Journal of Financial Market Infrastructures

ISSN:

2049-5412 (online)

Editor-in-chief: Manmohan Singh

Industry adoption scenarios for authoritative data stores using the International Swaps and Derivatives Association Common Domain Model

Abstract

In this paper we explore opportunities for the post-trade industry to standardize and simplify in order to significantly increase efficiency and reduce costs. We start by summarizing relevant industry problems (inconsistent processes, inconsistent data and duplicated data) and then present the corresponding potential industry solutions (process standardization, data standardization and authoritative data stores).

Introduction

1 Introduction

The stages of the trade life cycle include client onboarding, execution and post-trade. This paper focuses on post-trade, which refers to the back- and middle-office activities after a trade is executed. These activities include matching, confirmation, trade enrichment, collateral and margin, trade settling and certain life-cycle events and corporate actions. The post-trade industry is large (with an estimated USD20 billion total annual spending on post-trade processes (Bank of England 2020)) and complex (partly due to the incremental evolution of post-trade processes and technology over decades). There are significant opportunities to simplify and reduce costs.

Here, we aim to provide a design discussion of relevance to financial institutions, trade associations, fintechs and official institutions. We consider some important industry problems (inconsistent processes, inconsistent data and duplicated data), which have become key obstacles to improving post-trade efficiency. We then identify the corresponding potential industry solutions, including the use of the International Swaps and Derivatives Association (ISDA) Common Domain Model (CDM) (International Swaps and Derivatives Association 2019) and an authoritative data store (ADS). We also provide high-level descriptions with architecture diagrams to illustrate some of the key adoption scenarios for financial institutions, with the intention of conveying a sense of the variety of architectural options for both centralized and decentralized models in this design space. We hope the topics raised in this paper will stimulate discussion and we look forward to continuing industry collaboration on ADSs and the CDM.

2 Industry problems

The industry’s current methods of managing trades through the post-trade life cycle can be inefficient. For example, there are estimated potential cost savings of 80% from just the dealer cost base of approximately USD3.2 billion within the primary areas directly impacted by the CDM (Bansal et al 2019). In addition, it has been noted that if the cost per trade and the cost of doing business become unacceptably high, then financial institutions may start exploring the ongoing viability of certain offerings (International Swaps and Derivatives Association 2020a). It is therefore of strategic importance that the fundamental problems are identified, acknowledged and addressed by the industry.

We summarize the three fundamental industry problems as follows.

- Inconsistent processes.

-

Over time, each financial institution has separately developed a large number of complex post-trade business processes to support functions that are essentially the same both within and across asset classes (International Swaps and Derivatives Association 2016). The resulting variation across the industry in processing business logic and life-cycle events has introduced significant inefficiencies and increased the risk of errors requiring remediation.

- Inconsistent data.

-

Over time, each financial institution has separately enriched trade data and reference data with custom fields and values to incorporate the additional information required by their custom processes. The resulting variation across the industry in both data formats and data values has, similarly to the variation in business processes, introduced significant inefficiencies and increased the risk of errors requiring remediation.

- Duplicated data.

-

Trade data is stored in multiple entities across the industry, eg, at each of the counterparties and at a central counterparty (CCP). In addition, partly as a side effect of satisfying additional requirements over many years, changes to existing infrastructure have sometimes included storing trade data in multiple locations within each entity. Such data duplication across the industry clearly introduces inefficiencies.

Therefore, there is a perfect storm of industry inefficiency in post-trade processing, fueled by duplicated, inconsistent processes operating on duplicated trade data in inconsistent data formats. One result of this situation is that, every time there is a life-cycle event, each of the copies of the trade may need to be updated and then reconciled with each other (International Swaps and Derivatives Association 2020a). However, there are potential industry solutions to these industry problems and the next section discusses a promising way forward.

