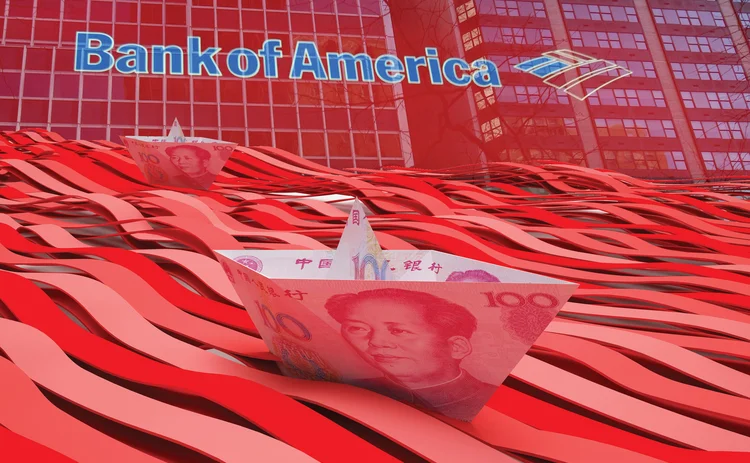

BAML may rejoin China swaps market after US policy shift

Clearing exemption removes swaps deterrent as bank seeks to hedge growing China exposure

Bank of America Merrill Lynch is expected to re-enter the Chinese interest rate swaps market, after US authorities signalled a more relaxed stance towards clearing house equivalence, sources close to the bank say.

The move would reverse a decision by the US bank to exit the market two years ago in response to punitive rules on clearing and margining that hit BAML’s branch structure in China.

The

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

BBVA joins growing Spire repack platform

Spanish bank becomes 19th dealer on multi-bank SPV issuer amid rising investor interest

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Integration strengthens e-trading in persistently volatile markets

Survey reveals that traders are grappling with daily volatility, while technology outranks liquidity as the top market structure concern

How Optimal aims to shake up US retail options trading

New wholesaler has assembled a team of market-makers to compete with Citadel, IMC/Dash and Jane Street

Repo stress drove 2025 SOFR-to-fed funds swap pivot

SOFR OIS volumes slipped to almost half of fed funds activity during September repo spikes

Renminbi options volumes plummet as vol grinds lower

USD/CNH volumes fell 84% in 2025 as PBoC currency management took hold

Esma to issue guidance on active account reporting

Briefing and Q&A aims to clarify how firms should report data ahead of RTS adoption

Forex looks to flip the (stable)coin

Friction-free foreign exchange is the prize offered by stablecoins such as Tether and USDC. But the prize remains elusive