Tail risk premiums versus pure alpha

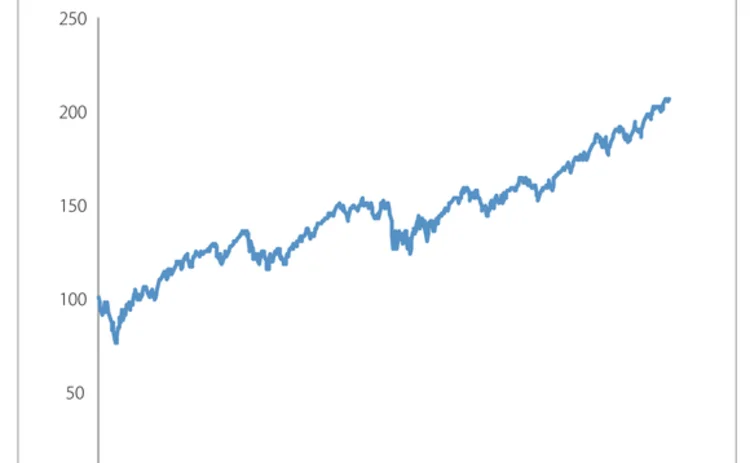

Here, Yves Lempérière, Cyril Deremble, Trung-Tu Nguyen, Philip Seager, Marc Potters and Jean-Philippe Bouchaud present extensive evidence that risk premium is strongly correlated with tail-risk skewness but very little with volatility. They introduce a new, intuitive definition of skewness and elicit a linear relation between the Sharpe ratio of various risk premium strategies and their negative skewness. They find a clear exception to this rule: trend following that has positive skewness and positive excess returns, suggesting that some strategies are not risk premiums but genuine market anomalies. Based on their results, they propose an objective criterion to assess the quality of a risk-premium portfolio

CLICK HERE TO VIEW THE ARTICLE IN FULL

One of the pillars of modern finance theory is the concept of risk premium, ie, that more risky investments should, in the long run, also be more profitable. If this was not the case, investors would divest, prices would fall and expected returns would rise until they become attractive again. Cogent as it may sound, this conclusion appears to be in

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Asset liability management

The future of ALM: the rise of risk-adjusted business planning

Where financial institutions can build a foundation for risk-adjusted business planning, aided by the ALM systems of the future

ALM technology systems 2023: market update and vendor landscape

Chartis' 2023 ALM research report returns to the key themes highlighted in the 2021 report. This update re-evaluates the complex ALM framework, which broadly comprises distinct segments that include funds transfer pricing, liquidity risk management and…

Incorporating climate risk into ALM frameworks at banks

In this webinar convened by Risk.net in collaboration with SS&C Algorithmics, experts discuss the challenges and benefits of incorporating climate risk into asset-liability management frameworks at banks

ERM reboot: how leading insurers are turning risk decisioning into strategic advantage

An expert discussion exploring how leading insurers are adapting ERM systems in support of a wider range of opportunities, helping to avoid losses, navigate unstable markets and maintain a strong reputation

Incorporating climate risk into ALM frameworks for banks

Banks are coming under increasing regulatory pressure to incorporate climate risk into their risk management frameworks. An emerging focus is incorporating climate risk into the asset-liability management (ALM) function. This webinar explores this new…

ALM and liquidity risk reporting greatly enhanced by big data applications

Sponsored video: Luis Mataias, IBM Watson Financial Services

Leading the way in the risk management (r)evolution

Sponsored feature: Prometeia

Insurers must perform balancing act

Winners' Circle: RBS