This article was paid for by a contributing third party.More Information.

Legacy benchmark risk – A robust and effective conversion mechanism

With an uncertain future for interest rate benchmarks, TriOptima has developed its triReduce Benchmark Conversion functionality, providing support to customers transitioning their over-the-counter (OTC) swaps portfolios to these alternative benchmarks

October 2020 saw the official launch of TriOptima’s triReduce Benchmark Conversion functionality, which facilitates the proactive reduction of exposure to legacy benchmarks. Much has been written about the future of interest rate benchmarks, but all we can say for certain is that the future is anything but certain. As a number of regulators recently updated their recommendations for legacy benchmarks, TriOptima is able to support customers in transitioning their OTC swaps portfolios to the alternative benchmarks.

Moving towards the most efficient form of legacy benchmark risk

Twelve months ago, TriOptima began the journey to increase awareness of how triReduce’s leading multilateral compression network could form the foundation of a robust and effective conversion mechanism on alternative benchmarks. TriOptima demonstrated the value of its existing compression activities and provided a window into the future where each individual party can proactively perform their transition.

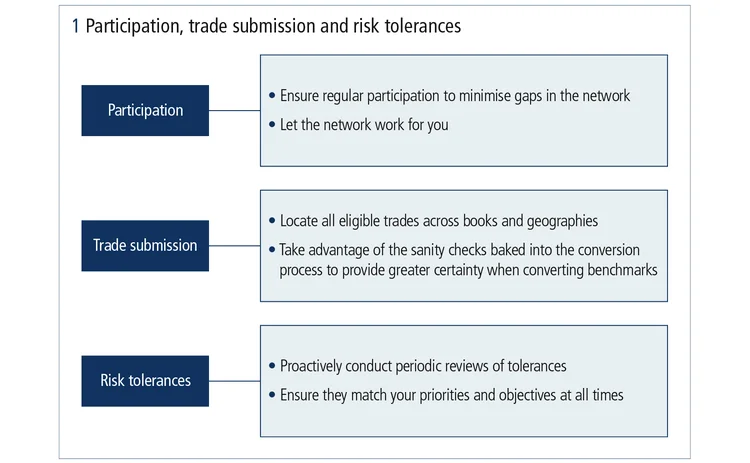

The basic tenets begin with maximising compression opportunities to remain close to the core net risk position in legacy benchmarks. This objective can be achieved by focusing on participation, trade submission and risk tolerances (see figure 1).

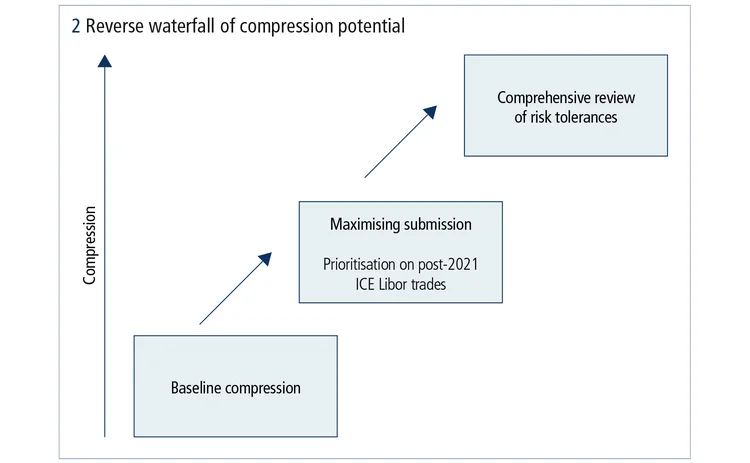

TriOptima conducted a series of co-ordinated simulations to demonstrate the potential in these key areas to each customer in quantifiable terms. These included a thorough examination of their compression activity and untapped potential, which are visualised in the reverse waterfall presented in figure 2. The conversations that followed helped shed light on the great work that was already being done, and clear guidelines for how service utilisation could be improved further, as well as establishing a comprehensive playbook for how back-book transition could occur with the adoption of triReduce’s Benchmark Conversion functionality.

