ETF investing – Building better portfolios

At the Asia ETF Forum 2019, Hong Kong Exchanges and Clearing (HKEX) welcomed industry experts from around the region to six key Asian exchange-traded fund (ETF) cities, offering attendees an updated view on the growing ETF market in Asia. This article explores the key topics covered in the first four cities, including total cost of ownership, generating location alpha with tax advantages and the latest investment trends

Beyond total expense ratio (TER) – Total cost of ownership (TCO)

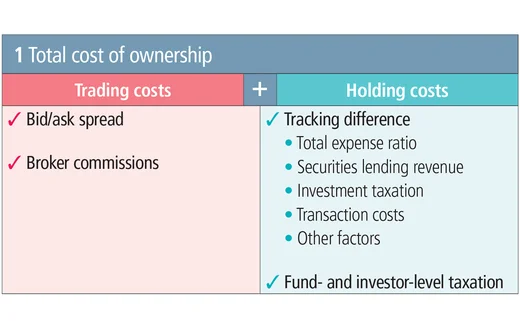

This year’s forum exposed one of the most common pitfalls in ETF selection: overemphasis on the TER. In fact, TER is only one component of ETFs’ TCO, which can be broken down into trading and holding costs (see figure 1).

Location matters – Generating alpha by saving tax

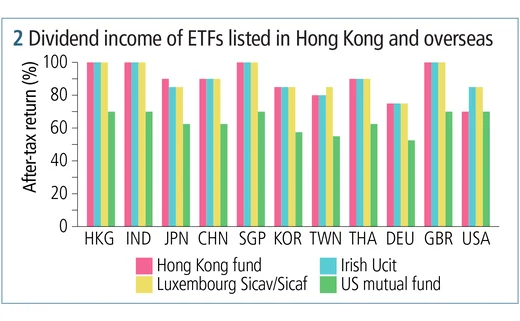

A significant yet often neglected TCO component is taxation, which can vary widely depending on the domicile of the investor, the domicile and type of ETF, and the jurisdiction of the underlying portfolio investments. For example, a Hong Kong investor of US‑listed ETFs is subject to a 30% withholding tax on dividends, but the same investor can be free from dividend tax if they invest in Hong Kong-listed ETFs (see figure 2).

“Investors seeking Asia exposure generally pay too much attention to singular components when they compare the costs of ETFs listed in Hong Kong and the US. In fact, a holistic approach to budgeting costs is more appropriate for ETF investors. That means also taking into account withholding tax on dividends,” said Brian Roberts, head of exchange-traded products at HKEX. “Investors in Asia can save tax and reduce the true cost of ETF investments if they bring their Asia exposure back to Asia. That makes a strong case for trading Asia in Asia.”

The benefit of trading Asian-based securities and bonds in the region as opposed to in overseas exchanges is not limited to tax advantages. ETFs with Asian underlyings listed in different time zones often entail larger tracking differences – defined as the total difference between the ETF and its underlying index – than their Asian counterparts.

Investment trends in ETF

Two of the latest ETF investment trends – namely smart beta and fixed income ETFs – were highlighted at the forum. Factor investing has been a dominant trend in the ETF world in recent years. Research conducted by Brown Brothers Harriman showed that 44% of investors in the Greater China Region will increase their allocation to smart beta in the next 12 months. During periods of market turbulence, 46% of respondents in the region said they would buy low-volatility smart beta ETFs to weather volatility, suggesting an increasing focus on factors in Asia.

On the other hand, fixed income ETFs allow for cost-effective portfolio management and greater flexibility by packaging thousands of bonds into one ticker. Investors can easily enter and exit positions in a way that wouldn’t otherwise be possible when trading individual bonds. “Today, we take it for granted that, through a fixed income ETF, we can trade $2 million–300 million every day, throughout the whole day, at a 1–2 basis point spread,” said a senior manager of a fixed income ETF. As stock market volatility picks up and the US Federal Reserve appears likely to slow down the pace on rate hikes, fixed income ETFs look set to gather more assets this year.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net