Swaps data: cleared vs non-cleared margin

Growing margin burden for non-cleared swaps means cleared margin is likely to grow further, argues Amir Khwaja

Initial margin numbers are growing for the over-the-counter derivatives market – a result of rules that require some products to be centrally cleared, as well as separate requirements compelling a growing band of firms to collect margin for non-cleared trades.

But the two regulatory edifices function in different ways and also interact, it is likely that, as the non-cleared rules steadily expand, they will encourage more firms to clear voluntarily and create incentives for the scope of cleared products to be widened as well.

Currently, the non-cleared margining regime requires approximately 50 financial groups to collect and post initial margin for OTC derivatives they trade bilaterally. The first phase of 20 firms started doing so on September 1, 2016 and only for new trades executed subsequent to that date, so it will have taken some time to build up to the $50 million exposure threshold above which initial margin must be collected and posted.

The remaining phases in September 2019 and September 2020, cover phase four and phase five firms with – respectively – greater than $750 billion and $8 billion of gross notional in non-cleared derivatives. The influx of new firms has been estimated at 1,100 in a recent document by the International Swaps and Derivatives Association, the Securities Industry and Financial Markets Association and other trade associations.

Given the size of the numbers involved, let’s look at the data on initial margin.

Initial margin for non-cleared derivatives

Isda’s most recent annual margin survey was published in April this year, covering 2017. It provides interesting insights as it has data provided by the 20 largest market participants (phase one firms).

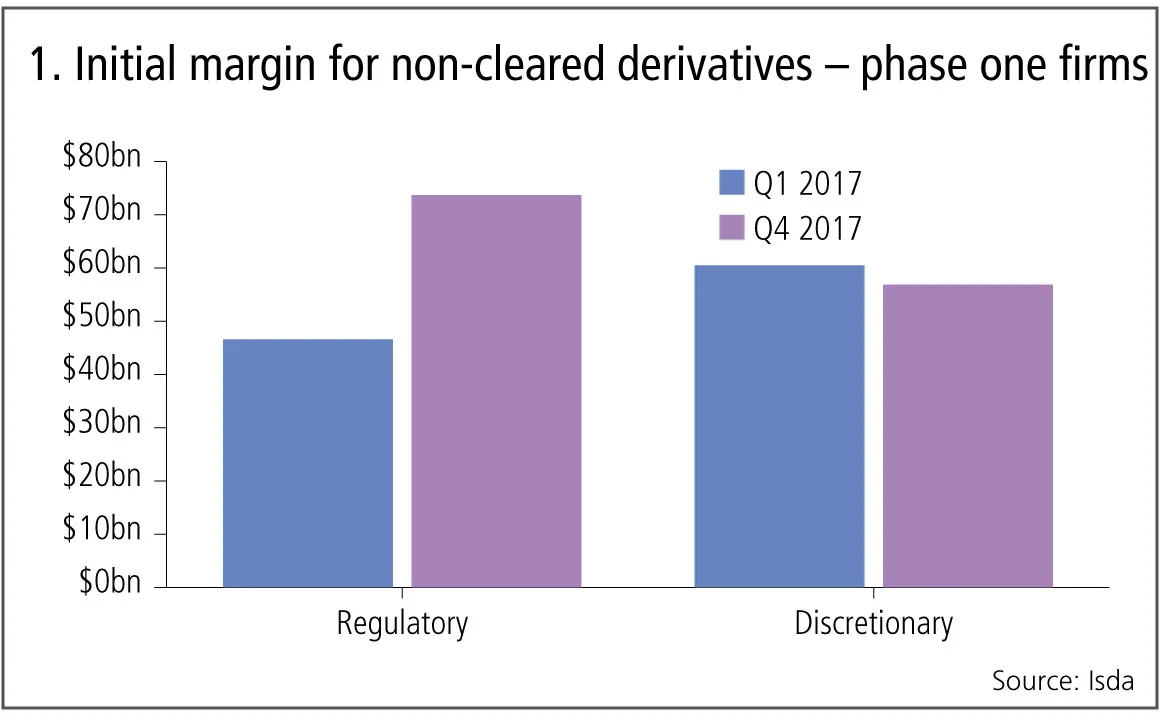

Figure 1 shows:

- Regulatory initial margin increasing from $46.6 billion at the end of Q1 2017 to $73.7 billion at the end of Q4 2017, an increase of 58%.

