Dislocation policy: LCH exodus risks CCP basis blow-out

Questions about post-Brexit status of UK CCP could spark mass migration – and severe volatility

Need to know

- The European Commission has proposed a mechanism through which EU entities could be barred from using a third-country clearing house – as LCH will be, after Brexit.

- Estimates suggest up to $24 trillion notional in interest rate derivatives positions could be caught if LCH is not recognised.

- Clarity on the scope of this decision is not expected until time is running out on the UK’s membership.

- Two European clearing houses – including Eurex – say they are now being asked for advice by EU firms, which are exploring their options to leave LCH.

- “Nobody is ready to pull the trigger yet, but I think the first decisions will be made at the start of next year,” says one European bank source.

- Large-scale transfers of risk between clearing houses would be accompanied by dealer hedging in the so-called basis market that links central counterparties.

- This market is thin and could be volatile – particularly if firms want to move large, directional positions. EU entities in the LCH euro swaps book are primarily banks that tend to pay fixed.

London’s banks are on the move. Unwilling to wait for clarity on the terms of the UK’s exit from the European Union, they are choosing new homes for their regional businesses – decisions that have been taken in the middle of a media scrum.

But the city is also quietly preparing for a second exodus – of cleared euro interest rate swaps from LCH, a venue EU firms may be barred from using after the UK goes its own way. This relocation would be no less historic: market participants estimate around $24 trillion in derivatives notional may need to be transferred from the London-based clearing house to one in the EU, requiring hundreds of thousands of trades to be closed out at LCH and then reopened at a new venue, and threatening wild moves in the price differential that exists between LCH and one likely destination, Frankfurt’s Eurex.

John Ahern, a partner at law firm Jones Day, says the mass transfer of positions would be “one of the biggest projects in the history of the market”. Simon Gleeson, a partner at Clifford Chance, predicts the scale of it will be overwhelming: “It’s going to be the most godawful bloody mess.”

Others see it as complex but manageable – as long as the industry prepares in advance, and the process of closing out and transferring portfolios is co-ordinated. In recent weeks, firms that may have to leave LCH have started laying the groundwork.

“A number of participants have approached us to find out what we can do to support them. Market participants still seem to be in the decision-making process, but the number of enquiries is continuously increasing,” says Matthias Graulich, an executive board member at Eurex Clearing.

A board member at a second central counterparty (CCP) reports similar conversations: “We’re hearing from some of our existing customers that if Brexit goes badly, they are interested in doing more business with us.”

Banks and brokers are also speaking to counterparties and customers about the mechanics of a potential switch from LCH. But with key questions likely to remain unanswered until well into 2018, expectations are growing that some firms will choose to move early.

“There is a lot of uncertainty and the only way for firms to mitigate it is to act sooner rather than later. Nobody is ready to pull the trigger yet, but I think the first decisions will be made at the start of next year,” says a source at one European bank, who has spoken to clients about the issue.

In order to sketch out the possible scenarios – and the mechanics of a forced, or voluntary, mass departure – Risk.net spoke to more than 20 banks, brokers, CCPs, exchanges and others.

If you’re talking about forcing $12 trillion through the market in a short period of time, then that basis could go anywhere

Stuart Giles, Tradition

Much of the talk focused on a potential switch of positions from LCH to Eurex. Fears swirled around the possibility of an early, disorderly departure, triggering volatility in the so-called CCP basis market that reflects the relative cost for dealers of clearing at two different venues.

Firms departing LCH for Eurex could conceivably lose tens of millions of euros if this basis moves against them, while the dealers facilitating the transfer could potentially gain or lose far bigger sums. “If you’re talking about forcing trillions of notional through the market in a short period of time, then that basis could go anywhere. There is no upper limit,” says Stuart Giles, managing director for strategy and business development at interdealer broker Tradition.

He declines to guess when firms might start moving positions, but says there may be an incentive to move early: if the banks using LCH all have similar positions, then getting out would mean finding other dealers that are effectively willing to double up on their exposure.

“I don’t know who is going to take the risk the other way; you’ll find the basis will have to move very rapidly to find equilibrium,” he warns.

LCH declined to comment for this article.

Timing is everything

In theory, the timing of any exit from London depends on politicians and regulators on both sides of the English Channel.

