Helen Bartholomew

London bureau chief

Helen Bartholomew is London bureau chief for Risk.net.

She has written on a range of derivatives and markets topics including benchmark reform, margin rules, equity derivatives and structured products. Prior to joining Risk.net, she was derivatives editor for International Financing Review, part of Thomson Reuters, where she previously reported on debt and equity capital markets.

Helen holds a bachelor’s degree in anthropology from the University of Durham, UK.

Contact Helen on +44 (0) 20 7316 9223 or helen.bartholomew@infopro-digital.com

Follow Helen

Articles by Helen Bartholomew

ECB’s Holthausen urges market to ditch Eonia

Regulator sees risk in relying on fallbacks to effect switch to €STR – and calls on dealers to educate clients

Friary deal clears path for Sonia switch revival

Consent solicitation for Libor-linked pass-through notes is first transition test for variable-duration instruments

Autocalamity: can hit product be reinvented?

Spreads on ‘worst-of’ bonds leap 50% as some dealers retreat and others pile on hedges

SOFR basis tightens on ‘big bang’ auction disclosure

Indicative auction portfolio unveiled by LCH shows discount risk heavily skewed to liquid end of curve

Bonds and loans clash on Sonia compounding style

Choice of ‘lag’ method for sterling RFR loan conventions bars use of BoE index

SOFR discounting: CCPs prepare for make or break auctions

Deluge of one-way risk and kinks in basis swap auctions could derail Libor transition milestone

Race to cash in on term Sonia is filled with twists

Pending merger and FCA’s effort to create synthetic Libor rates could sway outcome

SocGen mulls sale of structured product books after big losses

Rival Natixis also plans to place parts of its equity derivatives business in run-off mode

Stanford’s Duffie shakes up SOFR credit race with AXI index

Academics propose new credit index that ditches Libor tenors for a single funding spread

Term SOFR rate still possible this year, benchmark firms say

Administrators target year-end benchmark trials despite low swaps liquidity

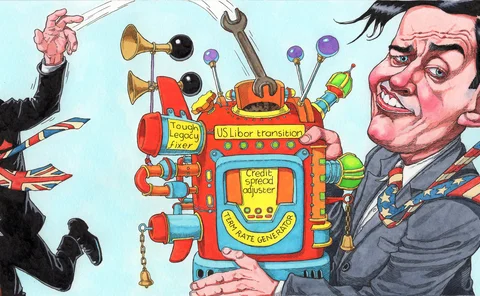

UK’s tough legacy fix spells trouble for US Libor transition

FCA will have little control over how synthetic Libor rates are used in other jurisdictions

Oil funds want to reduce risk. Will investors let them?

Despite posting big losses, funds that track front-month contracts remain popular with investors

Twin-track solution for ‘tough legacy’ Libor falls flat

Critics deplore lack of detail in UK taskforce's call for parallel legal fix and synthetic rate

Ice swap rate adds safety net with Tradeweb quotes

Inclusion of dealer-to-client prices will boost publication rate in stress periods, IBA claims

WisdomTree shuts oil ETPs after Shell terminates swap deal

Counterparty departure forces closure of eight oil trackers with $580 million of assets

US loan market will move to SOFR by Q1 of 2021 – Wells Fargo

Libor head predicts quick transition for loans following ‘big bang’ shifts in swaps

UK regulator rules out extending Libor deadline

Despite Covid disorder, FCA will not compel banks to submit Libor quotes after 2021

Markit plans SOFR credit spread add-on using CDS data

Vendor taps vast pool of credit market data to create new benchmark “not dissimilar” to Libor

Simm may come with a side benefit – a common data standard

Buy-side firms using Acadiasoft for Simm calculations must adopt the ORE XML data format

Pressure grows on structured products as losses mount

Dividend-related losses at BNP Paribas may be higher than previously reported

How axed dividends left SocGen in a €200 million hole

Collapse in equity trading revenues prompts rethink of autocall hedging

Covid loans support six-month extension for Libor lending

UK working group delays Libor loan end-date to March 2021 as emergency loan scheme shuns Sonia