Swaps data: are the new RFRs on track to replace Libor?

Progress on volumes of SOFR and Sonia swaps and futures

In just over two years’ time, Libor could cease to exist, so it’s no surprise to see regulators turning up the volume on transition to risk-free rates (RFRs). There’s a clear trend of rising activity in futures and over-the-counter swaps linked to replacement rates. What’s not so clear is whether participants are switching out of Libor exposures.

September 2019 was a watershed for US Libor’s successor, the Secured Overnight Financing Rate, or SOFR. The repo-based rate spiked to 5.25% on September 17, from just 2.43% the previous day. CME SOFR futures clocked up record trading volume in response, helping the contracts on their way to an impressive 11-fold jump in open interest compared to a year prior.

There are positive signs in the UK too, as swaps linked to the Sterling Overnight Index Average, or Sonia, continue to increase. But activity in sterling Libor swaps has also been rising. Worryingly for regulators, there’s little sign of a move away from Libor contracts expiring from January 2022, when the benchmark will be left to wither.

Libor transition in the UK may have enjoyed a head-start thanks to the selection of a pre-existing rate, but SOFR seems to have caught a slipstream. September’s volume jump may yet prove to be an anomaly, but there are clear triggers for wider SOFR adoption – most notably, a planned 2020 move by clearing houses to replace Fed funds with SOFR as the discount rate for all US dollar swaps.

SOFR futures

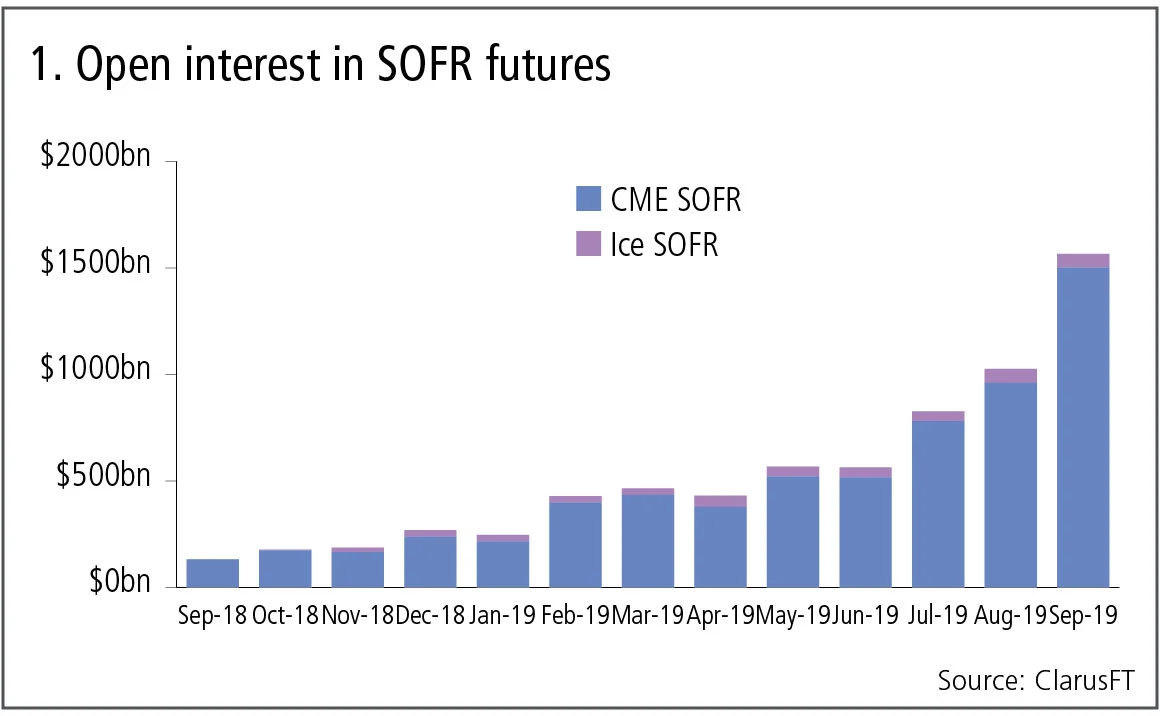

Let’s start with the largest currency, US dollars and futures on the SOFR index. We can chart the growth in open interest over the past year for CME and Ice contracts.

Figure 1 shows:

- September 2019 has been a stellar month for CME SOFR contracts, which now have $1.5 trillion notional of open interest, with significant increases from September 16 onwards. This was most likely linked to the jump in SOFR and Federal Reserve actions in the repo market, which have been widely commented on.