3 Potential industry solutions

The industry problems identified above (inconsistent processes, inconsistent data and duplicated data) could be resolved via the rigorous adoption of process standards, data standards and ADSs. Given the nature and scale of these industry problems, the potential industry solution must be bold. Transformation across both financial market infrastructures (FMIs)11 1 We use the term FMI to refer to a “legal or functional entity that is set up to carry out centralised, multilateral payment, clearing, settlement, or recording activities” and we “exclude [from the definition] the participants that use the system” (Committee on Payments and Settlement Systems–Technical Committee of the International Organization of Securities Commissions 2012). and broker-dealers22 2 We use the term broker-dealer to refer to “any person engaged in the business of effecting transactions in securities for the account of others” (a broker) or “any person engaged in the business of buying and selling securities for his own account, through a broker or otherwise” (a dealer) (US Securities and Exchange Commission 2008). covering processes, data formats and data repositories would clearly be a significant and lengthy endeavor. The adoption challenges would include industry coordination on business cases, funding/resourcing, prioritization, deployment and potentially the decommissioning of legacy systems. Therefore, in this paper we explore the incremental stepping-stones on the route toward a desirable end state.

3.1 Standardization

The current lack of standardization could be ameliorated via industry-wide adoption of the ISDA CDM. The industry already has a standard file exchange format called the Financial products Markup Language (FpML),33 3 URL: http://www.fpml.org/the_standard/current/. but that does not address the problem of process variation resulting from custom business logic and custom calculations. Building on the principles of FpML, the CDM in addition provides process standardization.

ISDA published an initial digital representation of the CDM in 2018, providing “a standard digital representation of events and actions that occur during the life of a derivatives trade” (International Swaps and Derivatives Association 2018). In 2019, ISDA and REGnosys provided open access to the “full version of the CDM for interest rate and credit derivatives” (REGnosys 2019). Since then, the model has been downloaded, deployed and tested by many market participants. For example, Barclays (in collaboration with ISDA and REGnosys) hosted the Barclays DerivHack 2018 coding hackathon for market participants to explore the CDM for derivatives (Bansal et al 2019) as well as the Barclays DerivHack 2019 for securities (Williams 2019). There are several industry working groups with supportive market participants (including financial institutions, fintechs and law firms) contributing to the CDM; for example, ISDA has CDM working groups for collateral and equity,44 4 URL: http://www.isda.org/committees. and the ICMA has a CDM working group for bonds and repo markets.55 5 URL: https://bit.ly/3CjVqCU. However, broad industry adoption will require an increasing number of market participants to engage in the coming years.

Further, ISDA is working to directly integrate more of its legal documentation, such as the Credit Support Documents, the new 2020 Interest Rate Definitions (O’Malia 2020b, a) and the ISDA Clause Library (International Swaps and Derivatives Association 2020b), with the CDM via legal-agreement components in the model. This will allow the consistent implementation of operational clauses and related procedures from ISDA documentation, thus tying legal data to systems that perform activities governed by legal contracts, permitting analyses that can improve legal risk management.

3.2 ADSs

The industry problem of duplicated data could be ameliorated via industry-wide adoption of ADSs. An ADS can be considered a primary source of information that acts as a single logical reference point, thereby avoiding the inconsistencies that can arise in duplicated data. An ADS can be implemented using either a centralized model or a decentralized model, depending on requirements such as resilience, data distribution and technology maturity. Significant effort and resources are required to build an ADS for an individual financial institution and so, when considering an ADS for the industry, broker-dealers may look to FMIs to help drive industry adoption over several years.

4 Architecture models

Building on the potential industry solutions discussed above, we now explore how ADSs could be deployed to make CDM business events available to broker-dealers. For simplicity, we assume each ADS would be operated by an FMI. We take a high-level architecture perspective and consider both a traditional centralized model and a potential decentralized model. For each model, there are many possible adoption scenarios (depending on each broker-dealer’s degree of integration with the ADS and usage of the CDM) and we explore four key adoption scenarios as architecture options. In both models, the first three scenarios can be considered interim stepping-stones and the fourth scenario can be considered an end state. A particular broker-dealer may decide to remain on an interim scenario (for operational or other reasons), although they would not benefit from the simplifications and efficiencies of the end state. Our working assumption is that such architecture options could, if required, all coexist within a particular infrastructure system, thereby permitting broker-dealers with different degrees of integration to all participate in the same system.

