Credit data: Italian banks find themselves at a crossroads

Political chaos in Italy could undermine the banking sector’s recent improvement

The recent turmoil in Italian politics comes at a precarious time for the country’s banking sector.

An audacious effort by Matteo Salvini, leader of the far-right League, to bring down the government and force snap elections in the autumn – when annual budget negotiations were due to begin – appears to have failed. Salvini, who leads in the polls, has called for tax cuts and spending increases at a time when the country needs to find €23 billion ($25.2 billion) in savings to meet deficit goals agreed with the European Union. The prospect of early elections drove up Italian bond yields in mid-August and pressured the shares of domestic banks, which are large holders of the country’s debt.

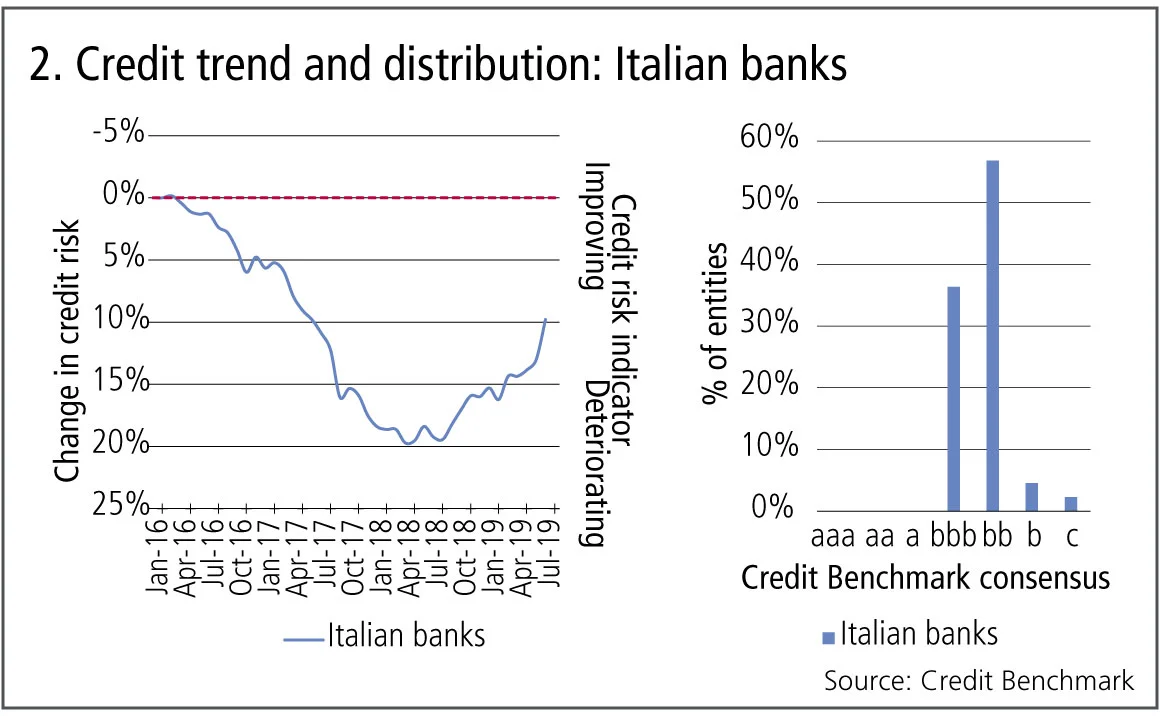

The banking sector can ill-afford another political crisis. Italian banks have spent the past three years raising capital and restructuring bad loans. Those efforts appeared to have reached a turning point last summer. The ratio of non-performing loans in Italy has been cut in half since peaking at 18.1% in 2016. Credit risk in the banking system, which increased by nearly 20% from January 2016 to July 2018, has improved by 8% since then. More than 90% of Italian banks currently sit on the boundary between investment and non-investment grade ratings.

Much now depends on Italian prime minister Giuseppe Conte’s efforts to form a new coalition government with support from the populist Five Star Movement and centre-left Democratic Party. The alliance is fragile and steeped in bad blood between the parties. Still, markets are showing greater confidence in the country’s prospects. Borrowing costs fell sharply at the end of August and bank shares have recovered. Much now depends on whether the coalition, if confirmed, can agree a budget deal that stays within EU rules. With Salvini waiting in the wings, any missteps could leave Italian banks once again staring down the barrel.

