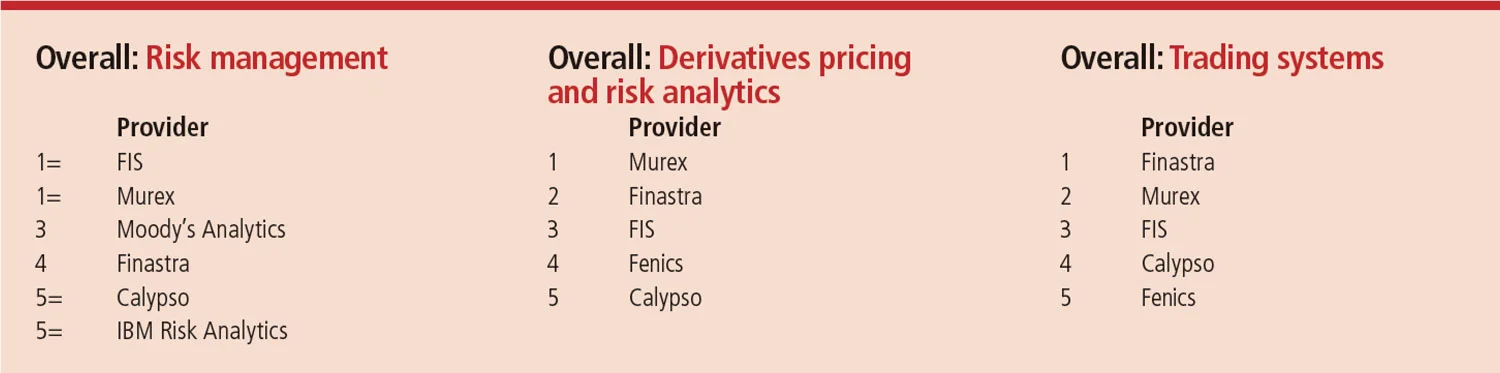

Asia Risk Technology Rankings 2017: The winners

Murex tops tech provision

Click for full rankings breakdown

Over the last year, interactions between financial institutions and technology vendors have centred on regulatory compliance, improving efficiency, reducing costs and seizing emerging business opportunities. Regional players are not only reacting to new local rules, but in many cases also aiming to meet European and US regulations as they extend their business globally. Many of the new rules, such as the Fundamental Review of the Trading Book (FRTB), the International Financial Reporting Standard (IFRS) 17 and the second Markets in Financial Instruments Directive (Mifid II), require complex calculations and frequent reporting, driving the need for efficiency and high performance. And everywhere there is a focus on cost and rationalising IT infrastructure.

Murex has attempted to address all these themes with ongoing developments in its MX.3 capital markets platform and associated services. “Regulation remains at the heart of our client concerns,” says Guy Otayek, chief executive of Murex Asia-Pacific, who is based in Singapore. Murex topped the rankings, scoring highly in almost every category. “There is momentum around Basel IV reforms that will impact how our clients are organised, manage their trading business and view their risks. The new requirements are putting a significant pressure on existing IT infrastructure and our clients are looking at Murex to help them with massive transformation projects. FRTB in particular advocates for a complete alignment of risk and front-office processes and valuations.”

This need for front-office and risk alignment is manifested in the the complex set of valuation adjustments, collectively known as XVA, that must now be calculated when pricing instruments to take all risks into account. “In particular counterparty, funding and margin become critical in Asian markets [for financial institutions] to remain competitive,” says Otayek. Murex has invested heavily in supporting FRTB and XVA calculations in MX.3, he says. Among clients in the region relying on Murex to support their business and regulatory compliance is China Merchants Bank, which recently implemented MX.3 for front-to-back office support for its capital markets teams based in Shenzhen and Shanghai.

On the technology side, the adoption of cloud computing for critical systems is another major development in 2017, says Otayek. “Our clients and their regulators are now embracing the cloud and a transfer of IT infrastructure towards hybrid cloud solutions. We are engaged on this subject in multiple countries and some of our clients are already getting ready to move production workloads into public clouds,” he says.

Finastra, which came second overall in the rankings, has also been working with clients in the region to revamp their technology infrastructure in the light of the new regulatory and business challenges. “IFRS 9 will require the co-ordination of finance and credit risk teams, and FRTB needs the front office and risk to be consistent rather than independent,” says Chee Hwee Seah, Singapore-based head of risk management solutions for Asia-Pacific at Finastra. “This creates disruptions and leads financial institutions to take on transformational projects for their risk platforms.”

Many institutions still have risk systems based on a segmented model with multiple data sources and calculations, and separate reporting of risks, says Seah. Finastra’s approach is to offer a set of components, such as a centralised pricing engine and an FRTB compliance component, that can replace or be implemented with elements of an institution’s infrastructure to create an integrated front-to-back office platform. “Banks are interested in a componentised solution that enables them to deploy shared analytics across multiple working departments. This allows them to have better insight into their risk attribution and regulatory compliance and achieve significant capital savings and operational efficiency,” says Seah.