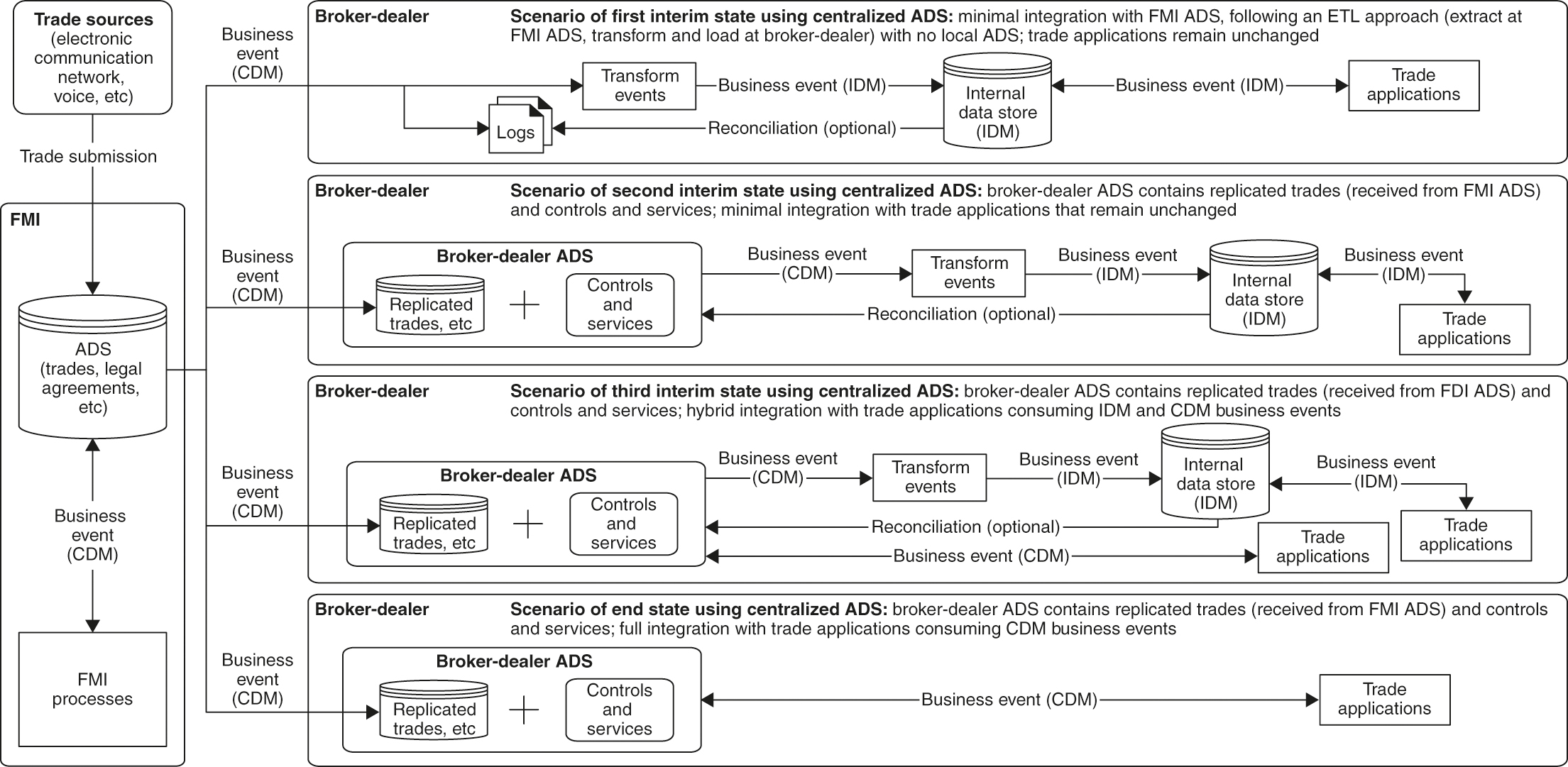

4.1 Centralized model

In a centralized model, the FMI maintains a central ADS, as shown in Figure 1. The FMI receives trade submissions (eg, from electronic communication networks and via voice trading), processes the trades internally and carries through CDM business events to the central ADS. Broker-dealers can then consume the CDM business events via an application programming interface (API). Each broker-dealer maintains a local copy of relevant data from the central ADS, implemented in a form that could potentially range (depending on requirements) from a simple log to a database containing replicated trades. The broker-dealer also maintains relevant local controls and services (including trade process data that is private to the broker-dealer). The combination of the local copy of the ADS and the local controls and services can be considered the broker-dealer’s ADS. There are several implementation options to create this combination, such as enriching private fields in CDM business events with broker-dealer-specific data or joining “immutable” trades with broker-dealer-specific data in a separate repository.

Until the broker-dealer’s internal applications are able to consume CDM business events directly, the broker-dealer would have to transform CDM business events into its internal data model (IDM) business events for its applications to consume. Such IDM business events are typically in an existing proprietary format and are persisted in an internal data store, so it should be noted that the CDM has synonyms to allow firms to internally extend the CDM to map to their IDM and manage those mappings over time until the firm transitions to using the CDM directly. The internal data store may need to be reconciled with the broker-dealer’s ADS, so careful design is required to minimize any increase in complexity arising from interim adoption scenarios.

We now consider some specific options that may be made available to broker-dealers regarding their degree of integration with the central ADS. Figure 1 illustrates four key options that can be viewed as different adoption scenarios along a long-term journey of increasing integration, ie, the first three scenarios are interim states and the fourth scenario is the end state.