- Isda attributes the large increase to the fact that each month more and more new trades are executed and so fall under the initial margin rules.

- In addition a smaller number of phase two firms started complying with the rules on September 1, 2017.

- Discretionary initial margin decreased to $56.9 billion from $60.5 billion, a drop of 6%.

- Isda attributes this decrease to more firms falling into regulatory initial margin, so more and more of this will move into the regulatory bucket.

A cumulative $131 billion of initial margin as at end Q4 2017 sounds like a large amount indeed, let’s see how this compared to cleared OTC derivatives.

Initial margin for cleared OTC derivatives

Disclosures required of central counterparties (CCPs) by the Committee on Payments and Market Infrastructures and the International Organization of Securities Commissions cover initial margin totals. Using the data we can aggregate seven of the largest OTC derivative clearing services: CME IRS, Eurex OTC IRS, Ice Credit Clear, Ice EU CDS, JSCC IRS, LCH ForexClear and LCH SwapClear.

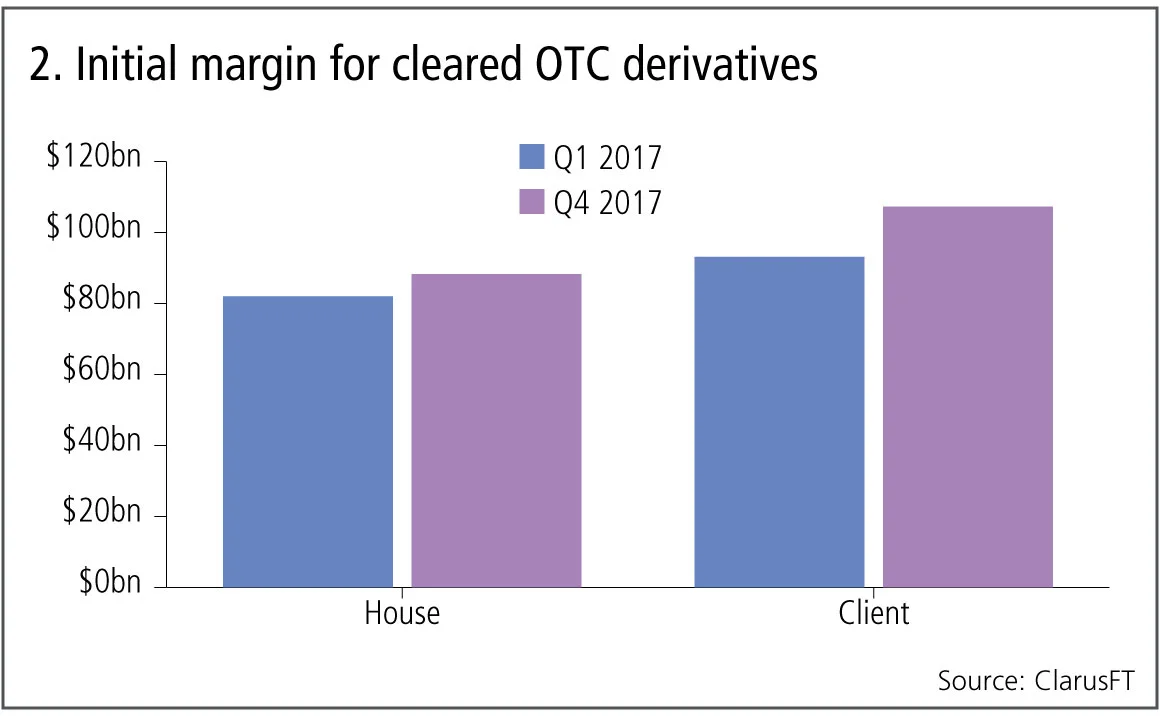

Figure 2 shows:

- House (or member) initial margin increasing from $82 billion to $88.3 billion over the same period, an increase of 8%.