IFRS 17, the new international standard for insurance contract accounting, is currently exercising insurers across the globe. The deadline for implementation is 2021 but South Korea, with some other Asian countries, is adopting the new rules early. IFRS 17 imposes a principles-based approach to contract accounting that is challenging both in its interpretation and its calculation requirements. FIS, which came third in the overall rankings, has built up expertise in the new regulation and adapted its Prophet actuarial modelling platform to handle calculations. The company is already working with three insurance clients in Korea on achieving compliance.

FIS has also been evolving other elements of its broad suite of capital markets software for regulations such as FRTB and the new IFRS 9 accounting rules. “Under IFRS 9, risk finance and lending units have to work together and share the same data, models and standardised process workflow to calculate expected credit losses. We have addressed IFRS 9 with our Ambit solution and modelling tools,” says Nasser Khodri, FIS’s group managing director for Asia-Pacific, Middle East and Africa, who is based in Singapore. “For FRTB, we are helping a lot of clients in Australia and Japan to understand the quantitative impact of the new rules, how they can comply with the regulation, and save important capital dollars.” The company is also exploiting adjoint algorithmic differentiation, or AAD, on top of in-memory cube technology to improve the speed and precision of risk calculations in its Adaptiv risk management platform. These are among the developments that helped FIS top the risk management categories in the awards.

Like FIS, Moody’s Analytics has been addressing the implications of IFRS 9 to support its financial institution clients. It has developed a new feature in its RiskFrontier portfolio risk management platform that allows users to simulate their future impairment charges and resulting impact on earnings. “This feature is called credit earnings and is now available in the latest version of RiskFrontier,” says Shailendra Jain, general manager for enterprise risk solutions at Moody’s Analytics in Singapore. “It will allow an institution to measure and manage the portfolio risk/return trade-off based on its impact on its earnings.”

Moody’s Analytics came fifth in the rankings overall, scoring particularly well in liquidity risk management, regulatory capital calculation, asset and liability management, and market and credit risk management. “In the last year, we have seen an increased need to blend economic risk measurement with regulatory requirements and accounting-based measures,” says Jain. “Many firms are trying to reconcile regulatory capital, whether it is Basel III or stress testing-based capital, with economic capital. To help facilitate this, we have developed a composite capital metric to help align the different views of risk.” The new metric is available in RiskFrontier.

Moody’s Analytics has also been enhancing its RiskAuthority Basel III compliance software to help clients meet the requirements of the rules on exposures to central counterparties, as well as calculate the exposure at default for derivatives under the standardised approach to counterparty credit risk, and has added new calculation methods for computing the capital requirements of equity investments in funds in the banking book, such as calculations for the look-through, mandate and fallback approaches.

Singapore-based Catena Technologies, which scored particularly well across a number of technological and support categories and came sixth overall, is focused on the Asia-Pacific market and is especially alert to local needs. “Hong Kong Phase 2 trade reporting was a major challenge for clients over the past year, given that the number of product types to be reported increased by an order of magnitude, along with the new requirement of valuation reporting,” says chief executive Aaron Hallmark.

The company has increased the level of automation in its Trace cloud-based trade reporting and analytics platform, helping clients to shift to real-time reporting, which is increasingly important under new local and global regulations. “The Hong Kong Trade Repository is challenging to implement automated reporting for,” says Hallmark. “It requires special lifecycle event-level reporting with very particular sequential controls, and it also has unique rules for the amendment of reporting data. Our real-time, lifecycle event-driven data sourcing architecture lends itself perfectly to the Hong Kong Monetary Authority reporting model, and our new post-submission workflow management tools make it much easier for our clients to deal with the unique rules for data amendments.”

Catena has been improving its validation processes to ensure the quality of trade data before it is reported, in order to help clients increase the efficiency of their reporting and avoid mis-reporting or under-reporting which can result in punitive actions by regulators. “We have developed a trade repository simulator that replicates the validations applied by the trade repository, and we have further extended that simulator to cover additional regulatory standards, in order to help our clients pre-validate their submissions before they are ever submitted,” says Hallmark.

“At the same time, we want to help clients ensure that data coming out of the repository to the regulators is high-quality as well. So we have extended our Trace Reconciliation framework to support multiple jurisdictions and to be able to reconcile between not only the positions held with the trade repository and the firm’s own source data, but also to any arbitrary third-party data source, such as a back-office report or a counterparty position report.”

