A volatile blend

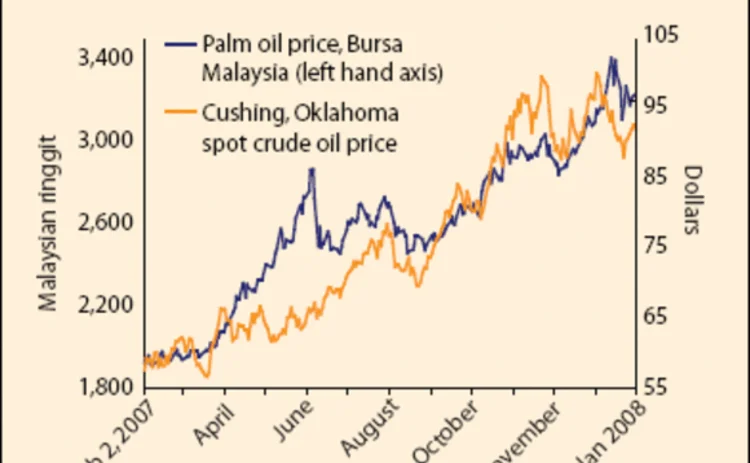

How will Malaysia's palm oil plantation owners be hedging in 2008, given the record-breaking run of crude palm oil prices, mixed international views on biofuels and a likely US slowdown affecting demand for commodities? By Kathleen Kearney

Palm oil producers across Malaysia and Indonesia have adopted very different hedging strategies, but few have been consistently active in the commodity's futures market during the palm oil price bull run of the past eight years. But with improvements in liquidity, greater interest in the commodity by funds and the toppy chart picture for crude palm oil prices, this market could undergo major

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら 環境-再生可能エネルギー

European Parliament vote on carbon market reforms seen as bullish

Energy traders welcome reforms seen as shoring up ailing EU carbon market

Modelling the financial risks of wind generation with Weibull

The manner in which wind generation can affect the half-hourly APX price is discussed

EU TSOs need carrot to tackle congestion – EEX's Reitz

Power grid operators and capacity mechanisms seen as impeding cross-border trade

Q&A: Ercot's Doggett on wind power surge and EPA rules

Outgoing president and CEO discusses challenges posed by renewables in Texas

EU power traders rail against national interventions

Capacity and renewables schemes deterring investment, say panel participants

Weather house of the year: Munich Re Trading

Weather derivatives specialist wins praise for consistent, high-quality service

Emissions house of the year: CF Partners

Specialist knowledge of carbon market is crucial to company's success

Asian emissions markets seen as step in right direction

China and South Korea emissions schemes show promise, say industry groups