- Client initial margin increasing from $93 billion to $107 billion from Q1 2017 to Q4 2017, an increase of 15%.

- A cumulative total of $196 billion of initial margin at end Q4 2017, so significantly larger than the $131 billion of cumulative uncleared initial margin in the prior section.

- It is also interesting to note the ratio of house to client initial margin is 45% to 55%, so while house margin contains the largest market participants – which are also the phase one, two and three firms in the non-cleared regime – the fact that client initial margin is larger is a reflection of the fact that these portfolios are more directional and so attract larger initial margin.

Now, in comparing cleared initial margin and uncleared initial margin, we have to be cognisant of the differences; in particular, in how netting operates.

Multilateral netting

One of the most important benefits of central clearing is multilateral netting, meaning all my exposures can be netted down to one margin number, as opposed to individual bilateral margins against each counterpart. While this is of great benefit for variation margin, it is even more important for initial margin as the following figure illustrates.

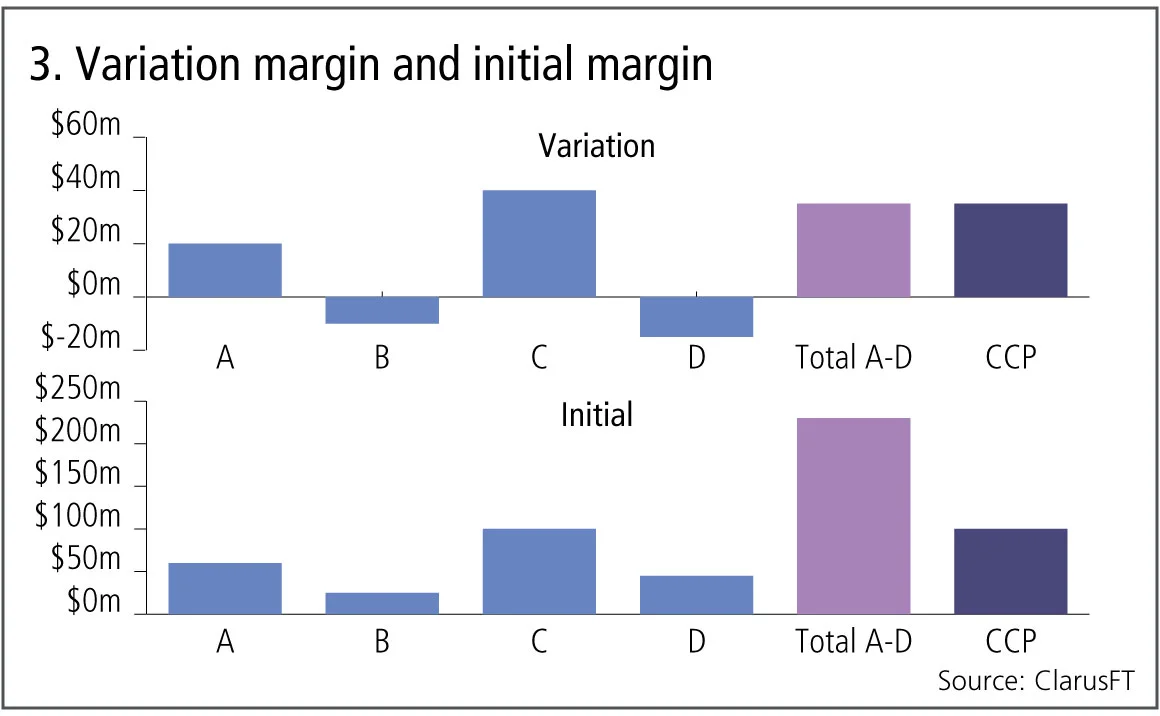

Figure 3 shows:

- Variation margin that needs to be paid or received on a given day to each of four counterparties; A to D, the total of these is $35 million.