Foreign exchange options are caught up along with other derivatives instruments in the current regulatory tide, but changes in the market are also being driven by technology and business factors. Chief among these are the move to electronic trading in the footsteps of forex spot trading and the need to improve efficiency and reduce costs. With a growing number of electronic venues becoming available, market-makers are looking for infrastructure for connectivity and distribution. Wealth managers and those serving the retail market want simpler user interfaces to present products to their clients, and all participants want to automate their workflows to cuts costs as well as handle growing volumes. Until last year, Fenics happily occupied the niche of providing pricing analytics and workflow to forex options professionals. But with a growing clamour from clients for help to manage and exploit the changes in market, the company built a technology platform called Fenics Trading Solutions (TS) that provides institutions of all types and sizes with the infrastructure and tools they need to operate in the new environment.

“Interactions in the forex options market are increasingly becoming electronic,” says John Crisp, the London-based head of product for Fenics. “Fenics TS supports any foreign exchange options workflow as well as connecting to any liquidity source.” The platform is proving a success in the region and helps explain why the company topped not only the foreign exchange pricing and analytics category, but the forex front-to-back trading category as well.

In recent Bloomberg surveys, nearly half the respondents in Singapore and almost a third in Hong Kong indicated that Mifid II is the regulation that will have the largest impact on their businesses in 2018. And as a measure of the work still to be done for compliance, only 35% in Singapore and 21% of Hong Kong respondents believed they would be ready for Mifid II by January 2018.

Bloomberg, which was voted top market data vendor and came in the top 10 overall, has taken a number of steps to help its clients with the new regulations. For example, it issues and maintains standard LEIs, or legal entity identifiers. “Getting an LEI is a first step for Asian firms to become Mifid II-friendly,” says Jose Ribas, global head of Bloomberg’s derivatives and risk business, who is based in London. “And as non-EU sell-side firms embark on their Mifid II journey, they need to think about best execution, know-your-customer and research.”

Basel III collateral management rules, with their requirements for higher quality collateral, have led to a dramatic increase in the volume of repos traded. This has necessitated better risk management capabilities for repo portfolios, with functionality to cover sensitivity calculations and value-at-risk, as well as stress-test capabilities and better support for global master repurchase agreements, says Ribas. Bloomberg has enhanced the capabilities of its Multi-Asset Risk Solutions (Mars) in these areas “to better support our Asian clients”, he says. Thailand’s Thanachart Bank has recently adopted Mars, as has pan-Asian insurer AIA, which is also implementing Bloomberg’s order management and portfolio and risk analytics applications.

“In Asia, we are consistently observing that clients are increasingly demanding integrated full-service platforms, with less necessity to integrate disparate ‘best-of-breed’ systems. This is due to greater need for operational efficiency and risk management as Asian firms expand and invest overseas,” says Ribas.

To help their clients comply with changing regulations and cut costs, vendors are having to exploit the latest high-performance technologies to cope with the complexity and volume of calculations and improve efficiency. On top of cloud computing, AAD and in-memory data cubes, highly ranked vendors are also using graphics processing units (GPUs) for fast parallel processing of calculations, packaging new functionality as ‘microservices’ that can be easily integrated into existing platforms, and pursuing ‘agile’ software development with regular and frequent delivery of new capabilities for quicker and more customised deployment.

With many compliance deadlines in the next few years, the vendors that continue to succeed are likely to be those that combine effective use of these leading-edge technologies with a deep understanding of the business and regulatory issues and a strong partnership approach to their clients.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Rankings

TP ICAP: leveraging a unique vantage point

Market intelligence is key as energy traders focus on short-term trading amid uncertainty

GEN-I: a journey of ongoing growth

GEN-I has been expanding across Europe since 2005 and is preparing to expand its presence globally

Bridging the risk appetite gap

Axpo bridges time and risk appetite gaps between producers and consumers

Axpo outperforms in the Commodity Rankings 2024

Energy market participants give recognition to the Swiss utility as it brings competitive pricing and liquidity to embattled gas and power markets

Hitachi Energy supports clients with broad offering

Hitachi Energy’s wide portfolio spans support for planning, building and operating assets. Energy Risk speaks to the vendor about how this has contributed to its strong Software Rankings performance in 2024

Market disruptions cause energy firms to seek advanced analytics, modelling and risk management capabilities

Geopolitical unrest and global economic uncertainty have caused multiple disruptions to energy markets in recent years, creating havoc for traders and other companies sourcing, supplying and moving commodities around the world

ENGIE empowers clients globally to decarbonise and address the energy transition

In recent months, energy market participants have faced extreme volatility, soaring energy prices and supply disruptions following Russia’s 2022 invasion of Ukraine. At the same time, they have needed to identify and mitigate the longer-term risks of the…

Beacon’s unique open architecture underlies its strong performance

Recent turmoil in energy markets, coupled with the longer-term structural changes of the energy transition, has created a raft of new challenges for market participants