Enron’s California schemes haunt regulators 15 years later

The failures of the first liberalised US power market still shape the Federal Energy Regulatory Commission’s anti-manipulation agenda. But has the pendulum swung too far towards enforcement?

It has been 15 years since the lights literally went out in California. Hundreds of thousands of people across the state were left in the dark when rolling blackouts hit on January 17–18, 2001, and the first major US experiment in power market liberalisation suffered a blow from which it never recovered.

How did things go so wrong? Initial analyses of the origins of the California energy crisis focused on market fundamentals, poor market design and the exercise of market power. Since then, however, years of litigation have pointed to another reason for this catastrophic market failure: fraud-based manipulation.

The explosive revelation of manipulative schemes carried out by traders at Houston-based energy trading firm Enron and the graphic demonstration of their damaging impacts in western US power markets prompted new legislation and stricter regulation. Notably, the US Federal Energy Regulatory Commission (Ferc) won enhanced authority to combat fraud-based market manipulation. Armed with new powers, Ferc also augmented its enforcement capabilities through staffing increases, the extensive collection of transaction data and the development of sophisticated screening techniques to identify suspicious trading behaviour. The commission has moved aggressively to use its expanded resources and powerful new authority, as reflected in an escalating number of enforcement actions and associated multimillion-dollar settlements.

These actions have caught the attention of the trading community, but they have not clearly delineated the boundaries between acceptable and unacceptable behaviour. Such ambiguity and the resulting regulatory risk raise the prospect that efforts to promote market efficiency by punishing and deterring manipulative behaviour may, ironically, discourage efficient trading – and undermine the benefits of liberalising energy markets in the first place.

Fraud and the crisis

Following its deregulation of US natural gas markets during the 1980s and early 1990s, Ferc turned its attention to electricity. In 1996 it issued Order 888, which assured non-discriminatory access to transmission systems operated by vertically integrated utilities. Franchised monopoly markets were thus opened to competition.

Seeking to reduce rates, the California Public Utilities Commission (CPUC) likewise voted in 1995 to deregulate the California electricity industry, ordering the state's utilities to divest significant portions of their generating capacity and to surrender control of their transmission systems. The CPUC directed the formation of a Power Exchange (PX) – a wholesale energy auction market – and an Independent System Operator (ISO) to run the transmission system. In 1996, the California legislature embraced the CPUC restructuring framework, with some modifications, in Assembly Bill 1890.

The design of California's electricity markets involved competing proposals sponsored by various interest groups, resulting in a less-than-ideal outcome. The PX was to be the primary wholesale market, running day-ahead and hour-ahead auctions. The ISO was to run an energy imbalance market to provide the real-time resources needed to deal with transmission constraints and balance generation and load. Timing mismatches in the daily operations of these markets and the decoupling of energy and transmission optimisation into two separate entities complicated management of the system and opened myriad opportunities for gaming. A rate freeze mandated by the legislature amplified these problems by insulating consumers from fluctuations in wholesale prices, yielding virtually inelastic demand.

Not surprisingly, suppliers found ways to exploit the system, primarily by withholding generation to elevate prices in the real-time market. Power marketers such as Enron, largely unable to withhold energy, took a different tack, developing a variety of gaming strategies based on fraud.

These strategies – many known by the colourful names given them by Enron traders, in emails that investigators eventually brought to light – fell into four categories. The first relied on falsified schedules submitted to the ISO to sell energy illegitimately into the ISO's imbalance energy and ancillary services markets. For example, "Fat Boy" exploited the balanced schedule provision of the ISO tariff by overstating the load the supplier intended to serve. "Ricochet", another such scheme, used offsetting day-ahead exports and real-time imports to misrepresent California-sourced energy as coming from elsewhere, allowing its illicit sale into the ISO's ancillary services and imbalance energy markets.

The second category included strategies that fraudulently claimed payments for congestion relief that was not provided. "Death Star" collected congestion payments on power flows scheduled on ISO transmission against congestion negated by flows scheduled on transmission outside the ISO. "Load Shift" created the false appearance of counterflows by altering levels of fictitious load scheduled on both sides of a congested interface.

The third category involved fraudulent misrepresentation of products sold. For instance, "Get Shorty" entailed the sale of ancillary services without the support of generating capacity required by the tariff. The final category involved the intentional creation of congestion to benefit other positions held by the supplier.

Because these strategies provided false information and schedules to the ISO, which relied on them for managing the ISO power grid, they had profound consequences in terms of undermining efficient grid operation and undercutting system reliability. Blackouts and serious system emergencies ensued. The manipulative strategies drove huge profits to suppliers – costs that California's major utilities, their hands tied by the legislature's rate freeze, were unable to recover, thus driving them to insolvency. The state was forced to move in, issuing $10 billion in long-term bonds to purchase the energy necessary to meet the utilities' customer loads and saddling ratepayers with debts that are still being paid to this day.

Ferc's handling of the California crisis made it clear the regulator was ill-equipped to deal with the observed supplier behaviour. In a situation that one senator would later describe as "an embarrassing and unacceptable failure", Ferc was not collecting the transaction data necessary to understand what was happening in the market and it lacked the staff for effective monitoring. It had neither a definition of manipulation nor a model of manipulative behaviour. Furthermore, in the commission's view, it lacked the legal authority to deal with fraud-based manipulation.

Ferc's evolution

In June 2003, Ferc proposed six ‘market behaviour rules' intended to prevent the acts observed during the California crisis. The second of these tried to address electricity market manipulation, prohibiting an odd assortment of acts borrowed conceptually from the US Securities and Exchange Commission's (SEC's) rule 10b–5 (fraud, wash trades); the Commodity Exchange Act (the concept of "artificiality"); and antitrust law (collusion and references to market power). But the rule had several holes. Notably, it lacked a general exemption for behaviour that served a legitimate business purpose; it failed to prohibit manipulative schemes performed by market buyers; and it included no similar provisions for overseeing natural gas markets.

Recognising these limitations, the commission sought legislation from Congress to give it greater ability to detect and deter manipulation in wholesale natural gas and electricity markets. This was granted in the Energy Policy Act of 2005, which gave Ferc a statutory anti-manipulation mandate tied to the same fraud-based standard (and successful body of case precedent) that underlies SEC rule 10b–5. Ferc adopted its new market manipulation rule in January 2006. Called rule 1c, it gave the commission broad authority to ban fraudulent schemes and devices such as those left undeterred five years before.

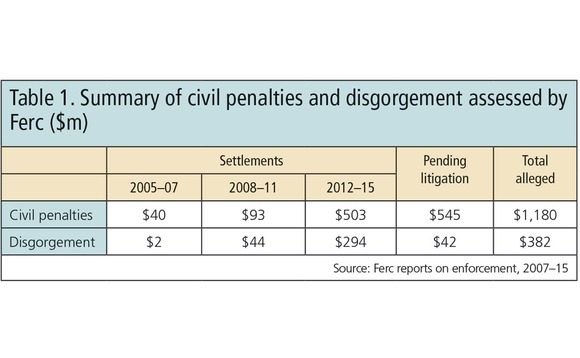

With its bolstered authority, the Ferc's Office of Enforcement (OE) has become an aggressive anti-manipulation force. In addition to adding experienced litigators to its Division of Investigations, the agency has grown its Division of Analytics and Surveillance to support investigations and screen for behaviour that might be missed by market monitors for individual ISOs or regional transmission organisations (RTOs), such as the exploitation of cross-market seams. OE's efforts have assessed almost $1.2 billion in civil penalties and $382 million in disgorged profits, as shown in Table 1.

The enforcement actions that produced these numbers alleged behaviour that was similar, in many respects, to the cross-market games played during the California crisis.

Many of Enron's strategies used uneconomic or otherwise fraudulent behaviour to exploit illiquid prices or flawed market rules to benefit positions tied to the biased price or garner payments from the flawed rules. Similarly, several of the schemes alleged by the Ferc against JP Morgan involved the uneconomic bidding of generators into the California ISO to exploit reliability rules and garner exceptional dispatch or other out-of-market payments; in 2013, the bank paid $410 million to settle Ferc's accusations, without an admission of wrongdoing. In another case, Gila River – an Arizona-based power plant owner, which settled for $3.4 million in 2012 – admitted using circular schedules to relieve congestion and increase physical sales from its generator.

If unabated, such behaviour exacerbates flaws within imperfectly designed electricity markets, resulting in price distortions and inefficiencies within and across those markets.

Too much enforcement?

While the abatement of manipulative behaviour is necessary to prevent market outcomes like those that unfolded so dramatically during the California crisis, it is possible for Ferc to be too aggressive, particularly if its actions discourage legitimate trading behaviour that promotes efficiency.

The purpose of competitive wholesale electricity and related financial markets is to maximise efficiency for the benefit of consumers. Robust market participation is essential to this process, such that all legitimate (i.e., profit-seeking) bids and offers are encouraged and market participants are able to effectively hedge (or take on) risk. An enforcement posture that needlessly impinges upon efficient trading robs markets of an element essential to their success.

In a prior article, we expressed concern that Ferc's recent successes have moved the agency toward a per se manipulation posture, such that a profit-seeking trade could be prosecuted as manipulative if the party executing the trade knew it would benefit other positions in its portfolio, yet executed the trade anyway. We believe this is a legally and economically unsupportable standard. Profit-seeking trades serve a standalone, legitimate business purpose for the trader and enhance the efficiency of the marketplace. Such trades are not fraudulent and therefore do not violate rule 1c, the Ferc's fraud-based anti-manipulation rule.

This is true irrespective of the presence of related cross-market positions that could benefit from the behaviour. A per se enforcement posture that would invalidate profit-seeking trading when the trader also holds cross-market positions that could benefit from those trades would likely discourage the accumulation of legitimate hedging or speculative positions for fear of unintended interactions within the trader's portfolio. Enforcement efforts should focus not on the mechanics of an interaction between trading instruments, but rather on the lack of a legitimate motivation for the trades, as confirmed by contemporaneous documentary evidence.

Ferc's Office of Enforcement and network of market monitors have made tremendous progress since the California crisis toward assuring that such widespread, cataclysmic behaviour will not recur – at least, not without redress – and that the lights will not again go out as a result. But in its efforts to zealously protect markets from such misbehaviour, the commission must practice restraint to avoid diminishing the efficiency benefits its manipulation rule is designed to protect.

Absent such self-restraint on the part of Ferc, litigation by traders accused of manipulation will be the only check against such regulatory overreach. Much efficiency will then be lost in the interim, due to the chilling effect of regulatory risk on legitimate trading and the defence of potentially unwarranted claims brought by Ferc enforcement on unsupportable grounds.

Shaun Ledgerwood is a principal in the Washington, DC, office of The Brattle Group and a former attorney and economist at Ferc. Gary Taylor is a principal in the Cambridge, Massachusetts, office of The Brattle Group and has worked on litigation related to the California energy crisis for 15 years.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Energy

ETRM systems 2024: market update and vendor landscape

This Chartis report evaluates energy trading and risk management systems that provide front-to-back, asset class-specific and geography-specific coverage, and considers the full energy trade lifecycle

CTRM systems 2024: market update and vendor landscape

A Chartis report on commodity trading and risk management systems that considers its different applications and addresses the market and vendor dynamics to determine the long-term and structural impacts of the overarching market evolution on the…

Energy Risk Commodity Rankings 2024: markets buffeted by geopolitics and economic woes

Winners of the 2024 Commodity Rankings steeled clients to navigate competing forces

Chartis Energy50

The latest iteration of Chartis’ Energy50 ranking

Energy trade surveillance solutions 2023: market and vendor landscape

The market for energy trading surveillance solutions, though small, is expanding as specialist vendors emerge, catering to diverse geographies and market specifics. These vendors, which originate from various sectors, contribute further to the market’s…

Achieving net zero with carbon offsets: best practices and what to avoid

A survey by Risk.net and ION Commodities found that firms are wary of using carbon offsets in their net-zero strategies. While this is understandable, given the reputational risk of many offset projects, it is likely to be extremely difficult and more…

Chartis Energy50 2023

The latest iteration of Chartis' Energy50 2023 ranking and report considers the key issues in today’s energy space, and assesses the vendors operating within it

ION Commodities: spotlight on risk management trends

Energy Risk Software Rankings and awards winner’s interview: ION Commodities