A game-changer – China’s new QFII rules open doors

The qualified foreign institutional investor (QFII) scheme now has a wider investment scope, simpler application process and lower barriers to entry. Family offices are taking note

International investment in Chinese assets has ramped up swiftly in recent years as Beijing has opened new access channels. Index providers have included A-shares and onshore bonds in their global benchmarks. As Thomas Fang, head of China global markets and QFII representative at UBS, points out, foreign holdings of Chinese equities have grown four-and-a-half times since 2017 to about 8–9% of free-float market cap of the A-share equity market. Even amid the global havoc wreaked by the Covid‑19 pandemic, inbound flows held up well as China’s economy has rebounded quicker than most.

Against this backdrop, the latest relaxation of rules for the QFII scheme – a key channel for accessing onshore assets – came into effect on November 1.

It is widely regarded as a game-changing move – and one that looks set to fuel another surge in overseas demand for Chinese assets, especially from family offices and hedge funds.

“The finalised rules simplify the QFII approval process, lower the barriers to entry and broaden the investment scope,” says Ben Teo, head of global market financing at UBS Securities, and chairman of UBS Futures. “They have made the scheme more attractive [on several fronts].”

The rules were approved and published by the People’s Bank of China, State Administration of Foreign Exchange and the China Securities Regulatory Commission (CSRC). This development follows the merger of the QFII scheme with its renminbi equivalent in June, which simplified the process around the repatriation of assets from China.

It is now easier for family offices and hedge funds to obtain QFII approval. Additionally, licence-holders can now access onshore margin financing and the stock borrowing and lending (SBL) market, and invest in new types of instruments and products, including listed derivatives, depository receipts, bond repo and asset-backed securities. They can now also invest in local private funds and private placements of shares (see box: New private placement rules).

