Structured products and volatility trends

The structured product market is one of the most dynamic of all retail markets. Product providers are constantly looking to develop products that will appeal to investors using the prevailing market conditions to provide a mix of return and protection. The raw materials of the product provider are the prices that they can access in the capital markets; the skill lies in using the difference between the market price and the investor perception of probable future trends.

There are many factors that will have an effect on the option prices that lie at the heart of a structured product. We focus here on two of the most important factors that have an impact on the products that can be offered; the implied volatility of at-the-money (ATM) options; and the difference in the implied volatility of high and low strike options (the volatility skew). We suggest why the prices have changed and how recent changes in these factors are changing the nature of products offered to investors.

Implied volatilities

Implied volatilities are one of the most important parameters that drive option prices and, as a result, determine the attractiveness of a given structured product. It is, therefore, vital to constantly monitor implied volatilities in order to opportunistically launch the most attractive investment product. When implied volatilities are high, investors will receive a large premium for assuming risk and reverse convertibles, for example, will offer a large premium over deposit rates.

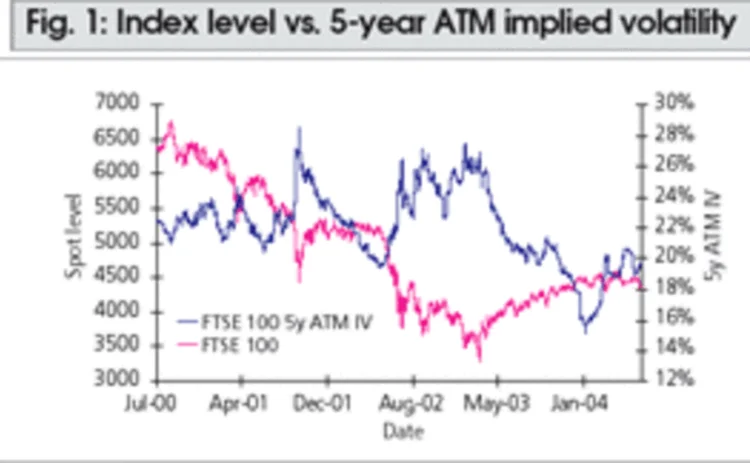

Implied volatilities are currently very much at the bottom end of their normal ranges. They have picked up slightly from the very low levels seen at the start of the year, but are still lower than the medium term average (see figure 1).

At the moment FTSE100 Index five-year implied volatility for ATM options stands at about 19.5%, versus an average of 22.1% for the last four years and a maximum of around 28%, reached during the 2000/2003 bear market. For the Eurostoxx 50 Index, the current level is at 20.8%, against an average of 24.9% for the last four years (see figure 2).

To put this in context, a five-year call on the FTSE priced at 20% volatility is worth 19%, against 22.4% at 25% volatility. For a typical guaranteed equity bond, this means that the equity participation drops from 101.1% to 82.6%. The participation rate is one of the most obvious selling points for structured products, so the current low levels of volatility have had a beneficial impact on the end user appeal of guaranteed equity bonds (GEBs).

For single stocks, we can observe the same phenomenon of a sharp decline of implied volatilities and a relative stabilisation at these low levels for the past three to six months. Realised volatilities have generally trended down, and ATM market volatilities have followed suit.

Single share implied volatilities are at around 80% of their corresponding averages, depending on the sector.

What are the main drivers of this implied volatility drop?

The end of the global bear market and the subsequent stabilisation of equity markets have been the most significant factor influencing short-term volatility. Rising equity prices usually have the effect of cooling off the realised historical volatilities, and the implied volatilities tend to follow or anticipate that move, especially on the short end of the curve. Conventional wisdom has it that bear market moves tend to be more volatile, with large spiky moves, whereas bull markets tend to be characterised by a steady appreciation in asset prices. This is compounded by the structural demand for protection from institutional investors, insurance companies and pension funds, who are increasingly being compelled to put risk mitigation structures in place.