EU entities would be immediately cut off from LCH – and London’s other clearing houses – if the UK leaves the EU without continued membership of the single market, or without some kind of transitional deal. At that point, under the EU’s clearing rules – contained in the European Market Infrastructure Regulation (Emir) – the UK would be a third country. EU financial counterparties can only access a third-country clearing house if the local system of supervision has been judged equivalent to Emir and the relevant venue has applied for, and been granted, recognition. Banks are a partial exception: their subsidiaries can use a non-recognised CCP, as long as they don’t provide access for any clients, subject to a devastating jump in the applicable risk-weight, from 2% to 20% or more.

In the context of Brexit, equivalence and recognition verdicts ought to be a formality; as part of the EU, the UK’s rules would be identical to those on the continent at the point of its departure. But in June, the European Commission proposed changes to Emir that would impose tougher requirements on systemically important third-country CCPs and give new powers to European central banks and the European Securities and Markets Authority to recommend that some CCPs should not be recognised at all if they are super-systemically important – the category into which LCH might fall, by virtue of its dominance in euro swaps clearing.

In short, any firm that wants to anticipate the fate of LCH and the euro swaps market has to make a judgement on the terms of the UK’s exit, the content of any transitional deal, the likelihood of the UK being granted equivalence if it loses single market access, and whether – in that case – LCH would be denied recognition.

Finally, if LCH becomes a non-recognised, third-country CCP, the big question is whether EU firms would be barred from using the service entirely, or only from putting in new trades; the second outcome is seen as most likely by some market participants, as it would avoid forcing the market through a bottleneck.

The problem is that answers on all of these points are some way off.

“Some type of grandfathering is usually foreseen when market participants need to adapt to a new regulatory status. If you think about potential clearing relocation options, this might mean grandfathering for existing portfolios, for example, but not for new trades. But this all depends on the negotiations overall – there is still a lot of uncertainty [over] which scenario we will face in the end – soft, hard or even cliff-edge Brexit,” says Alexandra Hachmeister, chief of regulatory strategy at Deutsche Börse Group in Frankfurt.

I don’t believe any of that stuff. Any EU bank that does even a little bit of strategic planning has to act well before the cliff-edge

Source at one European bank

Do market participants take any comfort from what they read in the press – for example, that the UK government is coming round to the idea that a transitional period would be useful?

“I don’t believe any of that stuff,” says the European bank source. “Any EU bank that does even a little bit of strategic planning has to act well before the cliff-edge. You’d need a very clear sign there was not going to be a cliff-edge.”

Even the technical decisions about the scope of any euro clearing prohibition are wreathed in fog: lawyers that spoke to Risk.net for this article say Emir can be read in different ways. If a CCP was not recognised under Emir, it might mean an EU firm could not send new trades there, or that existing trades at the venue would be impermissible.

An EU official, meanwhile, says it is “premature to speculate” on the treatment of trades already cleared by a third-country CCP. Further detail would be provided in a delegated act called for in June’s proposed Emir changes – and in an implementing act should EU authorities recommend barring LCH – but the first of these only has to be published within six months of the changes entering into force, and the second would emerge just before the shutters came down (see box: New trades or old?). A legal specialist within one bank’s clearing team says it is reasonable to expect the delegated act to arrive at some point in the second half of 2018, potentially just months before the clock runs out on the UK’s membership.

The bottom line is that market participants are unlikely to have quick verdicts on the terms of the UK’s exit, or clarity on whether relocation from LCH would take the form of a slow tide of trades or a tsunami. In the worst case – if the UK crashes out of the EU as a third country, with no market access and no equivalence – EU portfolios could be stranded at LCH even before a verdict arrives on whether to recognise the CCP.

As with banks’ decisions about their office locations, EU entities at LCH may not be willing to sit and wait.

“For anyone with a fiduciary duty, that’s definitely not the best option. You need to evaluate the different possibilities, which ultimately drive the implementation time and thus the starting point of your preparatory activities. It all depends on your assessment of the scenarios,” says Deutsche Börse’s Hachmeister.

Speed advantage

If firms choose to move faster, the market would not be in completely uncharted territory.