SBL on the rise

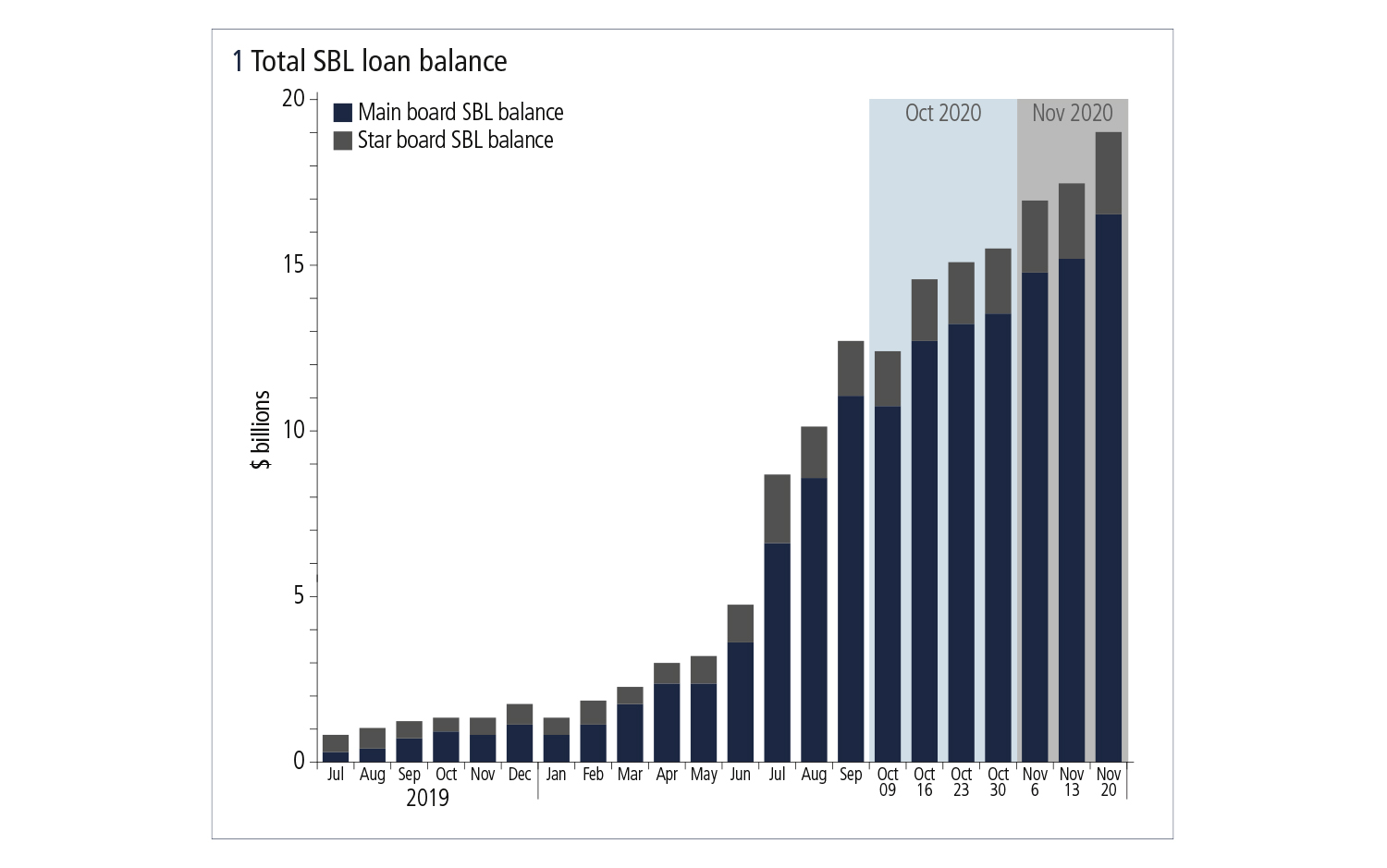

Inflows from new QFII holders are expected to help China’s nascent SBL market reach critical mass. It has already expanded exponentially from less than $100 million in December 2018 to $750 million in July last year to $19 billion as of November 20, says Teo (see figure 1).

This came as a result of two key developments in 2019. One was the introduction of a mechanism allowing flexible SBL rates and tenors to be negotiated bilaterally, replacing fixed rates and tenors. This mechanism was introduced on the Shanghai Stock Exchange STAR Market in July last year, subsequently extended to ChiNext and is expected to be extended ultimately to main board stocks.

The other change was the setting of clear rules on how – and how much – exchange-traded fund (ETF) providers could lend.1

“The market really took off towards the end of last year and the beginning of this year,” says Teo, as the top onshore ETF providers started to come in.

Further inflows are expected to come when other big strategic lenders enter the market. The likes of China’s National Social Security Fund and large insurance companies are yet to begin lending.

Family offices, hedge funds, quant funds and active managers are now very keen to tap into the onshore A-share inventory, says Teo. However, China’s SBL market operates differently from those elsewhere, via a centralised counterparty known as China Securities Finance Corporation Limited. To make use of it, QFII holders will need a new working model and end-to-end setup, from execution to settlement.

However, once everything is in place, the SBL market could ultimately reach $40 billion, at a very conservative estimate, says Teo.