Global credit industry trends

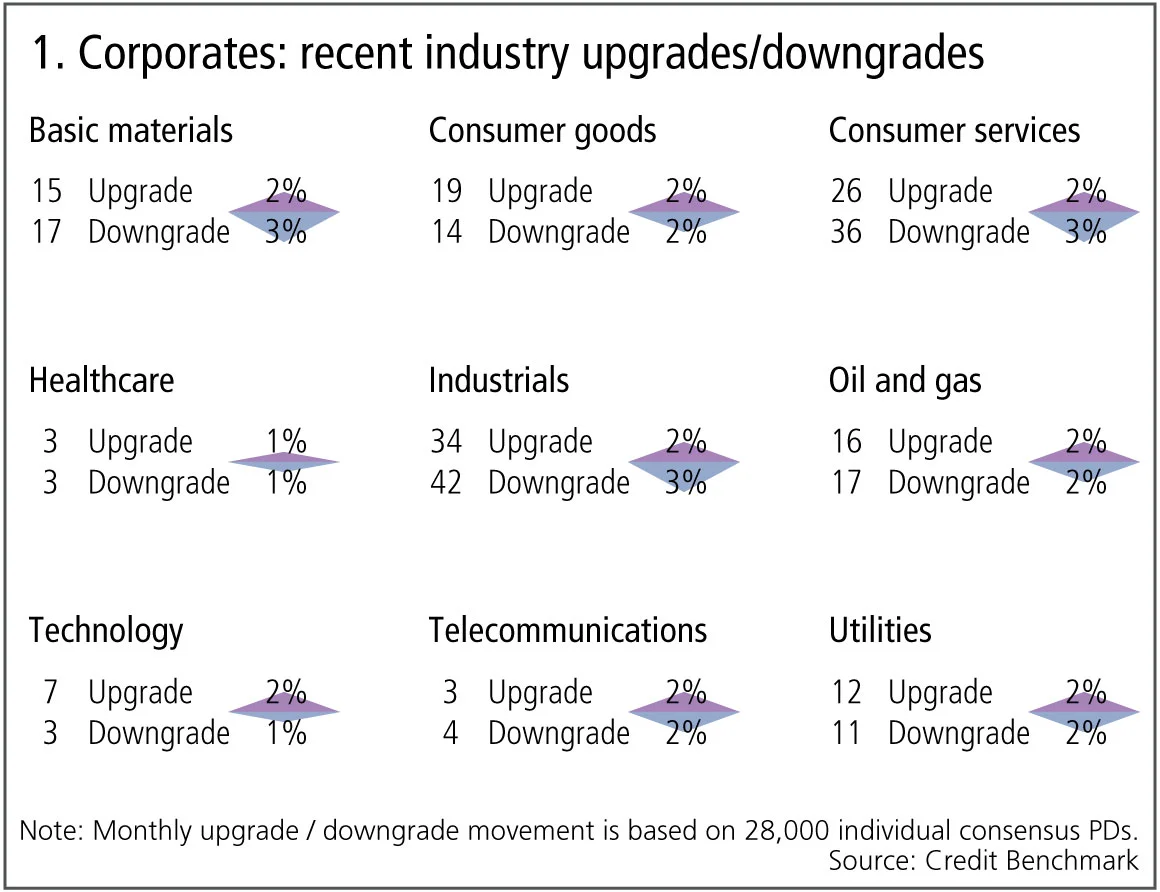

The latest bank-sourced credit data shows credit activity for corporates and financials has stayed stable, with 4% of entities moving by at least one notch, in comparison with 4.8% last month. Figure 1 shows detailed industry migration trends for the most recent published data, adjusted for changes in contributor mix.

Figure 1 shows:

- Globally, the number of corporate upgrades and downgrades are in balance.

- Upgrades outnumber downgrades in one of the nine industries, three industries are biased towards downgrades and five are in balance.

- Basic materials see downgrades outweigh upgrades for the first time in five months.

