag trades that support the financing of sustainable business projects as they pass through CME Clearing.

In addition, CME Clearing will then report back the level of trading activity that has been cleared for a given time period, information that can then be used in reporting and stakeholder communications.

A working example: Suppose that a Spanish solar power firm buys polysilicon from China in USD and wants to hedge its currency exposure as it then sells its electricity in EUR. They now can allocate their FX derivates trading through CME Clearing to demonstrate that it is being applied to a sustainable business purpose.

Conclusion:

For the first time ever, trading firms can allocate their derivatives trading into categories of sustainable finance and report data on cleared trading volume back to their leadership, authorities and other stakeholders.

No added fees, margins or other charges, all remain exactly the same – no additional financial impact to firms or their customers

Sustainable clearing requires a low-lift tagging of accounts or instruments, designed to seamlessly fit with existing operations

Other possible applications for Sustainable Clearing

Let CME Group help you find a solution to your challenge.

Sustainable Clearing

Explore a seamless solution for measuring and reporting on hedging activity in support of ESG initiatives. Offering independent oversight, Sustainable Clearing bridges the gap between growing demand for sustainable hedging and credible, transparent reporting of these activities, with minimal financial and operational impact.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net