Loans

At Goldman Sachs, loan-loss provisions top $1bn

Loans up 11% in 2019, but provisions for credit losses surge 59%

EU compounding confusion creates headaches for banks

With the fallback possibly illegal in some EU states, loan system updates may become more complicated

Top 10 operational risk losses of 2019

Fraud, embezzlement, tax evasion, subprime (still) and rogue trading – and Citi crops up twice. Data by ORX News

Risk weight tweak could fix IFRS 9 capital clash – research

Practitioner suggests way to cancel out double-counting of Basel credit loss provisions

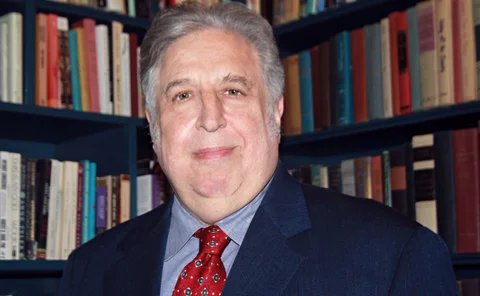

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

Compounded rate out of favour, finds Japan survey

Users prefer forward-looking term rate to replace yen Libor, but dealers bemoan “lack of understanding”

Euribor fallbacks could hit thin legal ice

In Italy and Germany, compound interest – the foundation of Euribor fallbacks – is actually illegal

CLO stress test shows losses for US insurers could top $6.9bn

Under one stress scenario, BBB tranches could suffer losses

EU banks cut toxic loans, but pace of improvement slowing

Cypriot and Greek banks improve NPL ratios the most in nine months to end-June

In hunt for profitability, EU banks turn to risky assets

Exposures to high-risk items across EU banking sector hit €97.2 billion

Credit portfolio manager of the year: NatWest Bank

Risk Awards 2020: Big deals and big ideas have helped transform stress-test laggard to leader

JP Morgan revs up securitisation engine

Exposures receiving securitisation capital treatment increase by $13.7 billion year-on-year

PRA drops ‘timely’ payouts in credit risk insurance

Plan for expeditious timeframe set aside to delight of banks worried about retaining capital breaks

Chafing under capital rules, JP Morgan sells home loans

Standardised risk weights for residential mortgages far exceed modelled equivalents

Loan appetite pushes credit risk higher at Goldman Sachs

Standardised credit RWAs for loans up 19% since end-2017

Impairment charge up 58% at BBVA

Write-offs and higher provisions take big bite out of bank’s income

Credit model update holds down loss provisions at Deutsche

German lender saved €167 million through model refinements

At large US banks, credit loss reserves up 12% in Q3

JP Morgan took $1.5 billion of provisions in the third quarter alone

The greening of Natixis’s balance sheet

Green weighting factor will be used to adjust the credit RWAs of loans

Goldman adds $17bn of deposits in Q3

Consumer platform Marcus doubles deposits year-on-year

Capital cut for synthetic securitisations splits regulators

European rulemakers wary of diverging from Basel standards

Credit loss provisions at US G-Sibs 14% lower in Q2

PCLs total $4.8 billion at end-June

Libor transition and implementation – Covering all bases

Sponsored Q&A

Bank of China pioneers SOFR lending in Asia

In absence of term rate, lender uses daily compounded backward-looking rate