- Consumer services continue to see downgrades dominating for the second month.

- Industrials see downgrades outnumber upgrades after two months of balance.

- Technology sees upgrades dominating downgrades for the second month.

- Healthcare is in balance after a quarter of downgrades outweighing upgrades.

- Oil and gas, telecommunications and utilities are in balance, after a period of downgrades outweighing upgrades.

- Consumer goods shows balance for the second month.

Italian banks

The outlook for the Italian banking industry is intertwined with that of Italian sovereign bonds, due to the unusually large proportion of domestic government bonds held by Italian banks. The third-largest economy in the eurozone has the second-highest debt-to-GDP ratio and recently avoided European Commission sanctions only by promising deficit cuts. With the recent political upheaval, those promises are under threat and this has driven Italian government bond prices down. So while the banking sector has made good progress on non-performing loans (NPLs), halving the total since 2017, politics may undermine its recent credit improvement.

Figure 2 shows the credit trend and distribution for 50 Italian banks.

Figure 2 shows:

- Italian banks saw a sustained deterioration until July 2018, with credit risk increasing by nearly 20% from January 2016.

- Since mid-2018, credit risk has improved by 8%.

- The distribution shows the majority of Italian banks are close to the boundary of investment grade/non-investment grade, with over 90% having a Credit Benchmark consensus of bbb/bb.

Top global companies

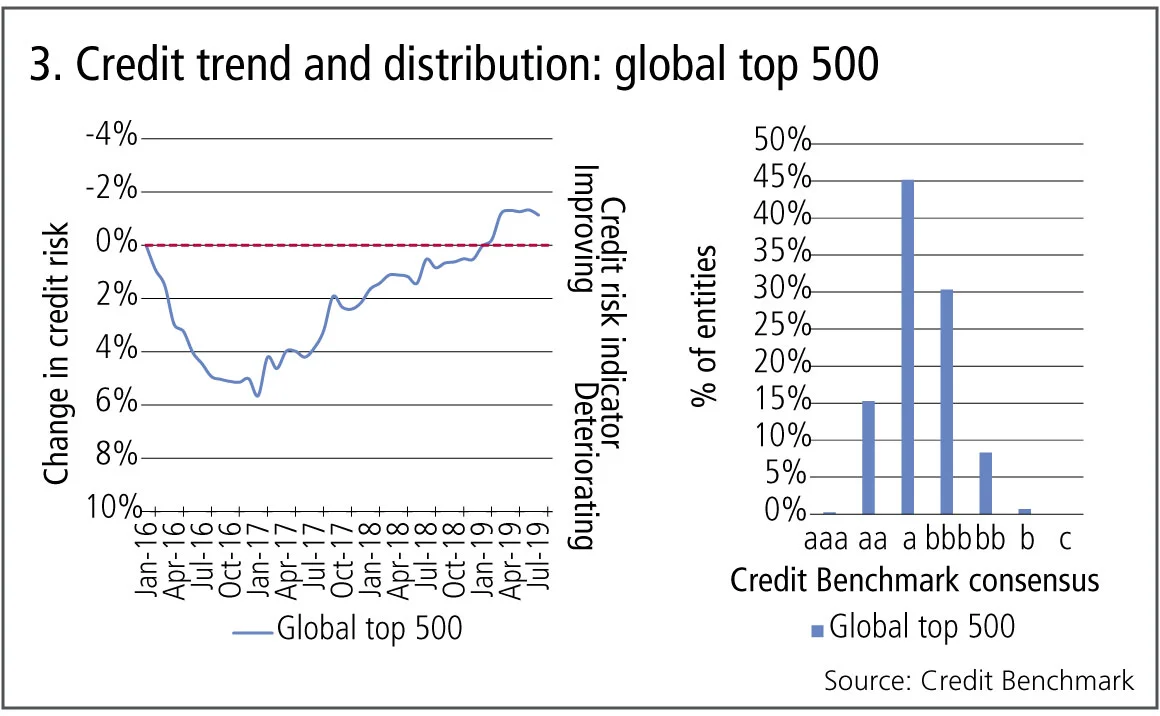

The largest corporates in the world are a diverse group, including banks, modern technology behemoths and traditional energy and manufacturing companies, and they are seeing major changes in their environment. Regulators around the world have been taking aim at the tech giants, citing anti-trust and tax issues, while trade wars and “de-globalisation” could result in supply chain disruption, market share erosion and drops in global demand. But there are some localised positive effects; for example, some US companies are picking up market share as imports are priced out by tariffs. And another round of global interest rate cuts following the Fed lead will provide some additional cushioning.

