Swaps data: cleared volumes and CCP market share

Data shows CME and Eurex growing faster than LCH Swapclear

All in all, it’s been a topsy-turvy first quarter of 2019. The US Federal Reserve first paused and then ultimately halted its rate rises. Meanwhile, after a series of bruising votes, the chances of an orderly Brexit hang by a thread.

Those machinations have pulled global swap volumes in opposing directions. Cleared US dollar swap volumes are down 14% on a year ago, while euro swaps volumes are 35% higher.

Looking at the market share of clearing houses, a different theme emerges. While LCH continues to dominate both US dollar and euro interest rate swap clearing, its rivals are gaining ground.

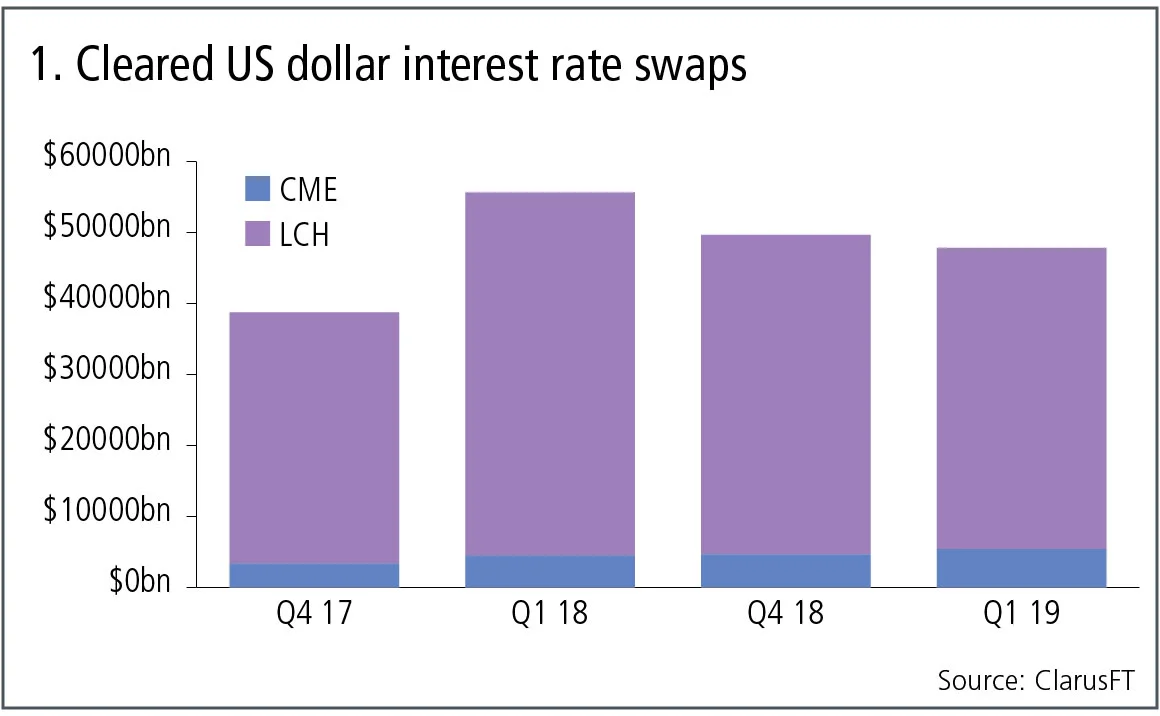

Cleared US dollar swaps

Let’s start with the largest product: cleared US dollar interest rate swaps. We include all clearable types – vanilla fixed versus float, overnight index, basis, zero coupon and variable – and look at single-sided gross notional volumes.

Figure 1 shows:

- Q1 2019 volumes at $48 trillion are 14% lower than the $55.5 trillion in Q1 2018, a very different trend to Q4 2018, which was much higher than Q4 2017.

- LCH SwapClear with 89% share and CME with 11%, in the most recent quarter.

- LCH SwapClear is down 17% from a year earlier, February 2019 was a particularly low month.

- CME is up 20% in the most recent quarter from a year earlier.

The halt in Federal Reserve rate rises for 2019, has certainly resulted in lower US dollar swaps volume at LCH, while CME has bucked the trend with an up quarter.