- Ice SOFR futures have open interest of $64 billion

- A total in September 2019 of $1.57 trillion open interest compared to $132 billion in September 2018 – massive growth indeed.

To put this into perspective, on September 27, 2019, CME Fed funds futures open interest was $10.6 trillion and CME Eurodollar was $12 trillion, which means that CME SOFR futures open interest is now 12.5% of CME Eurodollar open interest. That is a meaningful chunk and a significant achievement, it will be very interesting to see if the remaining months in 2019 live up to the massive increase seen in September.

SOFR swaps

Next let’s look at progress in SOFR swaps trading.

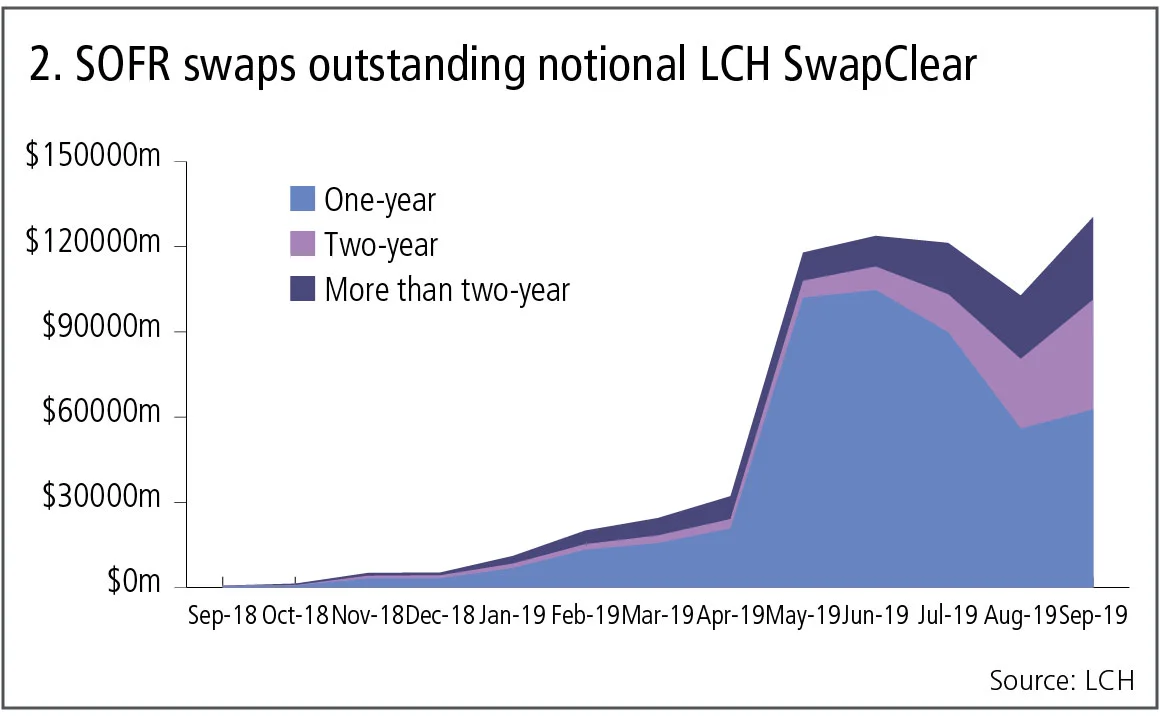

Figure 2 shows:

- Outstanding notional (single-sided) of SOFR swaps at LCH SwapClear over the past year, broken out by tenor.

- A big jump in May 2019, flat for two months, down in August and back up to a new high in September.

- At the end of September, total outstanding notional stood at $130 billion, so similar to SOFR futures open interest in September 2018, meaning SOFR swaps volume is lagging a year behind futures.

Also, September sees a much higher proportion of two-year and greater than two-year tenor SOFR swaps compared to under one year. Longer tenors, where Libor swaps dominate, are crucial to a wider use of SOFR swaps.

Sterling Libor and Sonia swaps

Let’s turn next to sterling, where the existing Sonia rate (after reform) has been selected as the RFR to replace Libor. The two questions we are most interested in are, first, is swaps volume in Sonia increasing and volume in Libor decreasing, and second, are longer tenors trading in Sonia.

Using data from LCH SwapClear, we can attempt to answer these.