Figure 3 shows the credit trend and distribution of the largest global corporates.

Figure 3 shows:

- The global top 500 companies saw an increase in credit risk throughout 2016, deteriorating by nearly 6%.

- The turning point came in early 2017, followed by a sustained two-year improving trend.

- By January 2019, credit risk had recovered to beyond the end-2015 level.

- The latest few months show signs of a potential turning point, with credit risk slightly deteriorating.

- More than 90% of the global top 500 companies are investment grade, with the majority in the a category.

Top German and French companies

As EU growth hovers close to recession levels, the European Central Bank is likely to embark on a further round of quantitative easing. There are a number of headwinds facing Europe – trade wars, Brexit and Italian politics. While France has announced a €17 billion stimulus fiscal package, the OECD recently warned that the overall fiscal stance in Europe – especially Germany – is too restrictive and called for more investment. Germany is actually planning a major climate-related investment push over the next few years but the concern is that something broader and more immediate is required.

Figure 4 shows the credit trend and distribution of the Germany top 30 company group and the France top 40 company group.

Figure 4 shows:

- From October 2016 to April 2019, the Germany top 30 and France top 40 showed a steady and substantial credit risk improvement, by 14% for Germany’s top 30 and 20% for France’s top 40.

- Since April 2019, the trends of the top companies in Germany and France diverged, with France continuing to improve while Germany has stalled and may be turning downwards.

- The top companies in both Germany and France are mainly investment grade, with only 4% of Germany’s top 30 being in the non-investment-grade category of bb.

- The majority of top companies in both countries are in the credit category of a, which accounts for 48% of the Germany top 30 and 56% of the France top 40.

Oil and gas

Brent crude futures have touched seven-month lows, hit by unexpected increases in US stockpiles and concerns about the trade war impact on global demand. China is boycotting a growing number of US exports and oil is not immune.

Figure 5 shows recent credit trends of 260, 120 and 55 oil and gas companies in the US, UK and EU ex-UK, respectively.

Figure 5 shows:

- The trends of US, UK and EU ex-UK oil and gas companies followed similar patterns of improvement for the first half of 2018.

- The UK has stabilised after a 5% improvement compared with its January 2018 credit risk level.

- EU ex-UK continues to improve, up 15% since January 2018.

- The US peaked following a steep 20% improvement up to February 2019. Credit risk has shown a modest but consistent 2.5% deterioration since the February 2019 turning point.

- Both UK and EU ex-UK oil and gas companies are investment grade, with credit categories of bbb- and bbb, respectively. The US oil and gas group is non-investment grade, with a credit category of bb+; but it is very close to the investment-grade boundary.

About this data

Credit Benchmark collects monthly credit risk inputs from 40-plus of the world’s leading financial institutions, making it possible to follow credit trends across geographies and industries. In all, the dataset contains consensus ratings on about 50,000 rated and unrated entities globally.

David Carruthers is head of research at Credit Benchmark.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Op risk data: FIS pays the price for Worldpay synergy slip-up

Also: Liberty Mutual rings up record age bias case; Nationwide’s fraud failings. Data by ORX News

What the Tokyo data cornucopia reveals about market impact

New research confirms universality of one of the most non-intuitive concepts in quant finance

Allocating financing costs: centralised vs decentralised treasury

Centralisation can boost efficiency when coupled with an effective pricing and attribution framework

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics

Does crypto really need T+0 for everything?

Instant settlement brings its own risks but doesn’t need to be the default, writes BridgePort’s Soriano

October’s crash shows crypto has come of age

Ability to absorb $19bn liquidation event marks a turning point in market’s maturity, says LMAX Group's Jenna Wright

Responsible AI is about payoffs as much as principles

How one firm cut loan processing times and improved fraud detection without compromising on governance