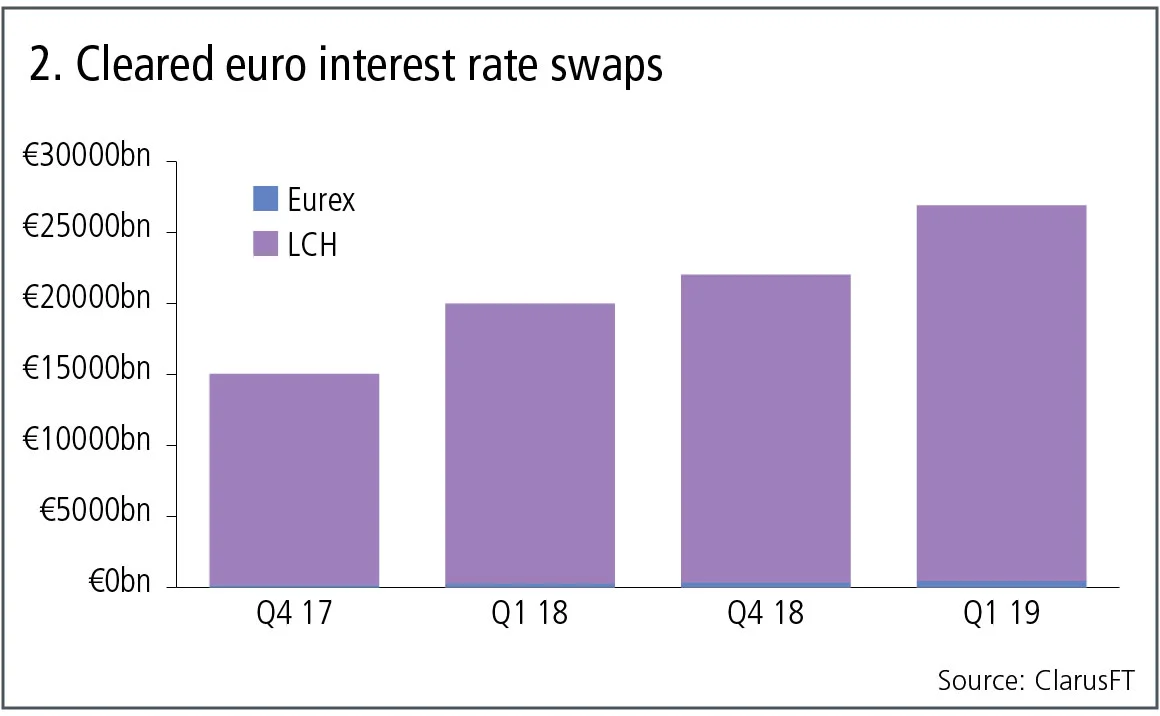

Cleared euro swaps

Next, the second-largest product: cleared euro interest rate swaps, all clearable types.

Figure 2 shows:

- Q1 2019 volumes at €27 trillion ($30 trillion) are 35% higher than the €20 trillion in Q1 2018.

- LCH SwapClear with 98.3% share and Eurex with 1.7% in the most recent quarter.

- LCH SwapClear up 34% in Q1 2019 from a year earlier.

- Eurex up 83% in Q1 19 with €454 billion of single-sided gross notional.

LCH SwapClear continues its dominance in euro swap volumes, but with Eurex growing at more than double the rate from a low base.