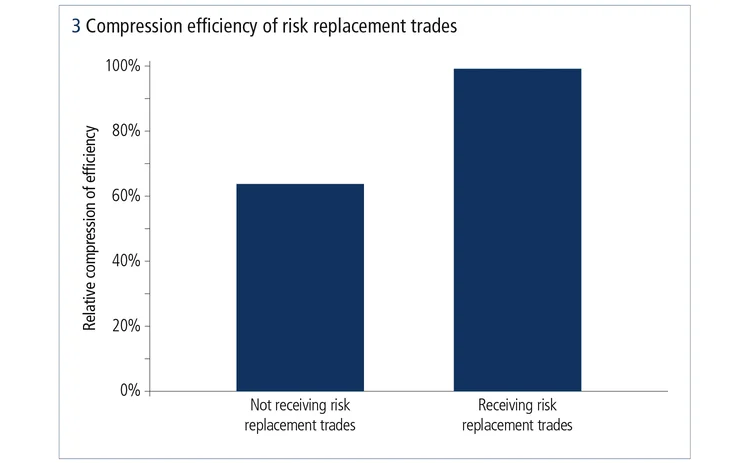

The mechanism for converting what remains

In preparation for the second part of the process – in which legacy risk can be converted into the alternative benchmark – TriOptima has delivered functionality for risk replacement trades based on trade templates that have been made available by central counterparties (CCPs). These templates are particularly important in portfolios where insufficient volume in the alternative benchmark exists. In this case, we can use the templates to obtain valuations and risk sensitivities from each participating firm’s own mid-market curves. As presented in figure 3, risk replacement trades are initially being used to further maximise the compression of legacy benchmark gross notional. Currently, early adopters are experiencing up to 40% greater reduction in post-2021 ICE Libor gross notional through the regular triReduce cleared compression cycles. This means that iteratively, over time, they will find themselves in the best possible position to handle whatever eventuality materialises after the end of 2021.

Maintaining best practices in alternative benchmark portfolios

While TriOptima’s customers focus on ensuring they maintain the most efficient legacy benchmark portfolio possible, they are also making certain they are implementing the best risk management practices for the increasing number of alternative benchmark trades in their portfolios. One of the ways they are doing this is to review their trade extracts that feed into the compression process, to ensure these new trades are being captured. In turn, they can verify these trades are being priced and risk-measured consistently and correctly through TriOptima’s unique pre-compression reconciliation checks. Here participants can also confirm their valuations against those determined by the CCP in a single, integral process, providing them with the confidence that, when the alternative benchmark trades are compressed, they are done within accurate net present value and risk boundaries.

Another way in which TriOptima’s customers are extending best practices to alternative benchmark trades is by validating that they can not only execute trades on the new benchmarks, but also price, risk-manage and process trade lifecycle events on these trades. Here, TriOptima once again lends its support to market participants by guiding them through submission into these compression cycles, so they can confirm that, beyond entering into such trades, they are also able to exit them when the appropriate time comes.

A comprehensive solution for managing a legacy benchmark back book

triReduce supports all approved alternative benchmarks in addition to regularly compressing trades on USD secured overnight financing rate (SOFR), euro short-term rate (€STR), sterling overnight index average (Sonia), JPY Tokyo overnight average rate (Tona), CHF Swiss average rate overnight (Saron) , CAD Canadian overnight repo rate average (Corra) and AUD overnight index average (Aonia). Extensive investment has been made towards developing a fully scalable infrastructure enabling triReduce to offer a comprehensive solution for managing benchmark transition in legacy portfolios.

Delivering certainty when performing compression and conversion at scale is what sets triReduce’s Benchmark Conversion functionality apart. The firm is already looking to take the lessons learned in its cycles on to other applications beyond the ICE Libor benchmarks. As the industry seeks solutions in the Eonia-to-€STR transition, this conversion functionality and these valuation submission checks will continue to play an important role in 2021.

When thinking about 2021 and the challenges that lie ahead, market participants can expect to need to evaluate all possible transition management options. Adherence to the International Swaps and Derivatives Association’s 2020 Ibor fallbacks protocol for legacy contracts is certainly a top consideration. However, a fully fledged strategy for transition doesn’t end there. It extends to a continued effort to mitigate legacy benchmark exposures, at the same time as ensuring readiness to hold alternative benchmark trades in the portfolio. Compression plays an integral role here and with it, Benchmark Conversion will offer a vital mechanism for transitioning between benchmarks.

Libor Risk – Quarterly report Q4 2020

Read more

CME and the CME logo are trademarks of CME Group. TriOptima AB is regulated by the Swedish Financial Supervisory Authority for the reception and transmission of orders in relation to one or more financial instruments. TriOptima AB is registered with the US National Futures Association as an introducing broker. For further regulatory information, please see www.cmegroup.com

TriOptima AB. Registered Address: Mäster Samuelsgatan 17, 111 44 Stockholm, Sweden.

Org no.: 556584-9758.

Copyright © 2020 CME Group, Inc. All rights reserved

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net