- (1)

The “scenario of first interim state using centralized ADS” shows a broker-dealer that has minimal integration with the central ADS. It receives CDM business events and transforms them into IDM business events, which are then carried through to its internal data store (this corresponds to an extract, transform, load (ETL) pattern of extracting at the FMI ADS and then transforming and loading at the broker-dealer). The IDM business events are then consumed by the broker-dealer’s trade applications. The CDM business events are also logged. Note that there is no local ADS and the trade applications remain unchanged. Reconciliation may be required between the broker-dealer’s internal data store and the CDM business events log.

- (2)

The “scenario of second interim state using centralized ADS” shows a broker-dealer that receives CDM business events and maintains its own local ADS including replicated trades from the central ADS. It retrieves CDM business events from its local ADS and transforms them into IDM business events, which are then carried through to its internal data store and consumed by its trade applications, which remain unchanged. Reconciliation may be required between the broker-dealer’s internal data store and its local ADS.

- (3)

The “scenario of third interim state using centralized ADS” shows a hybrid model in which some of the broker-dealer’s trade applications continue to consume IDM business events from its internal data store (as per the “scenario of second interim state using centralized ADS”) but other trade applications consume CDM business events directly from its local ADS (which includes replicated trades from the central ADS). This scenario illustrates the additional flexibility (resulting in some additional complexity) that may be required while a broker-dealer is transitioning from an IDM to the CDM.

- (4)

The “scenario of end state using centralized ADS” shows a broker-dealer that has fully integrated with its local ADS (which includes replicated trades from the central ADS) and fully adopted the CDM internally, with its trade applications consuming CDM business events directly from that local ADS. This is the least complex centralized scenario and can be considered an end state for the centralized model.