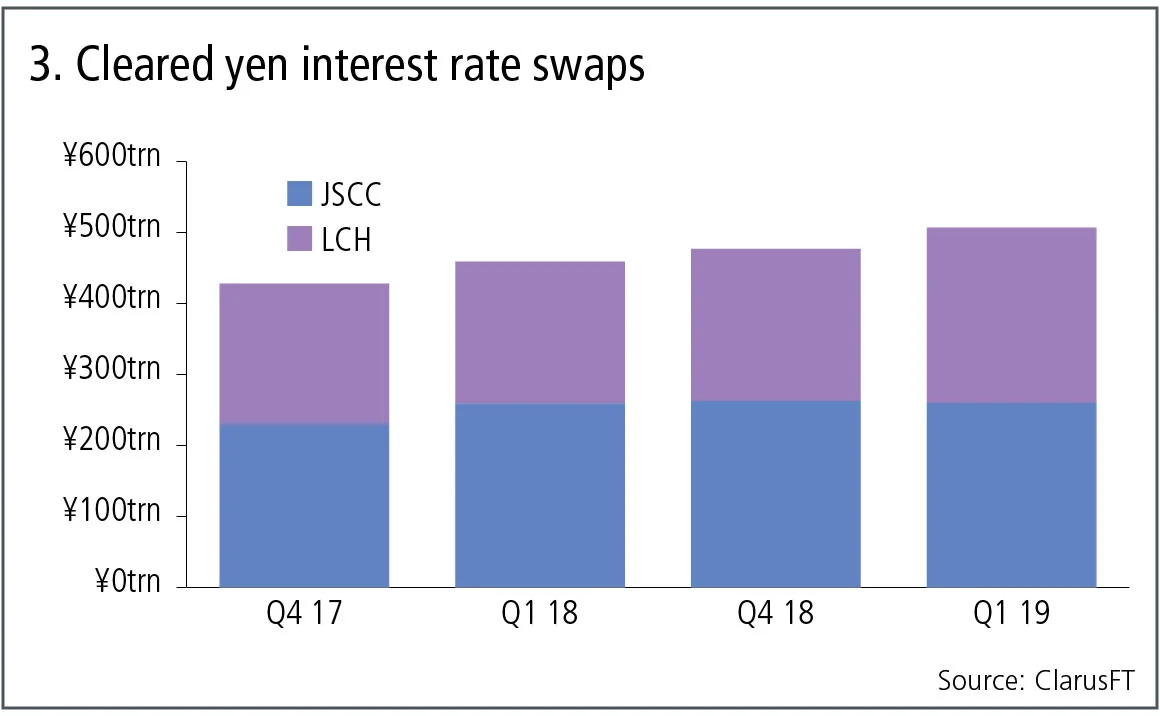

Cleared yen swaps

Figure 3 shows:

- Q1 2019 at ¥507 trillion ($4.56 trillion) is 11% higher than the ¥459 trillion a year earlier.

- JSCC with 51% share and LCH SwapClear with 49% in the most recent quarter, which is a 4% shift in LCH’s favour compared to Q4 2018.

- JSCC volume in the most recent quarter is the same as a year earlier.

- LCH is up 24% in Q1 2019 from a year earlier.

So, continuing growth in cleared yen swaps with market share evenly split between JSCC and LCH.

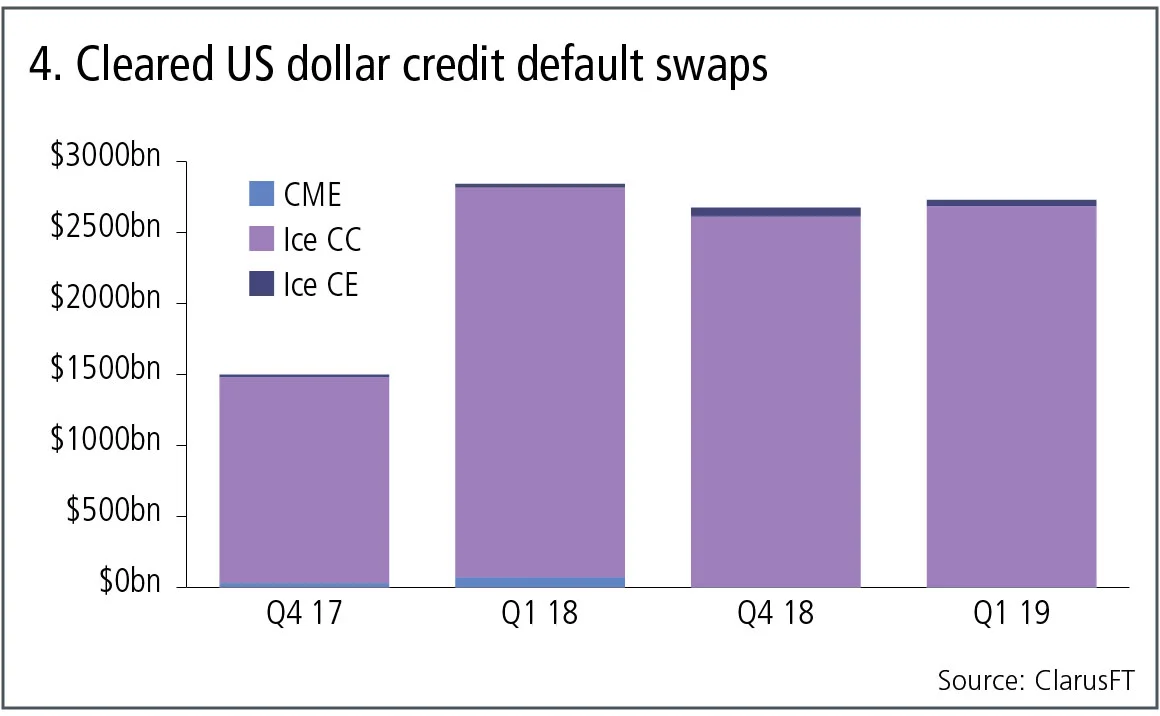

Cleared US dollar credit default swaps

Let’s now switch focus to credit derivatives and the volume of credit indexes and single names in US dollars.

Figure 4 shows:

- Q1 2019 volumes at $2.7 trillion are 4% lower than the $2.8 trillion in Q1 2018, a very different trend to Q4 2018, which was much higher than Q4 2017.

- Ice Credit Clear dominates with 98% share.

- Ice Clear Europe is up from a year earlier with $46 billion in Q1 2019.

- CME shutting down its service.

- LCH CDS with $3 billion in Q1 2019.

Cleared credit derivatives volumes in US dollars slightly down in the most recent quarter.

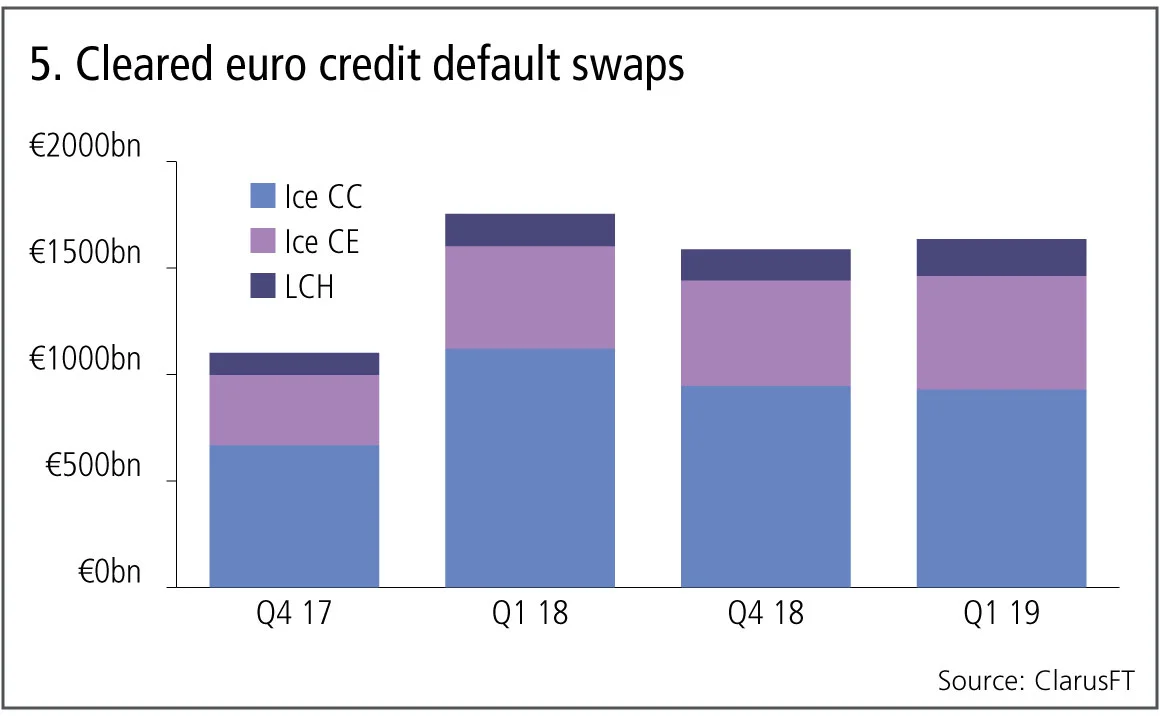

Cleared euro credit default swaps

Next, the volume of credit indexes and single names in euro.

Figure 5 shows:

- Q1 2019 volumes at €1.65 trillion are 7% lower than the €1.75 trillion in Q1 2018, a very different trend to Q4 2018, which was much higher than Q4 2017.

- Ice Credit Clear with 56.8% share, Ice Clear Europe 32.6% and LCH CDSClear with 10.6% in the most recent quarter.

- Ice Credit Clear down 17% from a year earlier.

- Ice Clear Europe up 11% and LCH CDSClear up 13%.

Cleared credit derivatives volumes in euros is slightly down in the most recent quarter.

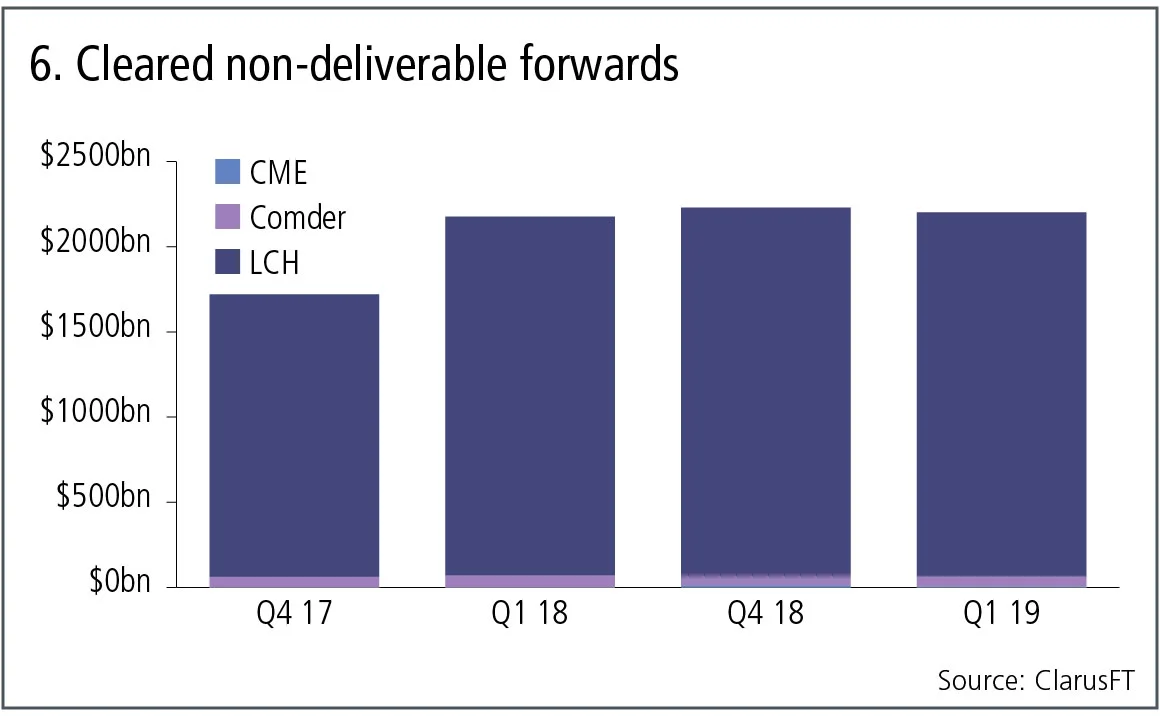

Cleared non-deliverable forwards

Finally cleared non-deliverable forwards.

Figure 6 shows:

- Q1 2019 volumes at $2.2 trillion are 1% higher than Q1 2018,

- a very different trend to Q4 2018, which was 30% higher

- than Q4 2017.

- LCH ForexClear with 97.1% share in the quarter.

- Comder with 2.7%.

- CME with volume from Q4 18 onwards, with $5 billion in Q1 19 for a 0.2% share in the quarter.

Cleared non-deliverable forwards volumes no longer show their long-running trend of high growth rates. Is this a pause before a further ramp-up later in the year when phase four of the uncleared margin rules takes effect in September 2019? Or will we have to wait until the lead-up to September 2020 and phase five of the UMR for the next growth spurt in non-deliverable forward volumes?

Only time will tell.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

BBVA joins growing Spire repack platform

Spanish bank becomes 19th dealer on multi-bank SPV issuer amid rising investor interest

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Integration strengthens e-trading in persistently volatile markets

Survey reveals that traders are grappling with daily volatility, while technology outranks liquidity as the top market structure concern

How Optimal aims to shake up US retail options trading

New wholesaler has assembled a team of market-makers to compete with Citadel, IMC/Dash and Jane Street

Repo stress drove 2025 SOFR-to-fed funds swap pivot

SOFR OIS volumes slipped to almost half of fed funds activity during September repo spikes

Renminbi options volumes plummet as vol grinds lower

USD/CNH volumes fell 84% in 2025 as PBoC currency management took hold

Esma to issue guidance on active account reporting

Briefing and Q&A aims to clarify how firms should report data ahead of RTS adoption

Forex looks to flip the (stable)coin

Friction-free foreign exchange is the prize offered by stablecoins such as Tether and USDC. But the prize remains elusive