Over a six-month period from June 5, 2015, the cleared US dollar interest rate swap portfolio at CME shrank by almost $5 trillion as firms voluntarily chose to shift risk to LCH.

The move was sparked by the appearance in early May of a price differential between the two clearing houses, making it roughly 2 basis points more expensive to pay fixed rates at CME on a 10-year swap and the same amount cheaper to receive – a gap that was chalked up to an imbalance in supply and demand. Big US asset managers were almost exclusively using CME for pay-fixed swaps to hedge their bond portfolios, but dealers who traded with them were struggling to find counterparties at CME to flatten their own position and instead had to go to LCH. The dealers ended up with a flat book in market risk terms, but had to maintain each side of the trade at a different CCP, resulting in higher margin costs; the basis was a reflection of those costs.

When the basis leapt wider, dealers had to re-mark their books, in some cases incurring painful losses. They also started executing so-called CCP switch trades, or CCP basis trades, to manage their exposure. In this case, banks that were paying floating rates to asset managers would have entered into paired trades in the interdealer market to pay fixed at CME and receive at LCH. Faced with higher costs, some buy-side firms also moved part or all of their business to the UK clearer.

Market participants expect basis trades would again be used by dealers to manage any large-scale transfer of risk from LCH to Eurex. Their hope is that it could be done in a more orderly fashion than in 2015 (see box: The birth of the CCP basis market).

“It would be unwise for the authorities to allow something extreme and dramatic to happen here – a price dislocation would be costly for issuers and other users of the market,” says Laurent Paulhac, head of customer relationship management at TP Icap in New York. “I’m sure the goal will be to provide a stable period of transition, but there will most likely be a material basis between Eurex and LCH – and I don’t think that basis currently trades very much.”