- If these same position were all cleared at one CCP, the net variation margin payment would also be $35 million, so economically exactly the same.

- However for IM, the situation is very different, as the sum of the four bilateral IM amounts is $230 million, while if one CCP cleared all of these, the IM could be $100 million, so economically the market is much better off.

In reality, market participants cannot net all cleared OTC derivatives into one CCP, so does the illustrated multilateral example still hold?

The answer is yes, as while a market participant may use a handful of CCPs for OTC derivatives, generally less than 10, the same participant is likely to have bilateral derivatives exposures against a much larger number of counterparties, generally in the low hundreds.

Consequently, the grossing up of initial margin in each of those relationships as more and more firms are captured by uncleared margin rules is likely to increase regulatory initial margin more and more.

The $50 million threshold below which initial margin only needs to be calculated and not collected and posted helps mitigate matters, however we still expect to see uncleared margin rules act as an incentive for firms to clear.

Increasing clearing

This incentive to clear, as well as mandatory clearing of certain products should mean cleared initial margin for OTC derivatives will continue growing for some years yet.

Let’s see if more recent data bears that out.

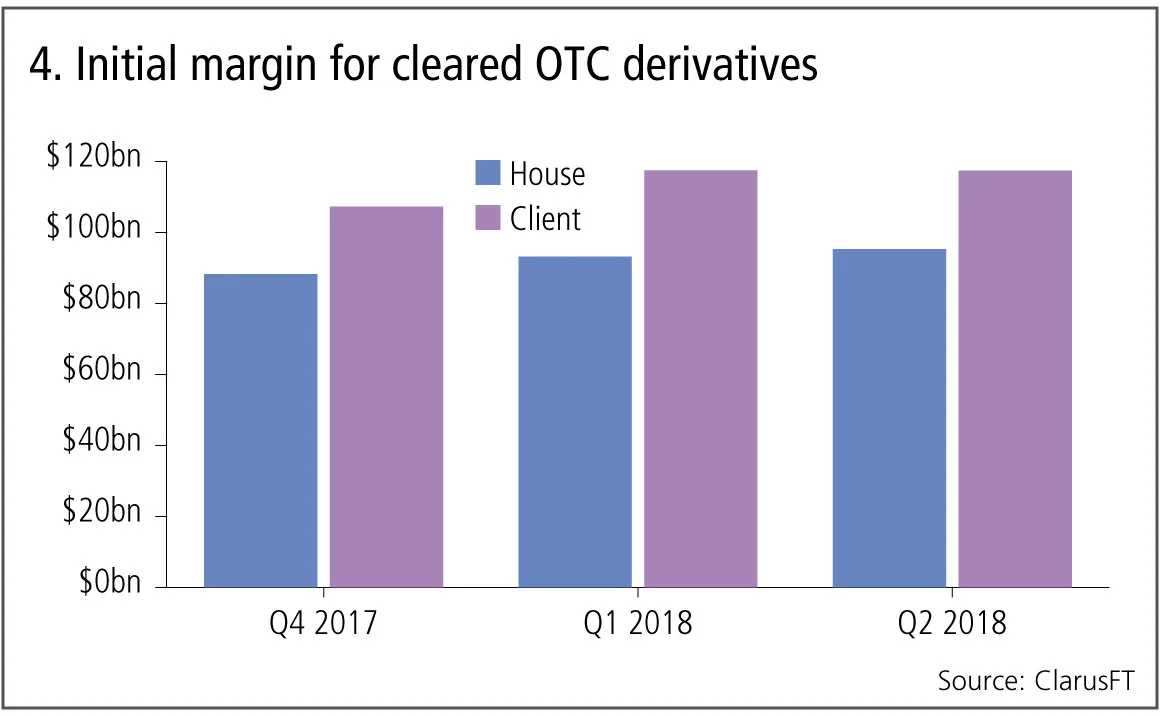

Figure 4 shows:

- House initial margin increasing from $88.3 billion at Q4 2017 to $95.3 billion at Q2 2018.

