Efficiency and control in collateral management

Collateral management has matured over the past five years to the point where the International Swaps and Derivatives Association estimates that the total collateral value in use has grown by more than 300% from $437 million in 2001/2002 to $1.329 trillion in 2005/2006. The number of agreements in place has risen by more than 380% - from 28,140 to 109,733 - and the percentages of total trades covered and total exposure covered have both risen from about 25% to more than 50% (Isda Margin Survey, 2006). The collateral function has become more closely aligned with credit and, in some forward-thinking firms, the front-office and collateral departments are working together to leverage collateral as a trade enabler, rather than viewing it simply as a post-trade operations function. Having spent these five years refining itself and proving its worth, where is collateral management going in the next five years? Some are looking to the frontiers for new ways to manage collateral through cross-product margining or trade portfolio optimisation. For many, however, the primary focus is in optimising their collateral programmes through increased efficiency and control.

The collateral management process

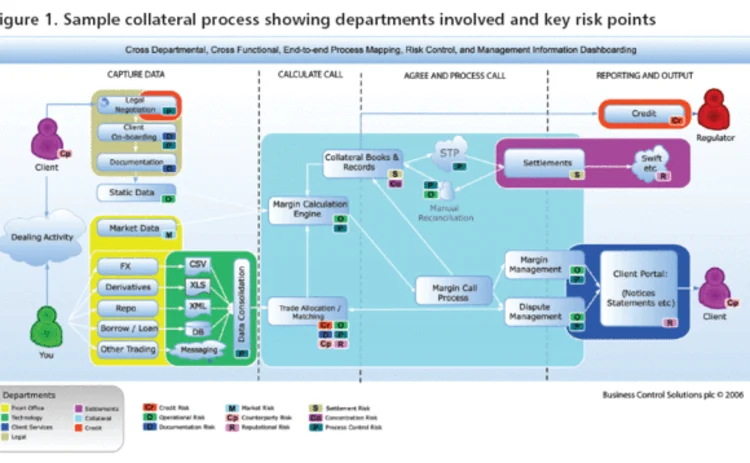

The collateral function interacts with a number of departments, from the legal communication during agreement negotiation, through to settlements when collateral is booked to meet margin calls. Each of these interactions is governed by one or more pre-defined processes, and each process carries its own type and level of risk. Figure 1 shows a representation of the collateral process, the interdepartmental relationships surrounding the collateral function and some examples of the types of risk that may be present in each relationship. There is no 'typical' collateral process because every firm is uniquely configured depending on where it has positioned the collateral function (for example, front-, middle-, or back-office, credit, outsourced, etc.); the systems in use; the technologies underpinning those systems; the maturity and primary focus of each department; the types of instrument predominantly traded; and the primary business drivers for running the collateral programme. Figure 1 will serve as a reasonable approximation of what a 'typical' collateral implementation might look like.

The most important thing to note about Figure 1 is that the collateral process starts and ends with the client. This may seem like a fairly innocuous statement but, in an increasingly competitive market place, particularly in the prime brokerage arena, the collateral process provides numerous opportunities to provide poor service to counterparties simply because there are so many possible points of failure. On the other hand, a firm that proactively manages the risk and provides an efficient service can clearly differentiate itself and become more attractive to its target market.

Controlling the risk associated with a process does not require that the collateral function owns the process, but it should be able to identify, record, assess and monitor the process effectively. The line function should be analysed under different operating conditions, for example, a normal business day, month-end interest processing, year-end special reporting, a particular weekday with a high number of weekly calculations, bank holidays that might invoke special processing due to upstream dependencies, and so on. Once the processes have been identified, the next challenge is to record them in a manner that promotes regular updates as the business evolves, and provides a structure that facilitates risk measurement and ongoing monitoring. The Sarbanes-Oxley Act of 2002 spawned many documentation systems that accurately recorded the state of affairs at the time of the analysis but are too cumbersome to update and provide no quantitative measurement of the ongoing status of the process. This obviously leads to an increasing divergence between the documented risk assessment and the actual daily situation but, more importantly, the actual daily situation is largely unknown. If a suitable environment could be found in which to record and measure key risk indicators, then a number of opportunities open up. It becomes possible to:

- identify areas that require more attention or where a disproportionate amount of budget or effort is being spent relative to the perceived risk;

- conduct trend analysis to determine whether service level agreements (SLAs) are being met or whether unrealistic expectations have been set;

- identify areas that are particularly dependent on key personnel, or that lend themselves more naturally to cheaper resourcing solutions; and

- effectively initiate and drive change that will increase efficiency and control.

Control the 'on-boarding' and focus on the 'client'

We will now identify some of the key risk areas in the collateral process, the negative impact that these may have and examples of how the implementation of effective control can minimise this impact and streamline the process.

The collateral process starts with the legal negotiation and client on-boarding phase. The process is usually iterative and involves much communication between the client, the relationship manager and the legal, credit and operations departments, and often takes place over several months. This generates a large volume of information that is shared between numerous people over a protracted period of time, requiring a comprehensive tracking system to maintain an accurate audit trail, while ensuring that all parties are operating with the most relevant information.

During this time, the firm has to balance the desire to realise the underlying trading opportunity with the credit and counterparty risk involved, whilst mitigating reputational risk and preserving goodwill. If this stage of the engagement is handled correctly, then it should result in a credit support annexe (CSA) that provides acceptable levels of risk mitigation to both parties, covering appropriate trading entities and products, and is operationally supportable at a cost that does not negate the benefits that the opportunity presents. In the worst-case scenario, there is a lack of continuity, the client feels like they never speak to the same person twice, the relationship breaks down and the entire trading opportunity is lost.

There are numerous points between these extremes at which the process can become unnecessarily prolonged, during which time the front office may already have commenced trading. In a desperate bid to expedite the process and cover the risk, the approved CSA terms may be relaxed, or the communications loop shortened and the operations department is left managing a non-standard CSA that requires additional bespoke processes and additional resources to support.

A well-structured workflow and escalation-based client on-boarding system - which can be rolled out across multiple departments, and allows each department to action its tasks in a way that does not generate an unreasonable extra workload - is the first step to identifying these risks. Having that system track the amount of time spent at each stage of the workflow, the number of times a particular communication loop is revisited, and the number and severity of escalations, makes it possible to track and record where the process is failing. Each negotiation can then be measured against the firm-wide trend to establish whether more relationship management effort may be required to meet the client's expectations. The process as a whole can be analysed for 'black spots' and the quantitative data can be used in conjunction with any qualitative data (such as client feedback) to instigate and drive change in the relevant areas.

Overnight processing - control the uncontrollable

Once the on-boarding process has been completed and the client details and CSA terms have been converted into electronic format, the trades will start feeding through to the collateral system from the applications used to book the deals. This will usually manifest itself as a feed that is generated during a complex end-of-day batch, which is itself dependent on a number of other systems and events. SLAs will be in place to try to ensure an appropriate level of support and urgency is directed at any overnight failures that may compromise the collateral function in dispatching its margin calls by the Isda-recommended 10:00am deadline. There are systems where it is relatively straightforward to generate specific information, in the format required and within the appropriate time window. There are other environments where a single feed may well be dependent on the stability of three different operating systems over five servers connecting to two different database platforms and built on a mixture of vendor and bespoke code. There are often too many links in the chain to guarantee 100% reliability. For example, a server could suffer a network card failure, resulting in a loss of communication to/from that machine; unexpected data in a critical field (such as a comma in the legal name) may cause that data to be misinterpreted; or a manual process that triggers a critical cascade of activity may not be completed correctly, leaving the rest of the process in a terminal wait state.

It may be impossible to predict every type of failure but it is certainly possible to identify key points of failure. Once this has been done, it is also possible to assess the impact that a failure at that point will have on the successful completion of the overall process, measure the level of confidence in any data generated post-failure and place appropriate emphasis on a suitable resolution or support option.