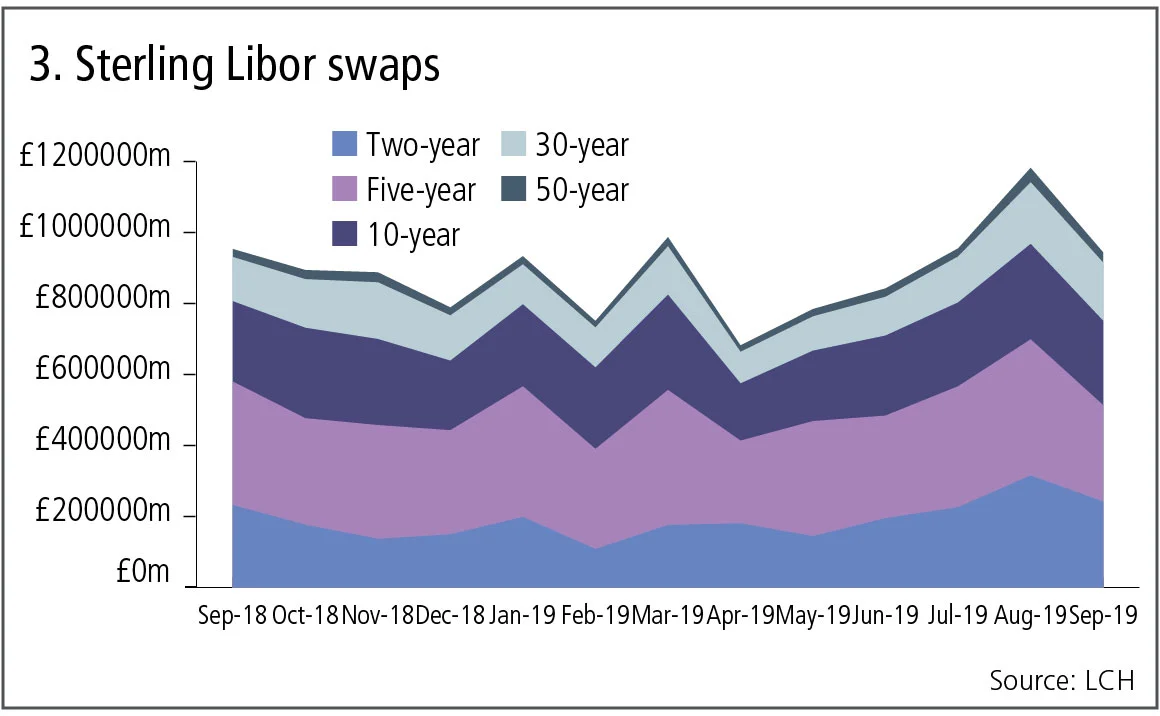

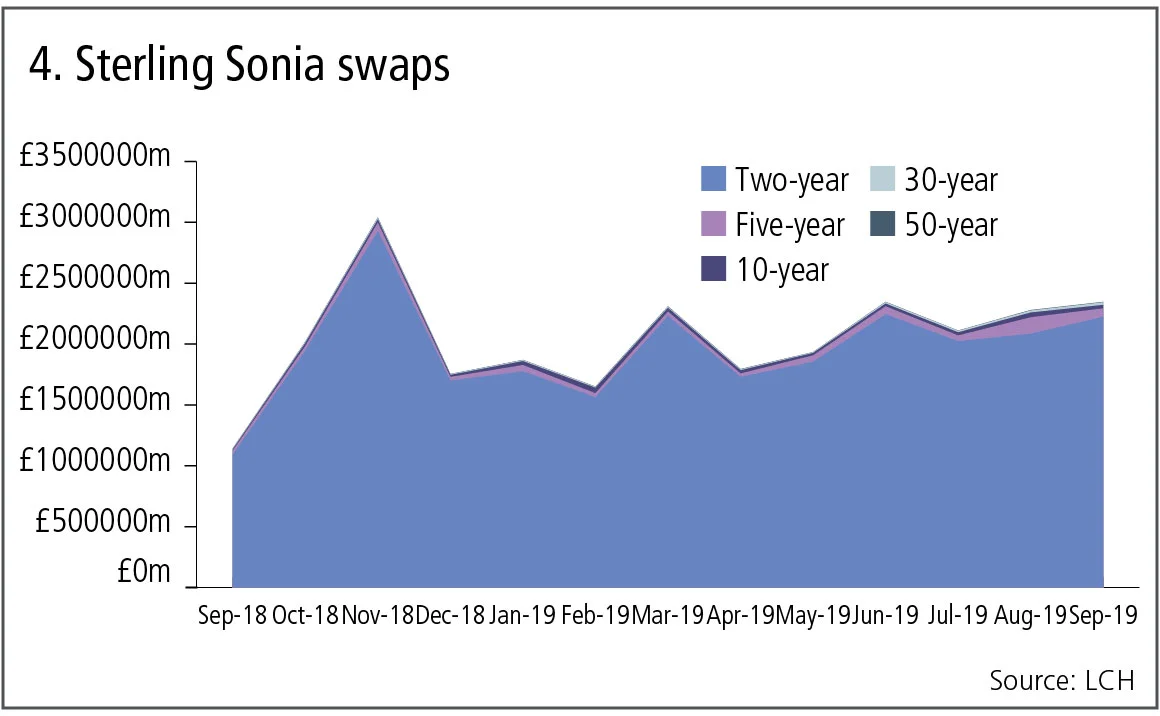

Figure 3 & 4 show:

- Monthly gross notional cleared at LCH SwapClear over the past year, split out by the major tenor buckets for Libor and Sonia swaps.

- For Libor swaps we can see that volumes have continued to increase, with a high of £1.2 trillion cleared in August 2019 and September 2019 with £950 billion.

- In addition, there is no material change in the portion of Swaps trading in longer tenors.

- So nothing in the data here suggests firms are stopping or reducing their trading of Libor swaps with maturities beyond January 2022.

