Mifid II – Will you be ready to report?

Mifid II not only imposes a new framework for European Union (EU) financial services that is hugely prescriptive (and, in some cases, prohibitive) in respect of how business can be conducted, it also adds significantly more layers of transaction reporting complexity.

In short, more entities will have to report more information about transactions to local regulators “as soon as possible” and by no later than T+1. The aim is to provide local regulators like the UK’s Financial Conduct Authority with a much bigger window into your – and the wider market’s – trading activities.

This is a major headache for operations and compliance teams in the wake of other regulatory regimes including the European Market Infrastructure Regulation (Emir), Dodd-Frank, the Alternative Investment Fund Managers Directive (AIFMD), Regulation on Wholesale Energy Markets Integrity and Transparency (Remit), the Market Abuse Directive (Mad) and Mifid at a time when precious internal resources – people and capital – are focused on satisfying new rules around front-end service provision, ‘fair and transparent’ trade execution and industry conduct challenges.

While the January 2017 deadline may seem a long way off, the complexity and extent of new transaction and trade reporting obligations mean that there can be no quick fix or shortcut to satisfying Mifid II and Mifir.

Regulators have indicated they expect all reporting parties to get Mifid II reporting right from the outset, and that they will take a very dim view of firms that fail to report in the prescribed manner, applicable equally to under- and over-reporting. Not only does this present the prospect of financial penalty, a burden that will likely fall more heavily on smaller firms, it has the potential to damage reputations. Who would want to be seen as a ‘failing’ firm in respect to ‘transparency’ and ‘best practice’ – the guiding principles driving Mifid and other financial markets regulation?

As such, investment firms and other reporting parties should be fully committed to Mifid II implementation programmes in order to be fully prepared to report by January 2017.

Who needs to report?

It might be simpler to list who doesn’t need to report under the new regulation. Mifid II extends the transaction reporting obligation to a much broader segment of financial market participants than the original Mifid. New reporting obligations apply to all investment firms, including:

• Investment managers providing advice and portfolio management to individual clients (for example, managed accounts)

• Credit institutions

• Market operators, including any trading venues

• All financial counterparties under Emir

• All non-financial counterparties falling under Article 10(1)(b) of Emir

• Central counterparties and persons with proprietary rights to benchmarks

• Third-country firms providing investment services or activities within the EU

What needs to be reported?

Not only do more parties have to report, they have to report more information about more transactions. Mifid I transaction reporting applied only to financial instruments admitted for trading on a regulated market (and to over-the-counter (OTC) derivatives contracts linked to those instruments). Mifid II expands the range of financial instruments that have to be reported to pretty much every tradeable instrument or derivative of an instrument, including:

i. Financial instruments admitted to trading or traded on an EU trading venue and to all financial instruments where the underlying instrument is traded on a trading venue. In addition to regulated markets, “Trading venues” now include multilateral trading facilities (MTF) and organised trading facilities (OTF), the likely home for OTC derivatives subject to the trading obligation.

ii. Financial instruments where the underlying instrument is traded on a trading venue. This essentially widens the scope to capture all OTC transactions in such instruments.

iii. Financial instruments where the underlying is an index or a basket composed of instruments traded on a trading venue. This means that just one component of either an index or basket will bring that financial instrument under the reporting obligation.

A transaction does not need to have been executed on an EU trading venue to be subject to the reporting requirement. For example, derivatives traded outside of the EU where the underlying is traded on an EU trading venue will have to be reported.

Investment firms must also report the details of any trade execution that changes a firm’s or its clients’ positions in a given product, for example, a short-selling flag for shares or sovereign debt. MiFIR also imposes specific reporting obligations relating to equity execution quality and commodities positions.

Mifid I to Mifid II – Key changes

Increased reporting fields

• The number of reportable data fields increases from 23 to (at least) 63

• Only 13 of 23 current reportable fields unchanged.

Increased reference data

• Enforced migration to legal entity identifier (LEI). Recent technical standards insist that no reportable transactions can be undertaken with any entity that is eligible for an LEI but doesn’t yet have one.

• Requirement for natural person identifiers, dependent on domicile. As well as enhancing client onboarding procedures, firms will their human resources systems to supply National Insurance and other personal identifiers for employees involved in transactions.

• Product identifier reporting (mix of International Securities Identification Number (ISIN) and Emir-like description). Alternative Instrument Identifiers for exchange-traded derivatives have been abandoned, in favour of the older ISIN standard, creating a new challenge in the maintenance of product reference data. Further, a complete and accurate Classification of Financial Instruments code (and up to 14 other fields) must be supplied for any product that does not have an ISIN contained in the European Securities and Markets Authority “official list”.