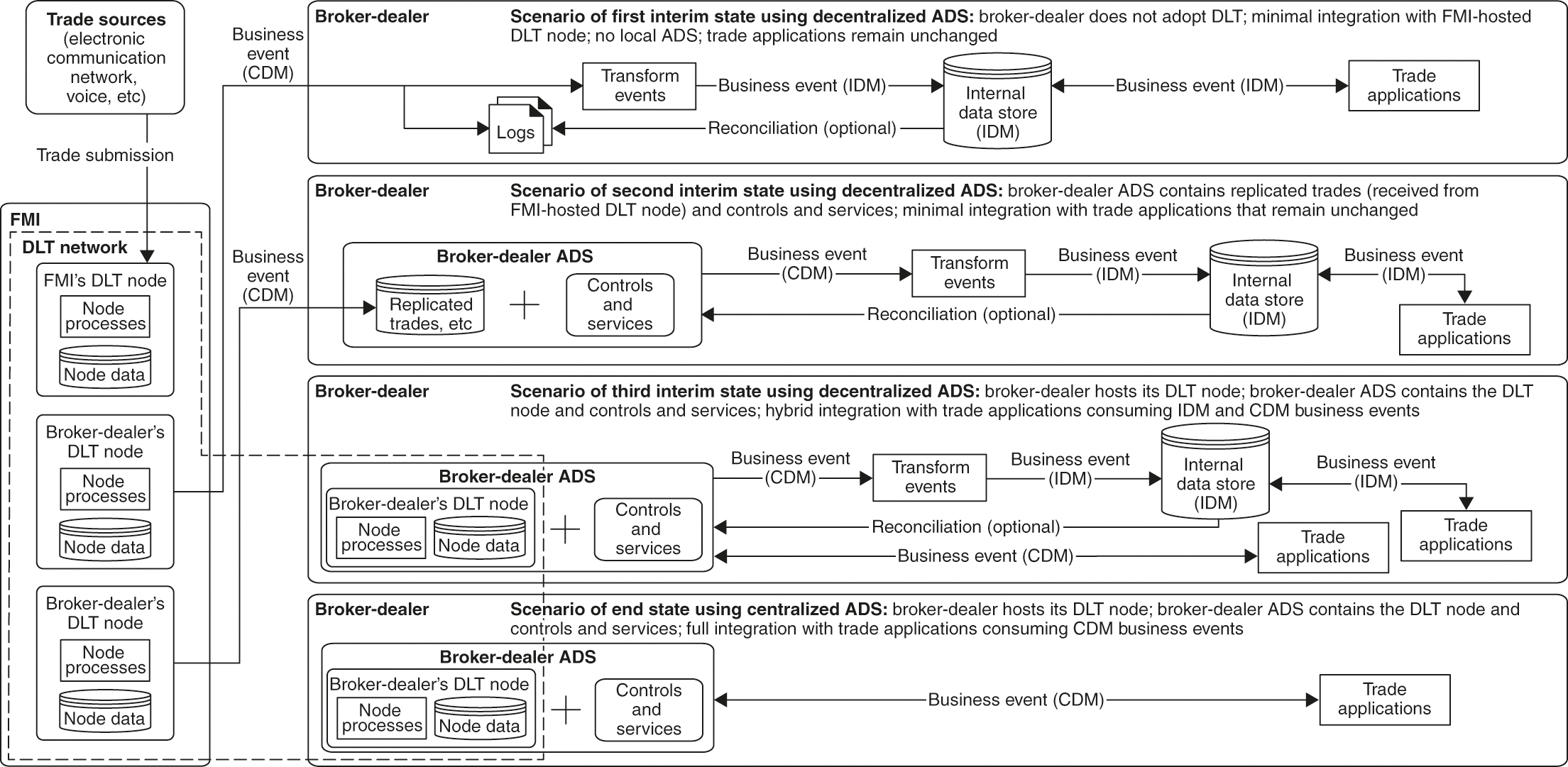

4.2 Decentralized model

The set of architectural options for a decentralized model is typically more complicated than for a centralized model. For example, instead of the ADS being maintained centrally by the FMI, the ADS could be maintained by a combination of both the FMI and the broker-dealers, using both distributed data and decentralized processing. Overall synchronization could potentially be facilitated via emerging technologies such as distributed ledger technology (DLT) (Walport 2016), where a system of distributed ledger nodes acting together can provide a single source of truth among multiple parties. The Depository Trust & Clearing Corporation is one of the post-trade market infrastructures that is exploring the potential to leverage DLT as a pivotal piece of technology that may help bring about new efficiencies in clearing and settlement (DTCC 2018, 2020).