- For Sonia swaps, the monthly gross notional traded is much larger, at least double, with August 2019 showing £2.3 trillion, and there does seem to be a growth trend; however, volume is dominated by tenors below two years.

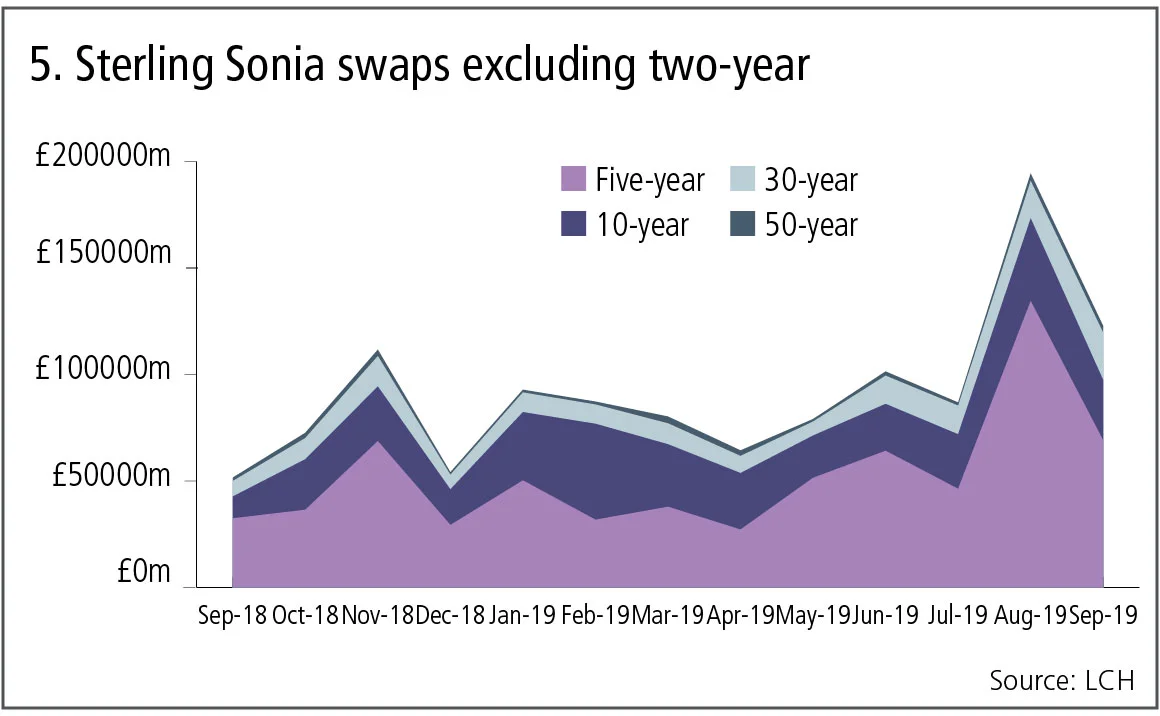

Let’s now chart Sonia swaps volume and exclude two-year and below tenors.

Figure 5 shows:

- A significant jump in August 2019 for the five-year tenor with £69 billion cleared and also for the 30-year with £28 billion cleared in September 2019.

