GS: Opportunities from commodities emerging markets constraints

Goldman Sachs says investors should get exposure to crude oil, and put a $105 per barrel price target on it, as one of the supply-constrained commodities China most needs, David Walker reports.

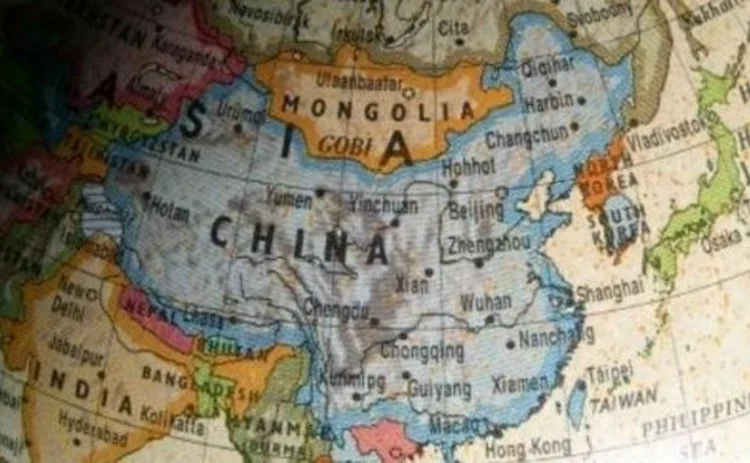

China is the world's largest commodities producer, overshadowing both America and Russia in second and third place, but it lacks easy access to some commodities its population badly needs, Jeffrey Currie, the bank's global head of commodities research, said at a conference in London yesterday.

He counselled investors at a Goldman Sachs Asset Management (GSAM) Global Strategy Conference to "focus

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Commodities

Energy Risk Asia Awards 2025: The winners

Winning firms showcase the value of prudent risk management amid challenging market conditions

Data and analytics firm of the year: LSEG Data & Analytics

Energy Risk Awards 2025: Firm’s vast datasets and unique analytics deliver actionable insights into energy transition trends

OTC trading platform of the year: AEGIS Markets

Energy Risk Awards 2025: Hedging platform enhances offering to support traders and dealers in unpredictable times

Electricity house of the year: Natixis CIB

Energy Risk Awards 2025: Bank launches raft of innovative deals across entire electricity supply chain

Voluntary carbon markets house of the year: SCB Environmental Markets

Energy Risk Awards 2025: Environmental specialist amplifies its commitment to the VCM

Sustainable fuels house of the year: Anew Climate

Energy Risk awards 2025: Environmental firm guides clients through regulatory flux

Weather house of the year: Parameter Climate

Energy Risk Awards 2025: Advisory firm takes unique approach to scale weather derivatives markets

Hedging advisory firm of the year: AEGIS Hedging

Energy Risk Awards 2025: Advisory firm’s advanced tech offers clients enhanced clarity in volatile times