Solvency II: The way forward

As the Solvency II directive progresses, this report considers the achievements that have been made so far and the challenges yet to come

Amidst the daily negotiations surrounding Solvency II, the constant supply of new papers to be read and written, the review of things you had thought were settled, and the challenge to maintain momentum for a directive in 2007 there has been much progress and much consensus amongst the major firms and many of the leading trade associations. The regulatory community may trail this consensus, but there is momentum in CEIOPS and determination in the European Commission to drive the Solvency II directive forward. Against this backdrop it is worth reflecting on achievements to date and challenges to come.

Market values

There is a broad consensus about the need to market value both the asset and liability side of the balance sheet within the Comite Europeen des Assurances (CEA) and Chief Risk Officer (CRO) working groups. This may not sound much of an achievement, but during the last equity bear market around 2002, there were still firms and regulators arguing for a book value approach to assets. Now the market valuation of assets by the industry is accepted, and the industry is pushing to extend the list of permissible assets to include hedge funds, derivatives, and private equity.

In an era when real return on traditional asset classes remains low, especially on bonds, insurers should be using alternative assets, within a risk management framework and a sophisticated capital calculation, to boost returns for customers and shareholders. The use of such alternatives is only open to firms that meet these requirements - many smaller and less sophisticated players will not need or want to take this route.

While most assets, including derivatives, have readily available valuations, it is often said that liability valuation is harder. Harder, yes, but not impossible. One of the commonly made mistakes is to argue that this difficulty means the only option is to create larger buffers of capital, added to the technical provisions, so as to be comfortable that assets will cover likely outcomes. For a European Directive in the 21st Century, designed to promote the efficient allocation of capital, and deliver on the Lisbon Agenda of creating leading companies, Solvency II cannot be content with such a poor answer.

Instead, insurers should be expected to model, or to use very prudent factors if they cannot model, in order to capture the market-consistent value of liabilities. In many areas, such as unit-linked products and much of the annuity book, these liabilities will be the expected present value of future liability cash flows, and they will be relatively easy to calculate. In some areas, such as participation contracts and CAT risks, there will be an additional and modelled cost for non-hedgeable risk. For most insurers in retail markets, dealing with common risks from household insurance to life insurance and pensions, these risks are relatively well known. Therefore, the additional margin (the market value margin) on a large and diversified book will be small.

Of course there will still be more arcane and complex risks where the margin will be much higher. But in all cases the need is to analyse and model the risk - to engage it analytically through modelling, using scenarios and stresses appropriate to the portfolio. These techniques, in open dialogue with the supervisor, and in forums that promote best practice in risk management (such as the various chief risk officer groups that have emerged in Europe) are the way forward. In this more open environment where capital is explicitly held against risk, the industry can make rapid progress well before Solvency II takes effect in 2010 or 2011. This is the progressive agenda - right for Europe's insurers, and for the emerging Lamfalussy framework for insurance within which national insurance supervisors will co-ordinate supervision to ensure the flexible delivery of common standards.

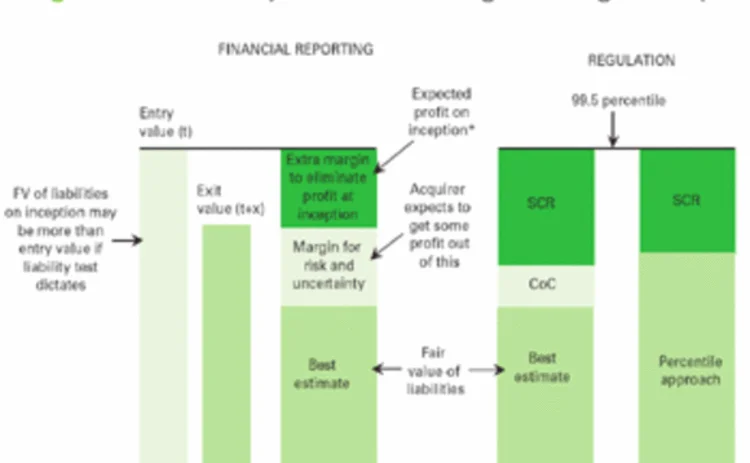

There are, of course, many challenges still remaining, such as weighing the viability of a market cost of capital approach over fixing on a percentile approach as a basis for calculating the market value margin in both life and general business (see Figure 1). Further, there will need to be much greater effort put into delivering a real diversification benefit - not just one based on surplus capital in national entities; and the delivery of this benefit in the context of EU-wide lead supervision by a national supervisor. All these are complex issues that are raised in Pillar I, and spill into Pillar II, but with a genuine economic approach to the realistic calculation of assets and liabilities there is a basis on which they can be solved.

Pillar II - A long way to go

While the foundations of Pillar I have been laid and construction progresses, there is something of a hole in the ground for Pillar II. In a Lamfalussy context it will be difficult to agree a common set of rules and processes for European-wide delivery in this area, a problem superimposed on the practical difficulty of not yet knowing the boundary line between the three pillars. Many insurers, particularly on the continent, are uncomfortable in moving to a more interactive and flexible relationship with the supervisor, and some seek comfort in completing long Pillar I forms in the hope that they will thereafter be left alone for a while. There is also a tendency to put difficult issues such as CAT or operational risk in Pillar II, as a means of keeping Pillar I clean and straightforward.