By recording the failures against these identified risks, it is possible to measure the actual versus the predicted impact to determine whether emphasis is being placed in the right areas. The frequency of the failure will indicate whether this is a regular event (in which case it may be necessary to redirect budget into finding a systemic solution to the problem) or a rare occurrence that is inconvenient but manageable. If the data is presented in a control dashboard that displays the information objectively and provides transparency to all parties, then key personnel will be able to proactively manage the process while keeping the end-user community and senior management fully informed. Most importantly, the relationship between collateral management and its data and service providers can be conducted based on quantitative data rather than a 'gut feeling' that system A or team B is compromising the efficiency of the collateral programme.

Margin and dispute management - more control does not mean less efficient

The margin and dispute management functions are core to the entire collateral management function. This is where the majority of daily client interaction takes place when calls are made, notices and statements sent, portfolios reconciled and collateral moved. The front office may be engaged in selecting suitable collateral to meet a margin call, settlements would be involved in instructing and moving the collateral, and credit would provide input on the tolerances surrounding disputes and whether calls can be waived.

The primary interactions during this process, however, are between the collateral line function and the client, and it exposes more operational, process control and reputational risk than anywhere else in the end-to-end process. This is also an area in which many firms struggle to find the right balance between efficiency and control - they find that the more control they apply, the less efficient the process becomes - and this is largely down to the way that control is implemented.

The traditional view of control in the margin and dispute management areas involves creating check lists for all the granular tasks in the process. The problem with check lists is that they need to be collated in order to get a consolidated overview. By 'walking the floor', a line manager will have a good sense of how things stand but that level of micromanagement becomes impossible in an environment where line functions have been offshored and/or reporting lines span multiple time zones. That type of information is not readily quantifiable and this reduces the ability to respond quickly to a market event.

The next evolutionary step is to convert the manual check lists into an electronic workflow that guides the user down a predetermined path from the calculation of the call to the final confirmation that the collateral has settled. This is certainly better than the paper check lists, but only insofar as it forces a user to follow the predefined path because the next step is not available until the current step has been satisfactorily completed. This definitely provides the additional control required but there is no significant gain in efficiency.

In order to truly exploit the control provided by the workflow and extract greater efficiency from the margin and dispute management process, the workflow must evolve into something more than a state transition engine. It must do more than simply get the user from item 1 in the check list to item 23. If values are within acceptable tolerances and no further validation is required, the workflow should progress automatically. It should prioritise which information is most critical so that the greatest effort is spent mitigating the greatest risk. It should collate the data that it is collecting in order to provide consolidated views of the current situation up and down the management chain, and across products, entities and departments so that, when a market event takes place (for example, Enron, Parmalat or a major client rating downgrade), there is instant visibility and transparency as to how the event is being managed. This empowers people at all levels in the organisation to respond appropriately and to quantify the impact that their efforts are having.

Using collateral management to drive change

These brief examples highlight the diversity of risk and process in evidence in the collateral arena today. Whether it is the legal negotiation of an agreement, the provisions of data to the collateral management system or the way in which margin calls are managed, the action points are consistent. In order to control the process, you need to identify it, record it, assess and monitor its status on an ongoing basis, leverage that data to provide clear management information that is appropriate to the level at which it is being used, and finally to use that information to drive the change required to improve the efficiency of the process and control the risk.

Collateral management is an ideal environment in which to apply these principles as it touches many different departments, crosses different product lines and interfaces directly with the client. There is a real opportunity in this area to drive systematic and programmatic changes throughout the organisation aimed at reducing cost per trade through improved efficiency, while maintaining the primary focus on controlling risk.

ABOUT BUSINESS CONTROL SOLUTIONS

Business Control Solutions plc has a number of specific technology solutions within its Collateral Control Architecture that can augment and enhance your existing processes and overall collateral management framework. Business Control Solutions has a proven track record in providing manual and automatic certification, process control mapping and management information solutions to several top-tier investment banks.

Visit: www.bcsplc.com.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net