- Client initial margin increasing from $107 billion to $117 billion.

- A total of $213 billion initial margin at Q2 2018, up 9% over the six-month period, which projecting at the same rate implies 18% annual growth rates.

Default resources

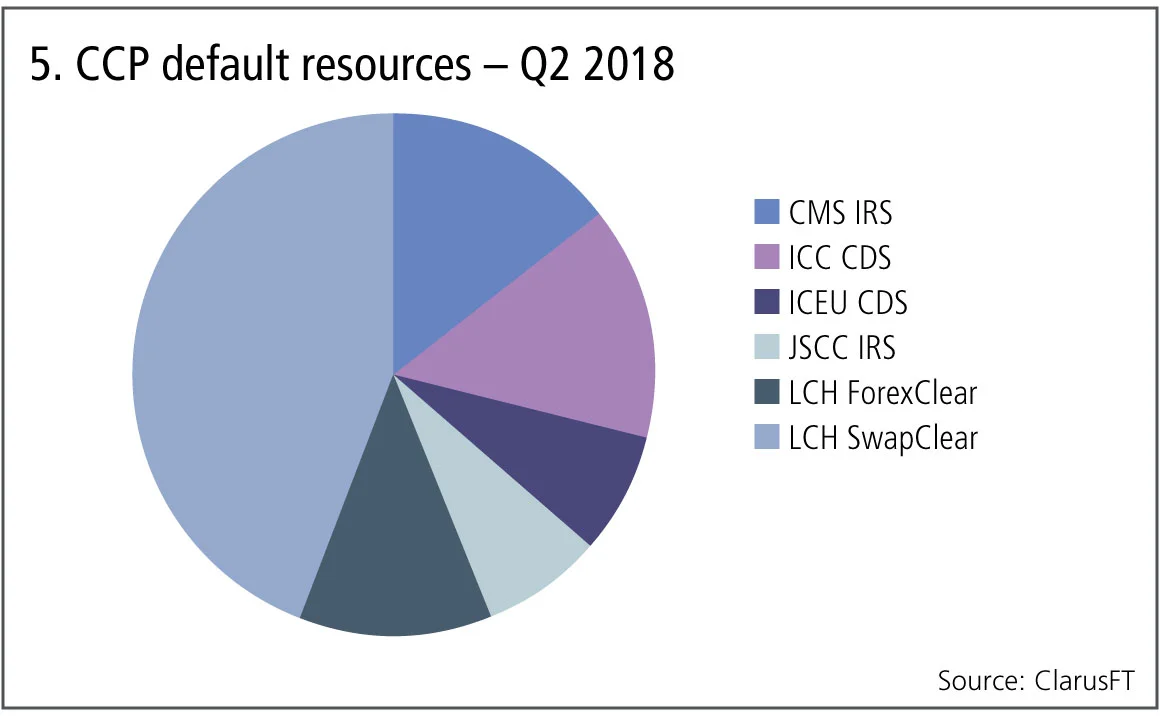

Before I end, it is worth mentioning CCPs also require their members to contribute to a defult fund. Below, we aggregate default resources for the same OTC CCPs, excluding Eurex, which has a combined default fund.

Figure 5 shows:

- Composition of the pre-funded and committed financial resources available to each of the CCPs.

- A cumulative $16 billion of prefunded resources and a further $14 billion of resources that are committed on default of a member, a grand total of $30 billion.

This additional $30 billion provides additional security and a backstop to member defaults, above and beyond the $213 billion of initial margin held for cleared OTC derivatives.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia