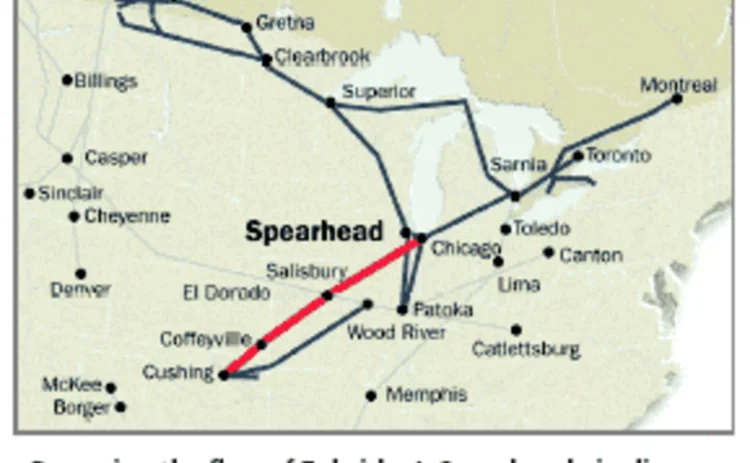

Crude imitation

Hedging Canadian heavy crude oil is difficult: unlike Canadian light crude, ithas no closely matching price benchmarks. Trading basis differentials is onesolution, but help may be at hand from another quarter. By JoeMarsh

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Trump’s LatAm gambit spurs FX hedging rush

Venezuela op boosts risk reversals as investors look to protect carry trades

One Trading brings 24/7 equity trading to Europe

Start-up exchange will launch perpetual futures Clob in Q1 after AFM nod

FXGO volumes surge despite fee switch-on

Dealers split on whether levy is behind volume increases across SDPs

Banks hope new axe platform will cut bond trading costs

Dealer-backed TP Icap venture aims to disrupt dominant trio of Bloomberg, MarketAxess and Tradeweb

Kyriba sees uptake in AI-assisted FX hedging tools

Automated data collection and cleaning helps corporates create better hedges and has cut unexplained P&L moves by 87%, says vendor

Review of 2025: It’s the end of the world, and it feels fine

Markets proved resilient as Trump redefined US policies – but questions are piling up about 2026 and beyond

Does crypto really need T+0 for everything?

Instant settlement brings its own risks but doesn’t need to be the default, writes BridgePort’s Soriano

Asset managers prep autocall ETFs with assets tipped to hit $30bn

Actively managed strategies wait in the wings after systematic approach nets Calamos $500m