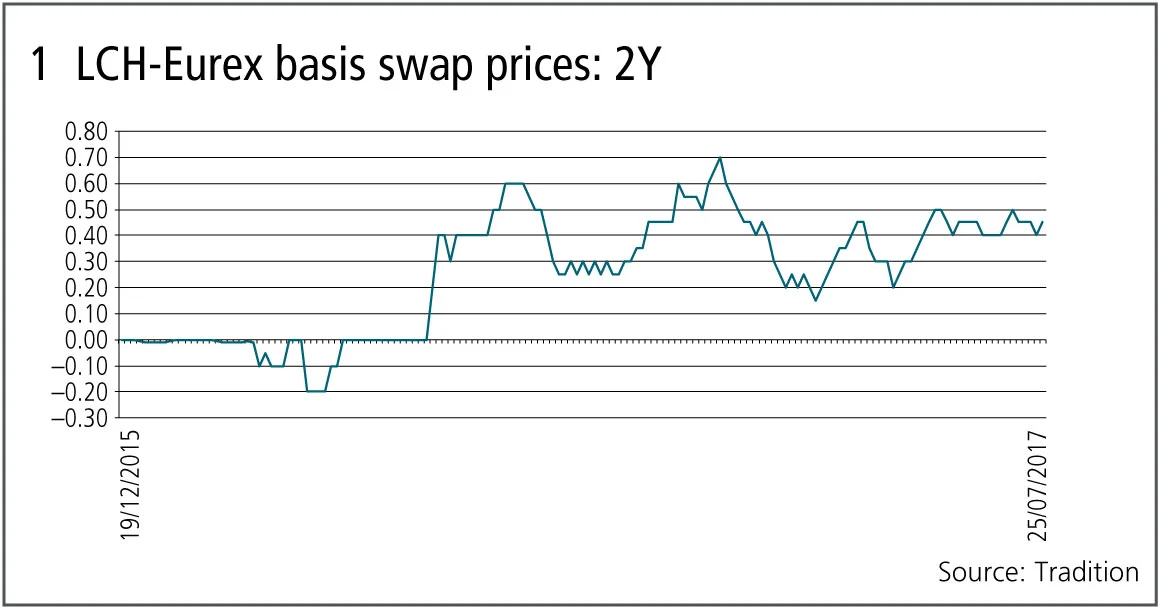

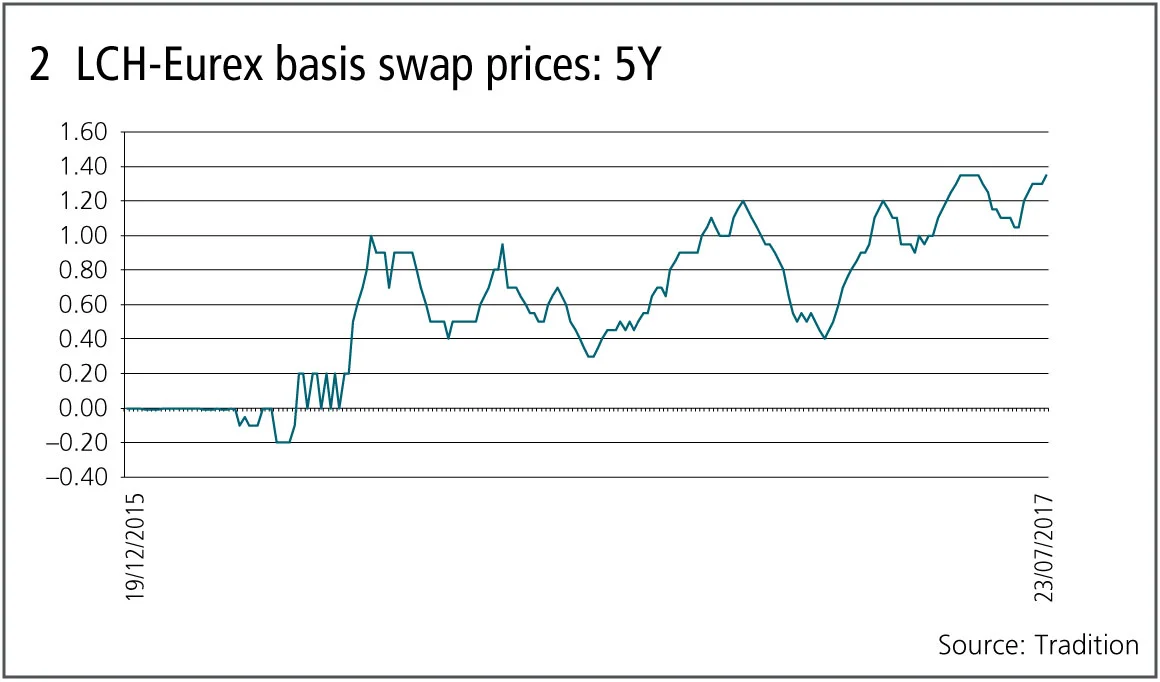

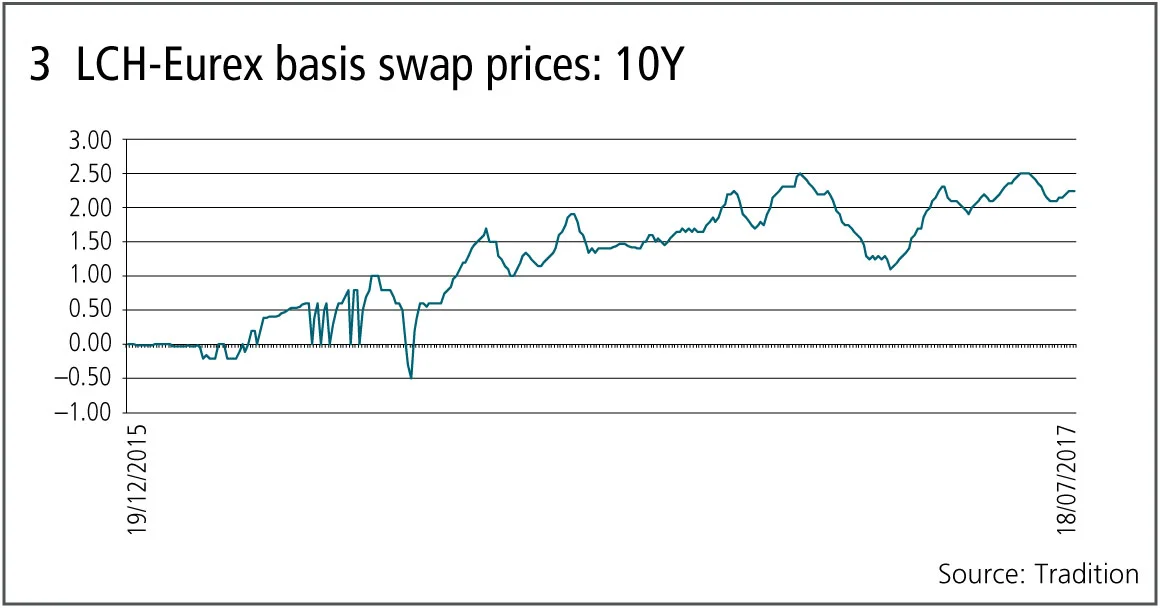

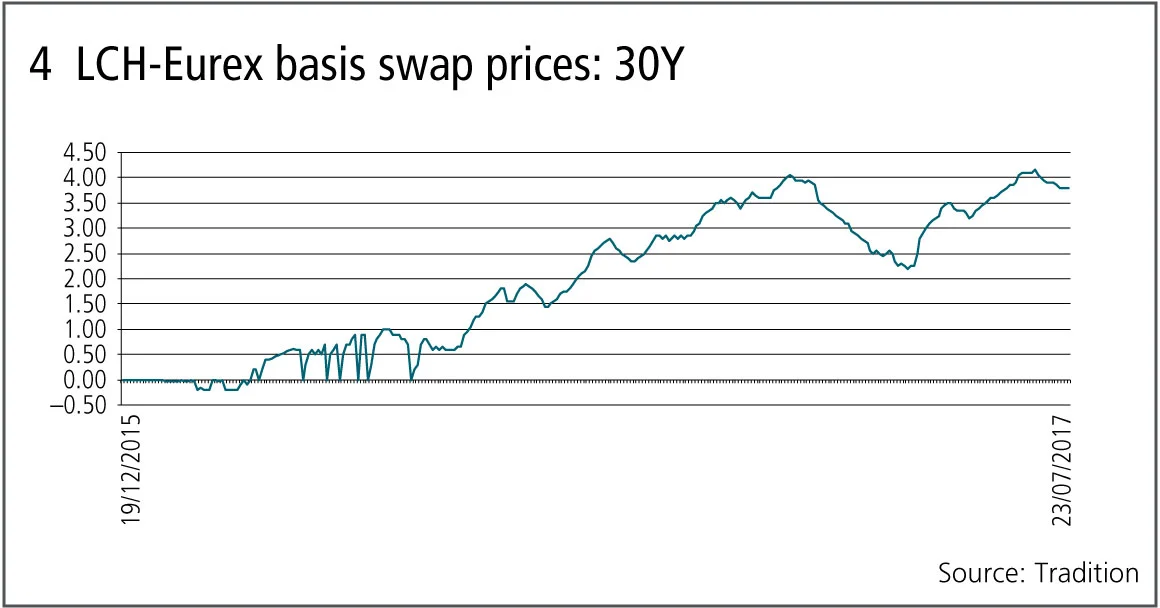

As of July 24, it was 2.25bp more expensive to pay fixed for 10 years at Eurex than at LCH – just below the market’s all-time high of 2.5, recorded in February this year (see figure 1-4). Again, this is blamed on a structural imbalance at Eurex, where the user base – including heavyweight bond issuers such as the German debt office and the country’s state-backed development bank – tends to trade pay-fixed swaps.

“The big guys – the Finanzagentur, KfW – are swapping their issuance, and the smaller banks that clear there also have a pay-fixed bias,” says a senior swaps trader at one US bank. “The natural fixed-rate receivers – pension funds – still have an exemption from the European clearing mandate, but the CCP of choice for the stuff they do clear is currently LCH.”

Market participants are split on whether the CCP switch market is deep enough to facilitate the exodus of LCH’s current users.

“The LCH-Eurex market is currently not deep enough to move anywhere close to the total amount of risk that needs to be migrated across. I know there are already some discussions about what can be done, but we need a much, much deeper market to migrate the risk,” says the European bank source.

Tradition’s Giles accepts the LCH-Eurex switch market trades sporadically – some months will see five trades pass through the market, while other months will see 50, he says – but the capacity of the CME-LCH market increased rapidly when required (see figure 5).

