Newcomer of the year: LiveDiligence

Energy Risk Awards 2022: First-of-a-kind online platform transforms renewables due diligence

Over the past decade, a drive towards digitalisation has transformed many areas of energy trading and financing. However, there are still large pockets that remain reliant on manual processes, leaving them subject to high levels of operational risk and inefficiency.

One such area is due diligence for renewable energy projects. This complex field involves multiple stakeholders, various rounds of negotiations, many different contracts and legal documents and the management of vast amounts of data. Changes and updates are needed frequently. Financiers often complain of a lack of clarity on risk reviews and encountering last-minute surprises. Reporting on due diligence can also be frustrating with advisers having to manage communications with many stakeholders by flipping between emails, spreadsheets and other applications and platforms.

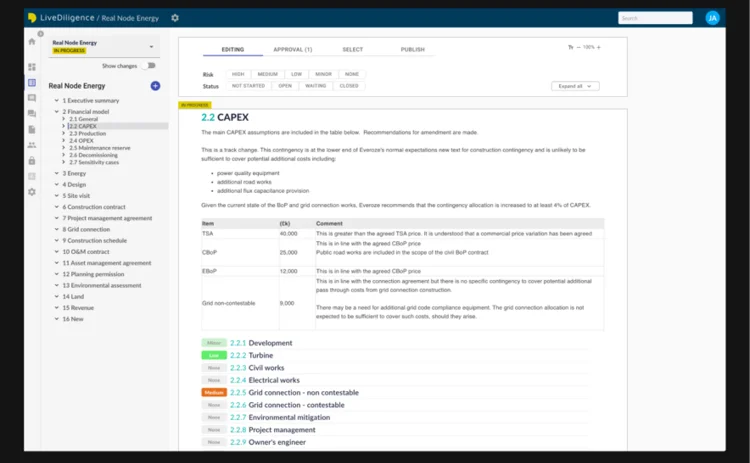

LiveDiligence set out to revolutionise renewables due diligence with a pioneering online platform for structuring and reporting risk reviews. The software-as-a-service business – the winner of Energy Risk’s 2022 Newcomer of the year award – digitalises all aspects of due diligence for renewables projects, providing collaborative access to status and reviews, with automated risk filtering.

“LiveDiligence is on a mission to make due diligence radically better,” says Felicity Jones, chief growth officer. “Renewables investment has become increasingly competitive, with compressed transaction timeframes driving a need for speed and clarity in risk reviews. The need to increase automation and improve efficiency is being felt by many in the industry.”

The platform was first deployed commercially in 2019 on an onshore wind project and has continued to evolve since. Today, LiveDiligence has been used on 200 clean energy transactions, with usage particularly prevalent in the UK, France and Ireland.

“We start by taking due diligence online, unlocking real-time communication,” explains Jones. “We then add structure to renewables project data – the key to automation and empowering organisations to leverage the value of their institutional knowledge. Finally, we introduce controls for users, getting more specific on who sees what and when.”

The platform not only provides advisers with the tools they need to deliver high-quality due diligence, but it enables investors to manage risks more proactively, reducing the likelihood of expensive mistakes. By bringing all elements of the risk review into one place, LiveDiligence makes communication between advisers, sponsors and lenders easier and more effective. All are provided access to the reviews and the ability to comment. Calls and emails can then be reduced considerably and days of reporting time can be saved.

“Speeding up the review process enables capital to be deployed into renewables more quickly, and projects built out sooner,” says Jones.

In 2021, LiveDiligence was selected for ESB and Bord Na Mona’s €135 million ($142 million) financing of Oweninny wind farm Phase 2, the largest wind farm in Ireland. Peter O’Hagan, project director at ESB, described the use of LiveDiligence for Phase 2 of the project as a “key change” from the first phase. “Phase 2 was delivered using this tool and we found it a welcome addition,” he said. “The live updates allowed the team to view the latest position on every aspect of the diligence report providing clarity for all correspondents making the process easier to manage, reducing calls and email traffic and ultimately reducing stress on all sides.”

The platform has received ringing endorsements from numerous other users. One is Luis Duran, director, energy climate action and infrastructure at Allied Irish Bank, who said: “Moving due diligence online is a major industry innovation and has had a beneficial impact on the five Irish wind transactions we have used LiveDiligence on in the last couple of years.”

Given the sensitive nature of the data and reports involved in due diligence, the platform needed to be built with cyber security front and centre. “As a first-of-a-kind solution, we’ve taken a number of steps to demonstrate to industry that our platform is fully secure and reliable,” says Craig Houston, chief product officer.

The platform deploys a suite of technologies to ensure data security, such as data encryption, multiple geo-redundant backups, active threat monitoring and security testing, data access logs and physical security. The LiveDiligence team also put a lot of work into building the trust of their clients.

“Winning trust is not just technical, it’s personal too,” says Houston. “We’ve worked hard to build relationships and ensure a responsive approach to user feedback.”

The LiveDiligence team’s hard work, expertise and evangelical attitude to modernising renewables due diligence is paying off.

“Today, we’re proud to say that over 600 professionals have logged into LiveDiligence to draft, edit, review or read a renewables due diligence report, from 120 different organisations,” says Houston.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Commodities

Energy Risk Asia Awards 2025: The winners

Winning firms showcase the value of prudent risk management amid challenging market conditions

Data and analytics firm of the year: LSEG Data & Analytics

Energy Risk Awards 2025: Firm’s vast datasets and unique analytics deliver actionable insights into energy transition trends

OTC trading platform of the year: AEGIS Markets

Energy Risk Awards 2025: Hedging platform enhances offering to support traders and dealers in unpredictable times

Electricity house of the year: Natixis CIB

Energy Risk Awards 2025: Bank launches raft of innovative deals across entire electricity supply chain

Voluntary carbon markets house of the year: SCB Environmental Markets

Energy Risk Awards 2025: Environmental specialist amplifies its commitment to the VCM

Sustainable fuels house of the year: Anew Climate

Energy Risk awards 2025: Environmental firm guides clients through regulatory flux

Weather house of the year: Parameter Climate

Energy Risk Awards 2025: Advisory firm takes unique approach to scale weather derivatives markets

Hedging advisory firm of the year: AEGIS Hedging

Energy Risk Awards 2025: Advisory firm’s advanced tech offers clients enhanced clarity in volatile times