Increased product range

• Products traded on all organised markets now in scope: regulated markets, MTF, OTF. So, for example, contracts for difference on currency pairs traded on an MTF must be reported wherever they are traded.

• No exemption for interest rate, commodity and forex products

Extended regulatory perimeter

• No automatic exemption for commodities brokers

• No waivers for asset managers

Additional information requirements

• Short sale flag

• Algorithm identifiers (decision and execution)

• Buyer/seller reporting model

Build or buy?

A critical first consideration for any firm is whether there are sufficient internal resources available to evaluate new reporting requirements. Secondly, it is important to determine how internal systems and processes might be adapted to deploy a compliant and efficient Mifid II solution, and indeed a multi-regime reporting framework.

As Kieran Mullaley, executive director, Financial Services Advisory, EY, observed (Capital Markets Reform Mifid II): “Organisations will need a plan that spans across individual regulations. Managing them one by one will incur significant costs and duplications and will simply stretch even large organisations beyond their capabilities.”

One way to alleviate the reporting headache is to partner with a specialist service provider and benefit from established expertise in understanding the regulation(s).

PROXIMITY

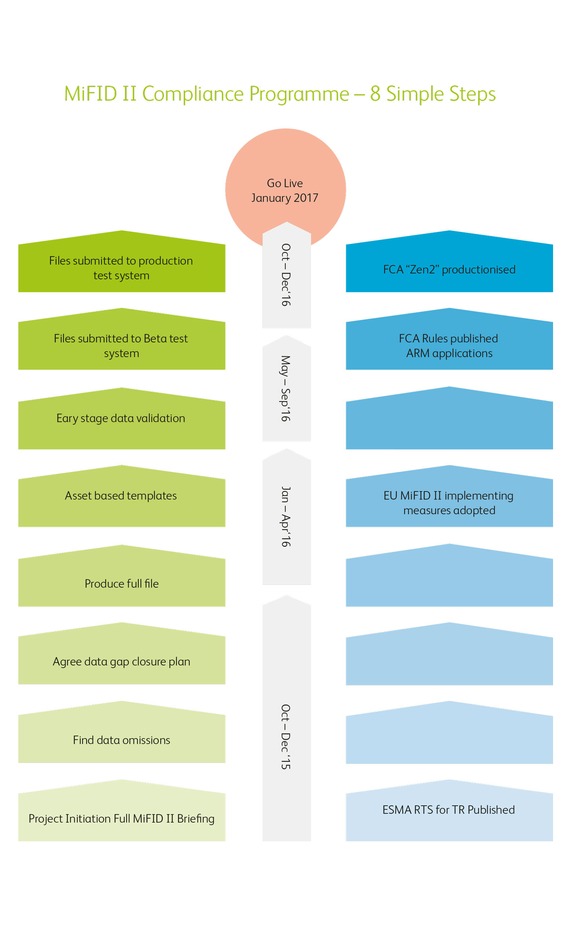

Prior to becoming fully compliant with Mifid II reporting requirements, eligible parties have quite a few boxes to tick in order to hit the ground running for the January 2017 deadline. Abide Financial has designed a programme to help counterparties prepare for Mifid II/Emir, learning from the deployment of Mifid I and EMIR reporting solutions.

PROXIMITY has been driven by client demand for a guided approach to solving Mifir data reporting challenges. Abide Financial has launched the PROXIMITY programme – a fully managed service that prepares client internal technology, operations and compliance ecosystem for Mifid II.

Clients benefit from:

• Abide’s experience in Emir and Mifid I client onboarding

• Full compliance with Mifid II requirements

• Expertise in implementing complex Mifid II reporting requirements

• Guidance for managing operational, compliance and technology risk across multiple reporting regimes

• Optimised operational resources and compliance costs

• A solid foundation to manage post go-live regime developments

The PROXIMITY programme is focused on providing clients with in-depth data gap analysis, producing a pilot reporting profile, carrying out early stage data validations and submitting files to the beta reporting test system. The aim of this programme is to provide clients with the best possible expertise and customised advice, maximising Mifid II reporting efficiency and regulatory compliance at go-live in January 2017 and beyond.

For a more in-depth conversation about what we can do to support you in the preparation and ongoing reporting challenges of Mifid II/Mifir reporting, please contact us: advice@abide-financial.com

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net