“It’s sporadic, but then all basis markets are sporadic. They trade when they need to, not for trading’s sake,” he says. “In CME-LCH, we did trillions of dollars in the months after the basis opened up – there were some massive, massive trades.”

On paper, a mass migration from LCH still looks a tall order. Estimates of what might have to be moved are derived from LCH’s own claim that around 25% of the euro-denominated interest rate derivatives cleared by the platform during 2016 had at least one counterparty belonging to an EU27 state. If the total euro swap portfolio of $44 trillion is multiplied by 25%, it produces a figure of $11 trillion – a rough, but reasonable way to get an idea of how much business might have to move, say market participants.

The estimate gets bigger if derecognition applies to all euro-denominated interest rate derivatives cleared at LCH’s SwapClear – including forward-rate agreements and basis swaps. This pool had a notional value of $97 trillion as of August 1, implying $24 trillion might need to move, if the same 25% EU27 share is assumed.

The only way to accommodate these kinds of flows is to move them gradually, says the second CCP’s board member: “I think it needs a minimum of six to nine months; it can’t be done in a short period of time.”

In position

Just as important as the size and timing is some idea of the type of positions that would be forced out. A source with knowledge of the make-up of LCH’s euro swaps portfolio tells Risk.net that banks constitute the majority of the book’s EU27 participants, and that these positions have a strong bias towards paying fixed. Expressed in terms of rates sensitivity, the ratio of pay-fixed to pay-floating is 3:1, the source says.

This makes any mass migration even more complex. Put simply, if dealers are already charging more to execute a pay-fixed swap at Eurex – reflecting an existing supply/demand imbalance – then a huge wave of additional pay-fixed trades is not going to help.

Market participants are split on this point. It depends how big the flows are, and over what period they materialise, as well as on the number of dealers willing to intermediate.

The European bank source worries particularly that US dealers have no incentive to help move liquidity to another CCP. Those that decide to get involved may apply a hefty spread.

In a worst-case scenario, users of LCH decide to jump – rather than run the risk of being pushed – potentially causing the basis to widen dramatically, and increasing the pressure on other firms to move early.

You either pay the piper now, or you pay more later

An expert on portfolio compression

One expert on portfolio compression sketches out the scenario: “Imagine you’re a German bank with a significant swaps portfolio at LCH. You don’t need to migrate every single trade – you need to flatten your exposure in London and put on a new trade for the netted exposure at Eurex. But the basis is going to richen if it becomes mandatory, and the banks are all pretty much axed one way, so you want to beat the crowd to do it – you either pay the piper now, or you pay more later,” he says.

The amount they would pay depends in part on the per-basis point sensitivity of the position. European banks using LCH to clear euro interest rate swaps will be doing so for various reasons, but market participants say the bulk of the risk is likely to be driven by a bank’s long-dated fixed-rate lending and by treasury positions – hedges of banking book exposure, such as bonds held via asset swap, or swaps on mortgage and corporate loan portfolios. Moorad Choudhry, a professor at the University of Kent – and former treasurer of the corporate banking business at Royal Bank of Scotland – says the interest rate sensitivity of a typical banking book could range from the single-digit millions to the high double-digit millions.

Market participants refuse to speculate on how much wider the basis could go, but note it has no theoretical upper limit and could increase significantly if pay-fixed positions are moved in bulk from LCH to Eurex.

“In that case, the basis only goes one way – some portfolios move, the basis widens, and it becomes self-sustaining. That is a risk, yes,” says a senior swaps trader at one US bank.

The European bank source describes this scenario as “a big concern”.

Such a move could also help resolve the underlying imbalance, however. As the basis widens, it simultaneously makes it worse to pay fixed and better to receive. This could tempt the other side of the market to move positions across, but this is a Catch-22: without liquidity in the switch market, a surge in additional pay-fixed demand could cause the basis to jump; but if supply appears on the other side of the market, the basis will collapse again.

“If the basis goes to 6bp or 7bp at the 30-year point, then you’ll see the receivers move as quick as they can. But then it will be back at –1bp in a heartbeat because the liquidity isn’t there yet,” says the US bank’s senior swaps trader.