For these reasons Pillar II is at a relatively early stage of development, but it is likely to have the following features in Solvency II if it is going to meet the broader objectives of the directive: Firstly, for all major and medium-sized players at least, it will involve a risk assessment of the firm or the group in its entirety, which will go beyond the modelling in Pillar I. It may well involve additional stress and scenario testing, particularly if these are constrained in Pillar I to relatively homogenous tests. On the basis of this assessment and a review of it by national supervisors - or a lead group supervisor for those with operations beyond one EU country - a decision will be made, with the relevant supervisor having the final say over the amount of capital and the scope of the authorisation available to the firm. Such a decision will need clear justification, and in today's society it will have to be in principle open to challenge in a review process, at least on grounds of fairness.

Secondly, the aim should be to capture most risks in Pillar I if at all possible, but to modulate that in Pillar II. Models may well, for example, capture market risks on the asset side in full in Pillar I, and the only Pillar II question that then needs asking is about the quality of the risk management process. In other words, how robust and reliable is the capture of market risk? Other risks, such as operational risk may not be captured so well, even in 2010, and it remains to be seen what methodology for Pillar I operational risk solvency Pillar II will allow. Therefore Pillar II may well enable a firm to argue that relatively crude and conservative standard analytics in Pillar I are not appropriate in its case because it can demonstrate a track record of collecting and modelling operational risk against an industry database. In this case, it could argue in Pillar II, that a lower capital charge was justified than the Pillar I outcome, especially under a standard approach.

Thirdly, the scarce resources involved in this process will mean that it is not practical for very small insurers, and that the cycle of review may need to be longer in some cases than others - especially where there is a relatively low risk portfolio involved. Finally, and most importantly, a framework of rules for such an assessment can be established. Pillar II is more about a process of risk assessment and review, not the completion of forms. It is a dynamic process, and the heuristics and parameters of this process will evolve over time. One of the real challenges for European regulators will be to develop the framework for this to happen successfully and for it to be sustained.

Pillar III - Greenfield site or IASB rules?

If Pillar II awaits foundations, Pillar III looks like a greenfield site to many. To others, the portacabins of international accounting standards are already being erected as part of the smooth and simplistic move to converging accounting and solvency. Both visions are wrong. Instead there will be a continuing dialogue as Solvency II firms up with the emerging IASB agenda, particularly plans to replace IFRS4 with a fair value approach to the valuation of insurance liabilities, and to align this with the troubled IAS39 standard on financial instruments.

We are therefore in a period of transition where the final outcomes of both are uncertain and the need is to recognise both the benefit of a common methodology in producing numbers for financial reporting and financial regulation; and also to recognise that there will be differences in what is required at some level. In particular, accounting numbers will tend to focus on the recognition of shareholder value and the release of profit; whereas solvency will focus on the viability of insurers and the prospects of their survival within specified conference parameters. Common language and common numbers help wherever possible, but different purposes are involved to some degree, as illustrated in Figure 1.

As the discussions continue between IASB rules and solvency rules, it is worth looking at the challenges raised in the context of Pillar III, and the read across to the original Basel thinking of 1988. The intention was to use robust market disclosure to reinforce market mechanisms, and thereby reduce the amount of supervisory weight that needed to be exercised through Pillar I and Pillar II. Some of this sense of a trade-off needs to be recaptured by regulators and industry alike if we are to avoid over-regulation in Solvency II.

For insurance - a less than transparent industry - this is a real challenge, but if it is possible for analysts and investors to see on a segmental basis what the capital is and what risks it is allocated against, then their collective judgement will drive the industry forward. Firms with better skills at writing risk, and at managing it against a specific quantum of capital will be rewarded, and the value of their equity and debt will have a rational price on it, according to the risks taken into the business.

Over time, more than any supervisor or form, this will support better practice among those firms that are weaker in writing and managing risk. Supervisors will not be out of a job, but if we get the challenges of Pillar III right, they will be working with the grain of the market.

Something for Europe

Basel II has not turned out that well. After too many political compromises and a dearth of good thinking about risk modelling and management, a large old-fashioned directive - the Capital Requirements Directive - has emerged, and it has few real supporters. Solvency II needs to be both elegant and sophisticated in its design, its legislative process, and above all in its implementation. Much of the fairly technical discussion to date has not focused on these three challenges. If they are met, then the real achievement of the forthcoming Solvency II regime will be in stimulating a better structure for the insurance sector through competition and consolidation; and better pricing of risk for retail and commercial customers in life and general insurance. These are the real achievements worth working for in Solvency II.

- Peter Vipond is the Director of Financial Regulation and Taxation at the Association of British Insurers.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Insurance

The future of life insurance

As the world constantly evolves and changes, so too does the life insurance industry, which is preparing for a multitude of challenges, particularly in three areas: interest rates, regulatory mandates and technology (software, underwriting tools and…

40% of insurers fail to specify climate as a key risk – LCP

Despite regulators’ urging, many UK and Irish insurers omit climate from risk statements, says report

Libor leaders: Prudential takes SOFR for a test drive

Test trades have allowed US insurer to start getting used to a life without Libor

Fed to push ahead with capital regime for single US insurer

Prudential faces risk capital add-ons unless it sheds “systemically important” label

Brexit dims hopes for Solvency II change in UK

Lawyers say political tensions may have killed off chance of reform, following PRA U-turn

BoE creates volatility adjustment ‘stepping stone’ for insurers

Dynamic VA may be used for assets that fail to qualify for matching adjustment, say experts

No plans to scrap systemic insurer rules, says IAIS chair

A US regulator claims Europeans asked IAIS to chart own course after FSB moved to ditch G-Sii list