At the long end of the volatility market, the significant growth of the structured product market has had a major influence on the supply/demand balance. Investors (both retail and institutional) have proved to have a strong appetite for products that assume equity risk. The investment banks supplying these products were effectively buying options from investors. As the banks have looked to manage these positions, their collective hedging has tended to suppress market volatility.

The long volatility position that the banks have assumed from the structured product market has been compounded by the nature of the options that they have bought. The banks are in what is described as a ‘negative volatility convexity’ situation: essentially books where the long volatility position that the banks have increases as volatility declines. The banks have had to respond to this by being aggressive sellers of volatility as volatility drops, so exaggerating the move.

Volatility skews

Aside from the fall in ATM volatilities that we have observed, there has been another change in the shape of the volatility surface, and that is an increase in the volatility of low strike options and a decrease for high strike options. The skew has become much steeper than it has previously been. The skew is the absolute difference of volatility levels between out-of-the-money puts and out-of-the-money calls. In the two-year example shown in figure 3 for the FTSE 100 Index, the volatility of the 80% strike put (24.4%) is 10.3% above that of the 120% strike call (14.1%). This feature is true for all maturities.

As far as structuring retail products are concerned, this means that not only are implied volatilities very cheap, but also that out-of-the-money calls are even cheaper. Therefore, structured products that rely on this feature and leverage heavily on upside options will look particularly attractive.

Structures worth considering in the current environment

The conclusion is that volatilities are down but the skew has increased. What does this mean for product providers? What are the products that are going to appeal to investors? How are product providers best able to exploit the current pricing environment?

Income

The reverse convertible has been the mainstay of the income product market. High certain coupons paid over a fixed term, with the promise of a full return of capital if the underlying index has not fallen below some threshold level. The low levels of volatility and changes in the regulatory environment have reduced the appeal of this product to the UK market.

Product designers have had to be more creative, but although there have been a number of alternative structures offered to the market, none have had the success of the traditional reverse convertible.

The most interesting new income trades have exploited the skew and have leveraged the high price of low strike puts. For example, high coupons are offered, provided that no more than four underlying shares from a universe of 30 or 40 fall by more than 40%. The so-called Equity CSO has been offered in the UK, but through a limited distribution.

Growth

There are any number of growth products that look much more attractive now than they have done before, from the vanilla GEB to more complicated structures that leverage the low price of high strike options. A simple variation on the GEB theme is to offer leveraged exposure, but only after a minimum threshold has been attained. This captures both the low volatility and the steep skew. Another variation of this would be a product that offers increasing participation to the market as the underlying asset price increases.

One of the most popular products over the last six months has been an investment that offers the greater of a high minimum return, and some participation in the index growth. The high strike calls embedded in these options are even cheaper than the ATM calls in the vanilla GEB.

Moving up the scale of complexity, the UK market has seen products that use the highest index level over the final observation period to calculate the gain, and also structures that look to lock in the gain at pre-set levels.

Combined income-growth and hybrid products

Low levels of volatility have also allowed providers to offer split bonds. Split bonds are structures that divide an investor’s money into two parts. One part will be invested into a GEB, the other part will receive a high interest over a shorter period. The high coupon is subsidised by reducing the participation in the GEB.

The low levels of volatility and low correlations between equities and other asset classes allow product providers to offer a range of hybrid products that, to a greater or lesser extent, are variations on the simple structures above. Using a full Asian call further enhances the benefits of low volatility, and so allows the averaging process to incorporate some ‘best-of’ features. For example, the average can be the best of the equity level and inflation at each average point.

Conclusion

The only certainty in the world of structured products is that the status quo will not be maintained. Product providers need to be acutely aware of the state of the shifting sands on which the underlying pricing is based, and react to the changing conditions.

| Contact Hassan Houari Head of Equity Derivatives Structuring T: +44 (0)20 7773 8058 E: hassan.houari@barcap.com David Stuff Head of UK Investor Solutions T: +44 (0)20 7773 8505 E: david.stuff@barcap.com |

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net