Eurex argues the basis will ultimately disappear. “The rationale is that this is associated with costs. But when I look at our numbers, I see huge netting efficiencies for large dealers, so I’d question whether a widened bid/offer is reflective of fixed costs. The basis is rather to steer certain transaction types to optimise efficiencies. Regardless, if we see a further increase in volumes at an EU27 CCP, based on a balanced client structure – which we have in the EU27 – the result is a market with excellent netting and compression efficiencies that should remove any justification for a basis or a widened bid/offer,” says Graulich.

To facilitate a mass migration, the board member at the second CCP suggests the market could agree to ignore the basis and execute all switches at the market’s mid-price.

That idea, when put to traders or brokers, is met with bafflement: “Really?” asks one former trader, after a confused silence – or with laughter: “That’s never going to happen in a million years,” says Tradition’s Giles.

There’s a short way to sum up the worst-case scenario: “Pandemonium,” says one clearing source.

Of course, it doesn’t have to be that way – but even something that falls short of a stampede would need to be carefully managed. The responsibility here rests on traders and risk managers at individual banks, and on the industry collectively.

It’s complex, but it can be managed. It’s not the end of the world

Head of derivatives at one Asian CCP

“It’s complex, but it can be managed. It’s not the end of the world,” says the head of derivatives at one Asian CCP. “Certain bases will move a lot – maybe the CCP basis – but it’s made easier by the fact that this is primarily a dealer market. The banks would get together. There would be some way of doing this in an orderly fashion. I think it’s achievable.”

Individuals will lay the groundwork, he says: “What you would do as a risk manager is look at your bucketed risk on the euro curve at LCH, work out whether you are net long or short at two years, five years, 10 years, 30 years, and then decide how you can potentially flatten that. You might start testing that – go to a broker and tell them what you want to do in each bucket. As it gets more and more real, I think you’ll see banks starting to reduce their bucketed risk at LCH.”

Some market participants envisage a co-ordinated approach. Ideas are hazy, but this might involve using a compression service to analyse portfolios that are departing LCH and suggest the best way to optimise them – as per a normal compression run, with the tweak that close-out trades would be done at LCH, and replacement trades at a new CCP. Such an approach could even incorporate analysis of non-cleared portfolios, where margin is determined by the industry’s standard initial margin model (Simm).

“That would definitely make sense. If you get a compression provider involved and they link it to Simm optimisation, then there’s a business case to be made,” says the European bank source.

There will inevitably be rough edges, though. A departing user of LCH may not close out its portfolio and reopen it at another CCP within a single day, so as the risk is moved across, it will have to pay margin at both venues. During this period, the total may be greater than when the position was all held at LCH.

If the user is not a member of either CCP, then its clearing firm will need to contribute to the default fund at both; the reduction of its client’s risk at LCH will not immediately result in a like-for-like reduction in its default fund contribution, because – as is the case at other clearing houses – a member’s default fund requirement is calculated once a month. The client may have to pay for these additional costs.

Birth of the CCP basis market

The pricing gap between CME and LCH may only have blown out in May 2015, but some clearing participants had long predicted its arrival; others had tried to hold it back.

Writing on the topic in early 2013, Risk.net related a story told by one clearing head about a powerful buy-side client – the description matched that of Pimco – that had been an early and enthusiastic user of CME, and protested when dealers started skewing their prices to favour LCH.

Another anecdote related to a bank that had cleared a huge credit derivatives trade for a client. This left the bank with no appetite to do similar, follow-up trades; it turned the client away when it wanted to add to the position.

The logic seemed to hang together: clearing is cheapest when positions can be netted down, so if a dealer is facilitating one-way flow at a particular central counterparty (CCP), its pricing may shift to reflect the additional margin costs.

Still, when the market finally cracked, it caught many banks flat-footed: “It was a one-off. We’d never seen anything like it in our industry,” says Laurent Paulhac, global head of customer relationship management at TP Icap. “At one point, people lost track of what rational pricing should be – the dislocation went to about 2.75 basis points for 10-year swaps, which is huge, but it was pure panic in the early weeks. A lot of money was made and lost in the development of the basis market, and dealers were among those hurt by it.”