Migrating from a centralized model to a decentralized model would involve significant infrastructure changes, but such a journey can also be viewed as a series of incremental stepping-stones. Figure 2 illustrates four of the options that can be viewed as different adoption scenarios along a long-term journey of increasing integration with an ADS and with DLT, ie, the first three scenarios are interim states and the fourth scenario is the end state.

- (1)

The “scenario of first interim state using decentralized ADS” shows a broker-dealer that has not adopted DLT and thus relies on the FMI to host its DLT node on its behalf. Similar to the “scenario of first interim state using centralized ADS” in the previous subsection, the broker-dealer receives CDM business events and transforms them into IDM trade events, which are then carried through to its internal data store (this corresponds to an ETL pattern of extracting at the “broker-dealer’s DLT node” hosted at the FMI and then transforming and loading at the broker-dealer). The IDM business events are then consumed by the broker-dealer’s trade applications. The CDM business events are also logged. Note that there is no local ADS and the trade applications remain unchanged. Reconciliation may be required between the broker-dealer’s internal data store and the CDM business events log.

Figure 2: Decentralized model showing an FMI maintaining a distributed ADS with broker-dealers and processing CDM business events. The four adoption scenarios illustrate different degrees of integration with the ADS, adoption of the CDM and adoption of DLT. - (2)

The “scenario of second interim state using decentralized ADS” shows a broker-dealer that receives CDM business events and maintains its own ADS including replicated trades from the central ADS. Similar to the “scenario of second interim state using centralized ADS” in the previous subsection, the broker-dealer retrieves CDM business events from its local ADS and transforms them into IDM business events, which are then carried through to its internal data store and consumed by its trade applications, which remain unchanged. Reconciliation may be required between the broker-dealer’s internal data store and its local ADS. Similar to the “scenario of first interim state using decentralized ADS”, the broker-dealer has not adopted DLT and thus relies on the FMI to host the node on its behalf.

- (3)

The “scenario of third interim state using decentralized ADS” shows a broker dealer hosting its DLT node and therefore taking on greater responsibility within the DLT network, with the FMI continuing to be an operator of the DLT network including setting the rules. The local ADS contains the broker-dealer’s DLT node. Similar to the “scenario of third interim state using centralized ADS”, there is a hybrid model in which some of the broker-dealer’s trade applications continue to consume IDM business events from its internal data store but other trade applications consume CDM business events directly from its local ADS (which includes trades in its DLT node). This scenario illustrates the additional flexibility (resulting in some additional complexity) that may be required while a broker-dealer is transitioning from an IDM to the CDM and also the additional complexity that may be required while a broker-dealer is transitioning to DLT.

- (4)

The “scenario of end state using decentralized ADS” shows a broker-dealer hosting its DLT node and having full integration with its local ADS (which includes trades in its DLT node). Similar to the “scenario of end state using centralized ADS”, the CDM has been fully adopted internally, with the trade applications consuming CDM business events directly from the local ADS. This is the least complex decentralized scenario and can be considered an end state for the decentralized model.

5 Summary and further work

In this paper, we highlighted an opportunity to significantly increase efficiency and reduce costs in the post-trade industry. We discussed using the ISDA CDM standard to address the industry problems of inconsistent processes and inconsistent data. We also discussed using authoritative data stores to address the industry problem of duplicated data. We then explored various adoption scenarios, considering both traditional centralized models and potential decentralized models.

