This article was paid for by a contributing third party.More Information.

Institutional ETF trading – Evolving workflows and execution strategies

The end of 2019 and the approach of 2020 come at a dynamic period in the evolution of exchange-traded funds (ETFs) and their role in the trading environment. Not only do ETF assets continue to grow – global assets under management recently reached $6 trillion – but the ways in which institutional investors are using them continue to evolve. In order to help assess the current landscape and provide insights for the future, Risk.net and Jane Street have partnered for the third consecutive year to produce a global survey of how institutions buy and sell ETFs.

The 2019 survey results show that buy-side traders are becoming more adept at gauging ETF liquidity, optimising execution strategies and selecting effective counterparties. In the current environment of fee pressure and increased regulation, prioritising competitive pricing has emerged as a theme that transcends both region and institution type.

Key takeaways from this year’s comprehensive survey

- Competitive pricing – Across regions and institution types, traders value competitive pricing above all else when choosing a counterparty. Globally, 58% of survey respondents said this was the most important criterion when choosing a liquidity provider. Respondents also revealed they are taking a more systematic approach to measuring the competitiveness of their brokers.

- Trading desks – A significant percentage of institutions (29%) have dedicated trading desks or dedicated traders for handling ETF orders. The same proportion use separate brokers for their equities and ETF orders. These statistics indicate that institutions increasingly value those who understand the nuances of ETF trading methods.

- Request-for-quote (RFQ) platforms – Buy-side traders are increasingly making use of RFQ platforms to place multiple counterparties in competition with one another. Forty-one per cent of respondents say they use RFQ platforms most frequently to trade – the highest share in the three-year history of the survey.

- Benchmarking – Comparing the execution price to the best bid/offer continues to be the most common means by which institutions gauge trading prowess, with 36% of respondents citing this as their primary benchmark. Four other benchmarks were each cited by more than 10% of respondents, suggesting a wide variety of benchmark preferences.

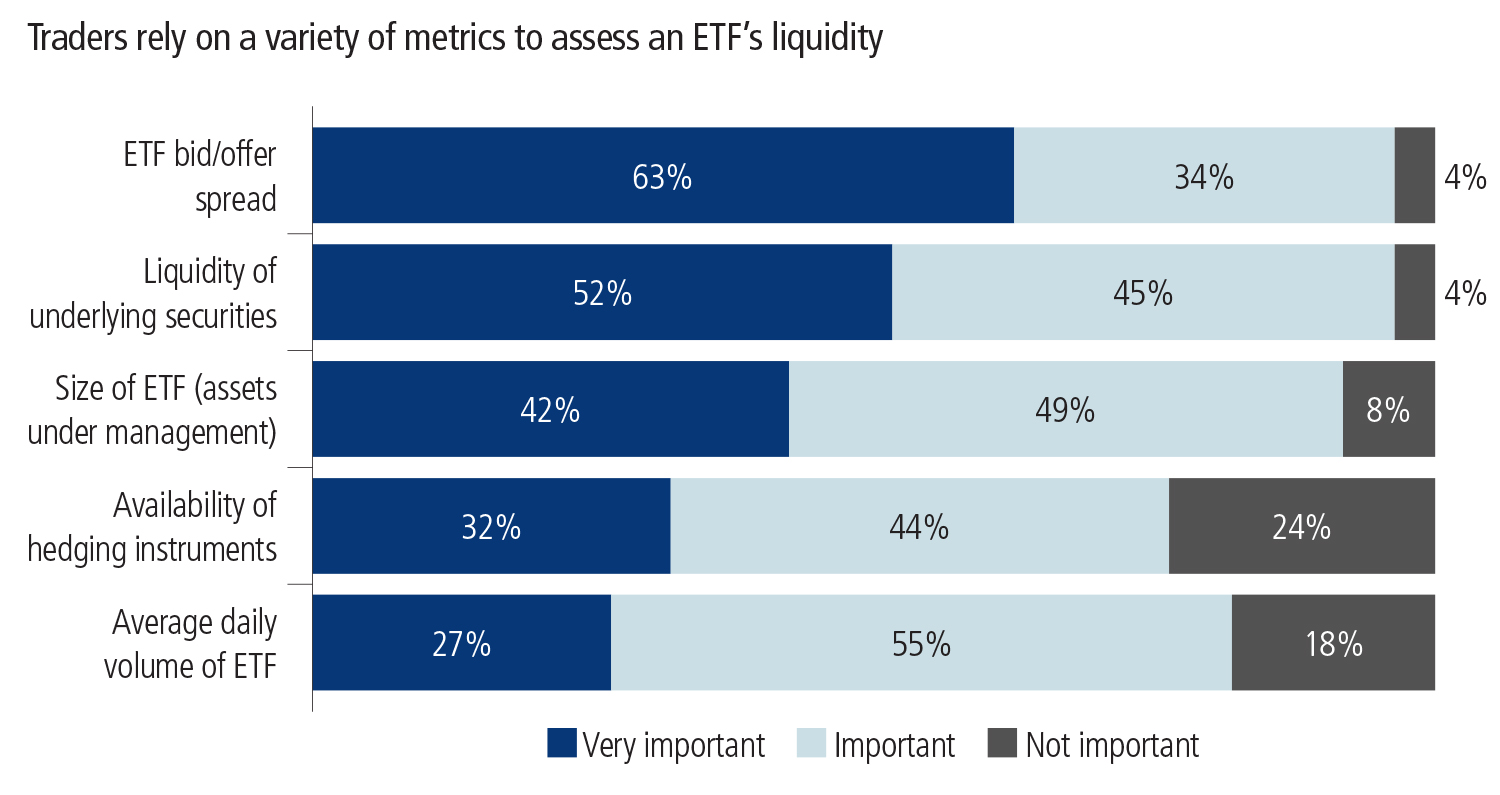

How important are the following criteria when it comes to gauging the liquidity of an ETF?

ETF average daily volume fell for the third consecutive year in terms of relative importance for traders in their liquidity assessments. One possible explanation for this would be that, as institutions become more familiar with the creation and redemption process, they are becoming more comfortable looking past the on-screen trading volumes to other metrics.

Availability of hedging instruments saw the strongest uptrend in trader importance under this year’s format, with close to one-third (32%) describing this as a “very important” element in their liquidity evaluation, whereas last year only 4% of respondents said this. Hedging instrument availability did prove the most polarising, however, with 24% calling it an “unimportant” aspect of their process.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net