One trader, speaking at the time, described the mindset: “What’s happening is you are running your portfolio and are marking at 0.15bp mid because you don’t know if it’s flat or at 0.3bp, and someone lifts it at 0.3bp – and then there’s an offer behind at 0.5bp and that gets taken and then you’ve got an offer at 0.75bp and that gets taken. And then you stop and look at your portfolio and it’s a case of ‘Oh my God, I’ve got a multi-trillion dollar portfolio that I was marking at 0.15 and it’s now trading nine-tenths of a basis point higher,’” he says.

TP Icap’s Paulhac believes dealers have become smarter as a result of the experience, and now manage their exposures more dynamically – dipping into the basis market as required to balance up positions that are split between two clearing houses.

Stuart Giles, managing director for strategy and business development at Tradition, shares that view: “People are managing it more accurately today. If there’s a big bond issue that’s being swapped at Eurex, with dealers hedging themselves at LCH, they will also be active in the basis market at the same time, rather than leaving the swaps split across two CCPs and worrying about it later.”

New trades or old?

If the EU refuses to recognise LCH, some of the scope of the derecognition is clear, and some is not. The European Market Infrastructure Regulation (Emir) outlines the implications for different market participants: bank subsidiaries could continue clearing at LCH, subject to a huge jump in risk weights, but they could not intermediate on behalf of clients; other financial counterparties would be barred outright.

The question is more about the population of trades that would be affected: would derecognition prevent EU entities from clearing new trades at LCH, or from holding any trades there at all? The former might trigger a gradual migration from LCH; the latter, a rapid one.

An EU official says this kind of speculation is premature. New requirements to split central counterparties (CCPs) into those that are systemically important and those that are not were outlined in proposed changes to Emir in June – but further detail on how to make this classification will only be provided in a delegated act after the proposals themselves have entered into force. The decision not to recognise some systemic CCPs – those that might pose a risk to the financial stability of the EU – will begin with a joint recommendation by the European Securities and Markets Authority (Esma) and the relevant central banks. The European Commission would then have the power to adopt an implementing act declaring that the CCP shall not be recognised.

The proposals to Emir contain no nuance – a recommendation is made, or not made; an implementing act is either adopted or not – but the EU official says the “scope and conditions” of the derecognition “are expected, where relevant, to be part of the recommendations of Esma and the relevant central banks”.

That implies derecognition may not be all-encompassing – potentially applying to certain cleared products, but not to others, or with some limits in terms of timing.

Some lawyers turn to Emir for the answer. Simon Firth, a partner with Linklaters in London, says only new trades would be out of bounds – a conclusion he draws from Article 4 of the regulation, which deals with the clearing obligation. This states that the obligation would apply at the point a trade is “entered into or novated”, the implication being that stripping LCH of recognition would not prevent an EU firm from leaving existing cleared trades where they are.

Simon Gleeson, a partner at Clifford Chance, is not so sure. He points to Article 2, where Emir’s key terms are defined. It describes ‘clearing’ in two ways – the “establishing of positions”, but also “ensuring that financial instruments, cash, or both, are available to secure the exposures arising from those positions”. The second part of the definition implies that clearing, for Emir purposes, extends to the provision and maintenance of margin and collateral.

The bottom line, says Gleeson: “Nobody knows. Partly because – you know what – nobody thought about this scenario.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

CME outage exposed FX market’s futures dependency, says SNB

Study finds EUR/USD spreads widened eightfold as non-bank PTFs blew out by nearly 30 times in November halt

CME rankles market data users with licensing changes

Exchange began charging for historically free end-of-day data in 2025

Gap risk fears push FX traders into Sunday-night Asia hours

Volumes surge at Singapore open as Trump’s weekend announcements force early risk management

BBVA joins growing Spire repack platform

Spanish bank becomes 19th dealer on multi-bank SPV issuer amid rising investor interest

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Integration strengthens e-trading in persistently volatile markets

Survey reveals that traders are grappling with daily volatility, while technology outranks liquidity as the top market structure concern

How Optimal aims to shake up US retail options trading

New wholesaler has assembled a team of market-makers to compete with Citadel, IMC/Dash and Jane Street

Repo stress drove 2025 SOFR-to-fed funds swap pivot

SOFR OIS volumes slipped to almost half of fed funds activity during September repo spikes