So, encouraging signs at the longer end, but a long way to go to approach the Libor Swaps five-year volumes of £380 billion and 30-year of £184 billion in August 2019

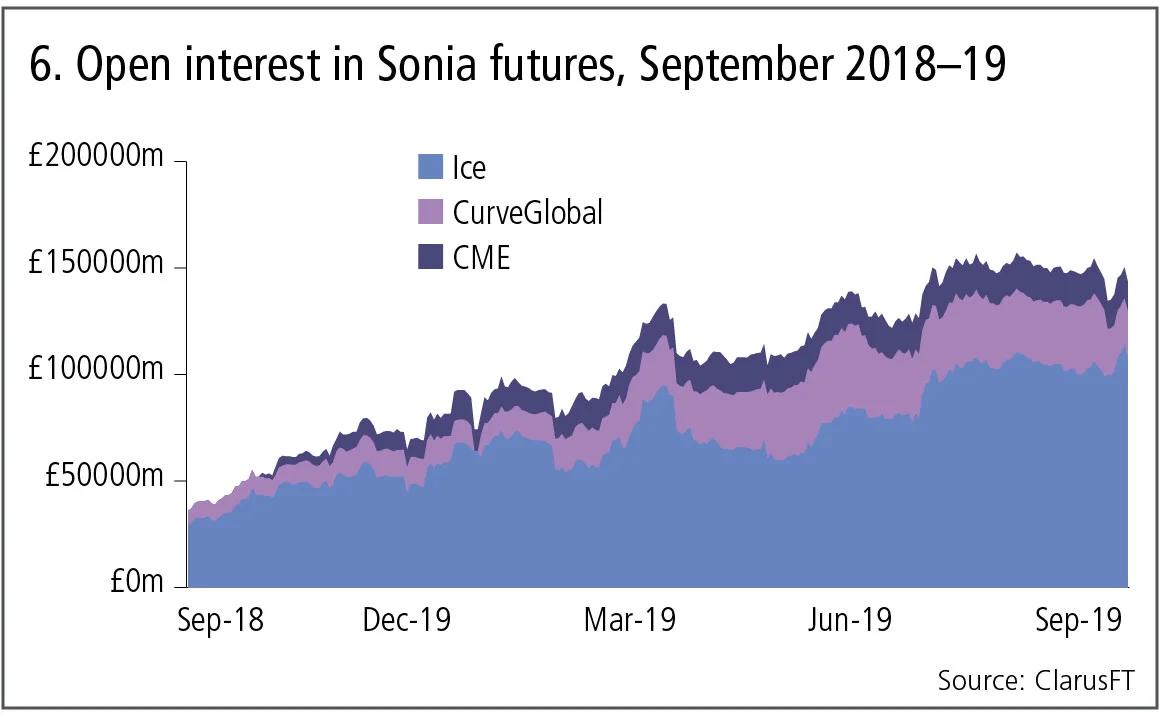

Sonia futures

Finally, Sonia futures, where we see a genuine competition between three exchanges – Ice, CME and CurveGlobal.

Figure 6 shows:

- Open interest growth in the past year, with a positive trend.

- Ice has the largest share – £107 billion open interest on September 27, 2019.

- CurveGlobal with £22 billion and CME with £14 billion.

- Aggregated for all three, there is £144 billion of open interest.

To put this into perspective, on September 27, 2019, Ice short sterling futures had £2 trillion of open interest, meaning Sonia futures now represent 7% of this figure. This is less than the 12.5% that SOFR futures represent compared to CME Eurodollar, so some way to go for Sonia futures.

As 2019 ends and we move into 2020, we expect to see much higher volumes in SOFR futures and SOFR swaps, with the upcoming Q3 move by clearing houses from Fed funds to SOFR discounting. While Sonia has no such trigger, as sterling swaps are already discounted with Sonia, continued exhortations from regulators should result in data showing higher Sonia and lower Libor volumes.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Op risk data: FIS pays the price for Worldpay synergy slip-up

Also: Liberty Mutual rings up record age bias case; Nationwide’s fraud failings. Data by ORX News

What the Tokyo data cornucopia reveals about market impact

New research confirms universality of one of the most non-intuitive concepts in quant finance

Allocating financing costs: centralised vs decentralised treasury

Centralisation can boost efficiency when coupled with an effective pricing and attribution framework

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics

Does crypto really need T+0 for everything?

Instant settlement brings its own risks but doesn’t need to be the default, writes BridgePort’s Soriano

October’s crash shows crypto has come of age

Ability to absorb $19bn liquidation event marks a turning point in market’s maturity, says LMAX Group's Jenna Wright

Responsible AI is about payoffs as much as principles

How one firm cut loan processing times and improved fraud detection without compromising on governance