Derivatives and private funds

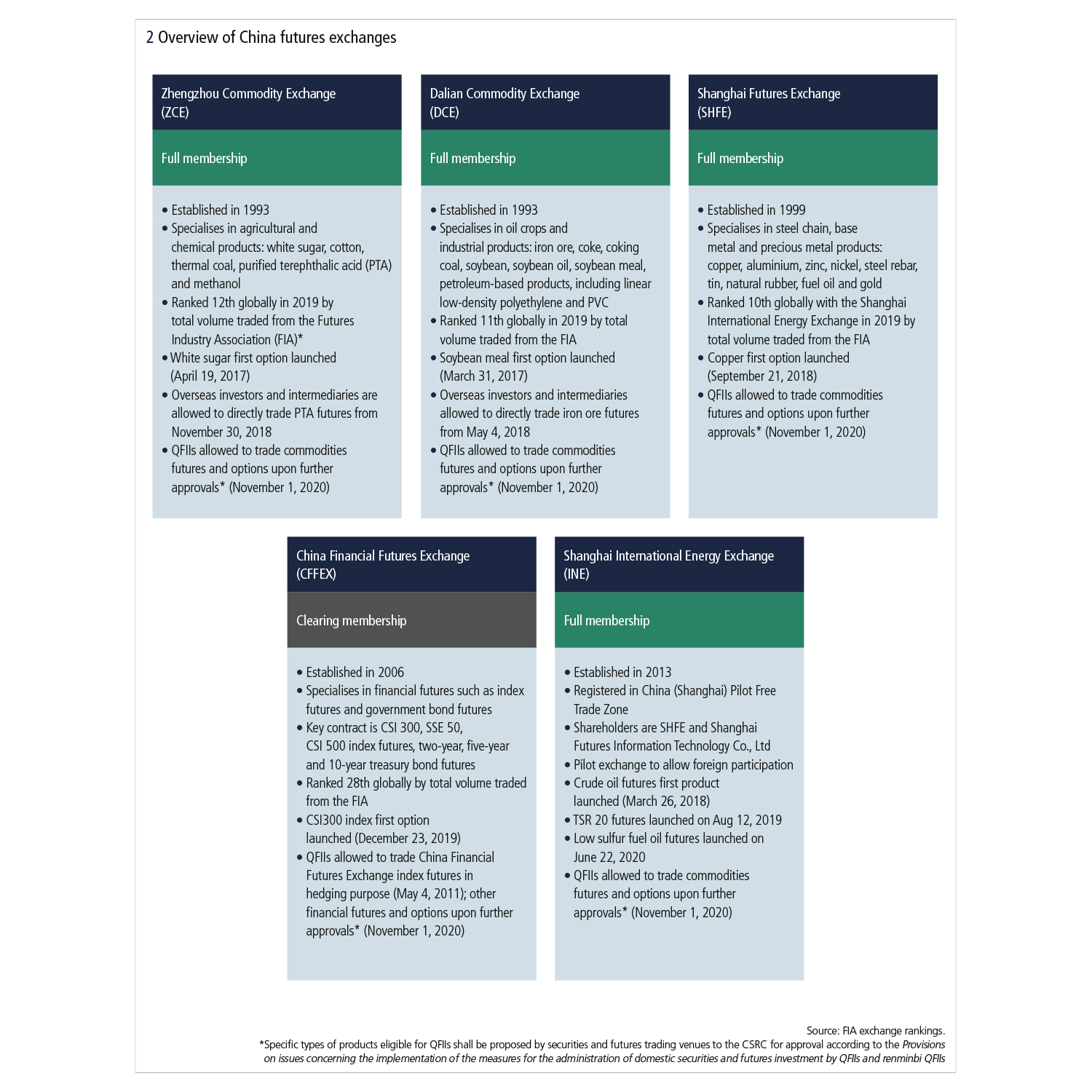

Another key development is that QFII holders can now trade all onshore listed derivatives. There are 60 listed commodity derivatives contracts, three index futures, three bond futures contracts and various listed options available, says Teo.

Before November 1, QFIIs could only trade index futures for hedging purposes. The CSRC requirement that financial futures can only be traded for hedging purpose is no longer explicitly stated in the finalised QFII rule, leaving room for exchanges to set their own rules. For the time being, hedging requirements in listed index futures for QFII holders still remain per exchange requirement.

There is a caveat, however. All products and trading models incorporating these derivatives instruments must be approved separately by the CSRC and relevant regulatory bodies. “We haven’t seen any products being approved yet, but we expect this to start in the first half of next year and proceed in batches,” says Teo.

The third important area of expansion of the QFII product scope is that licence-holders are able to invest in onshore private funds.

Family offices are keen to engage with local managers, says Teo. In addition, foreign hedge fund managers have set up shop onshore with wholly foreign-owned enterprises and private fund management licences (see figure 2).

Streamlining and simplifying

Not only do QFII holders now have more flexibility around the securities that they can invest in, it is also quicker and easier to gain approval for a licence in the first place.

To start, the entire process has been digitised; with the help of a local custodian, applicants are able to file all the requisite documentation online. With family offices often lacking the human resources of larger financial institutions, this alleviates some of the operation burden surrounding licence applications, says Teo. CSRC will also now process QFII applications in 10 working days instead of the previous 20.

In addition, the regulator has reduced the amount of documentation required to apply. For example, applicants no longer have to submit three years of financial records.

It is still early days, but UBS is already seeing rising interest in QFII applications from family offices eager to take advantage of the new opportunities on offer – even as they still await clarity on several areas. The growth trajectory, as ever in China, looks impressive.

New private placement rules

Recent changes to the qualified foreign institutional investor (QFII) scheme will allow foreign investors greater access to private placements, whereby debt or equity securities are sold privately to groups of investors.

This is expected to spark interest in the securities from institutions such as family offices, says Chris Bland, director of the capital consulting team in the UBS Asia‑Pacific global markets division.

The rules have also been changed around private placements, which relate to the length of lockups, the level of discounts permitted and the number of investors allowed into a placement and other restrictions. For example, a mainboard listed private placement in China could only previously be issued to up to 10 investors, and on ChiNext, the country’s Nasdaq equivalent, that number fell to five. The limit has now been raised to 35 for both markets.2

“The regulator has made it clear overseas investors are encouraged to participate, in another step to open up their markets to international participants,” says Bland.

In addition, the limit on the discount has risen to 20% from 10% versus the benchmark, which is the 20-day average price before issuance.2 And the definition of ‘benchmark days’ has become more flexible, so that the issuer can select a date – say, the date of an extraordinary general meeting, a board meeting date or the issuance kick-off day – that allows them to achieve the pricing it is looking for.

Moreover, the lockup period – imposed so that major shareholders cannot trade too freely as insiders – has been shortened for block trading. The time has been halved from 36 to 18 months for major shareholders and from 12 to six months for other investors.2

“The market is now much more attractive to secondary buyers,” says Bland. “A 36-month or 12-month lockup was a little too long for our clients to want to hold the assets. But 18 months or six months – that is a lot more palatable.”

UBS initially saw interest in the newly open private placement from its larger investment bank clients and is now starting to see interest from family offices, says Bland.

“Thanks to UBS’s long-standing footprint and strong brand in China, we have got first-mover advantage, from what we can tell,” he adds. “We are getting shown deals that I just don’t think all the other foreign brokers have the same level of access to.”

UBS has set up and road-tested the process with a few placements for the largest clients, and there are now 400–500 deals coming up this year, says Bland. “There’s now a very robust system in place that we’ve honed over the past few months, and everyone knows how it works from a market perspective.”

UBS handles all the documentation and bid levels and therefore takes care of a large portion of the risk for clients.

Notes

1. CSRC, June 2019

2. CSRC, February 2019

Family office investing – Special report 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net