For further work, Barclays is developing prototypes of the end states for both the centralized model and the decentralized model. We are reporting publicly on the findings, including the prototype of the centralized model (Bakshi et al 2021) and an upcoming technical comparison between the two models. There is also opportunity to explore the impact of regulatory requirements and liability concerns on a broker-dealer’s ability or willingness to adopt the proposed changes. There are many design choices when architecting industry ADSs using the CDM and we look forward to continuing industry collaboration to develop good patterns and frameworks.

Declaration of interest

The authors report no conflicts of interest. The authors alone are responsible for the content and writing of the paper.

Acknowledgements

We thank Ian Sloyan (ISDA), Rajagopalan Siddharthan (Barclays) and Vikram Bakshi (Barclays) for their helpful feedback.

References

- Bakshi, V., Nair, A., and Braine, L. (2021). Simulation of derivatives post-trade services using an authoritative data store and the ISDA Common Domain Model. Preprint (arXiv:2110.02571 [cs.CY]). URL: https://arxiv.org/pdf/2110.02571.pdf.

- Bank of England (2020). The future of post-trade: findings from the post-trade technology market practitioner panel. Report, Bank of England. URL: https://bit.ly/3HrSCaC.

- Bansal, K., Brodersen, C., and Sen, S. (2019). Future of post trade: shifting the cost curve. Report, Deloitte. URL: https://bit.ly/2YVJTMx.

- Committee on Payment and Settlement Systems–Technical Committee of the International Organization of Securities Commissions (2012). Principles for financial market infrastructures. Report, Bank for International Settlements. URL: http://bit.ly/1mcqA8x.

- DTCC (2018). A progress report on OTC derivatives trade repositories. White Paper, Depository Trust & Clearing Corporation. URL: https://bit.ly/31pqTan.

- DTCC (2020). Project Ion: case study. Report, Depository Trust & Clearing Corporation. URL: https://bit.ly/3FpnE13.

- International Swaps and Derivatives Association (2016). The future of derivatives processing and market infrastructure. White Paper, ISDA. URL: https://bit.ly/3djQHal.

- International Swaps and Derivatives Association (2018). ISDA publishes digital iteration of the Common Domain Model. Press Release, June 5, ISDA. URL: http://www.isda.org/2018/06/05/isda-publishes-digital-iteration-of-the-common-domain-model/.

- International Swaps and Derivatives Association (2019). What is the ISDA CDM? Factsheet, ISDA. URL: http://assets.isda.org/media/c2565206/0b805a0d.pdf.

- International Swaps and Derivatives Association (2020a). Standardise to digitise. ISDA Quarterly 6(1), 12–17. URL: http://www.isda.org/a/8ALTE/IQ-ISDA-Quarterly-January-2020.pdf.

- International Swaps and Derivatives Association (2020b). What is the ISDA clause library? Factsheet, ISDA. URL: http://www.isda.org/a/YiqTE/ISDA-Clause-Library-Factsheet.pdf.

- O’Malia, S. (2020a). Impetus for automation. Blog Post, April 20, derivatiViews, ISDA. URL: http://www.isda.org/2020/04/20/impetus-for-automation/.

- O’Malia, S. (2020b). From 2006 to 2020. Blog Post, May 28, derivatiViews, ISDA. URL: http://www.isda.org/2020/05/28/from-2006-to-2020/.

- REGnosys (2019). REGnosys and ISDA provide open access to CDM 2.0 for deployment. Press Release, REGnosys. URL: https://bit.ly/3rz4yC6.

- US Securities and Exchange Commission (2008). Guide to broker-dealer registration. Investor Publications Web Page, US SEC. URL: http://www.sec.gov/reportspubs/investor-publications/divisionsmarketregbdguidehtm.html.

- Walport, M. (2016). Distributed ledger technology: beyond block chain. Report by the UK Government Chief Scientific Adviser, UK Government Office for Science. URL: https://bit.ly/3npTVid.

- Williams, D. (2019). How financial services can accelerate the adoption of the ISDA Common Domain Model. Blog Post, EY. URL: https://go.ey.com/3nqh5VM.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net