Loans

Canadian banks see loan-loss reserves diverge

Provisions rise at Scotiabank and BMO; drop off at TD Bank, CIBC and RBC

Eurozone securitisation engine sputters in Q1

Holdings of eurozone bank loans by SPEs are contracting

Shadow banks gobble up cross–border loans

Traditional lenders' claims on non-bank financial institutions increased 8% at year-end

US Bancorp takes axe to toxic loans

Non-performing assets fall 17% year-on-year

Fed DFAST models project huge credit card losses

Losses of over 57% estimated for high-risk accounts

Accounting shake-up set to hit China shadow banking

Banks brace for extra provisions under IFRS 9 for loans masquerading as investment products

Canadian Big Five hoard reserves as credit outlook decays

Four of the five largest Canadian lenders saw provisions rise, with BMO the only outlier

Are lenders using risk-based pricing in the Italian consumer loan market? The effect of the 2008 crisis

This paper analyzes whether in Italy the price of consumer loans is based on borrower-specific credit risk.

First SOFR term rate coming in 2020

Staff at the New York Fed are working on a series of backward-looking averages

Model woes swell ABN Amro RWAs

Trim and model reviews add €5 billion in risk-weighted assets

Libor may linger as regulators ‘change tune’

CFTC and FCA suggest benchmark could be kept alive to avoid cash market chaos

Intesa Sanpaolo slashed bad loans 26% last year

NPL ratio plummets to 4.2% from 6.2% in 2017

Lenders favour eurozone non-bank borrowers

Cross-border claims on the euro area grow for the first time since Q2 2016

Large banks thrash regionals’ proposal on CECL

Plan would require more work and produce no capital benefit, executives tell FASB

Cross-border euro lending rebounds in Q3

Intra-euro area cross-border claims accounted for 40% of the annual increase

Non-payment insurance grows as banks shun stuttering CDS market

Credit portfolio managers explore insurance contracts to offset risk from loan book

US G-Sibs hike loan-loss provisions by $737m

Five banks increased PCLs in the fourth quarter of 2018, with JP Morgan leading the way

Overseas lenders back eurozone, shun UK and US

Cross-border loans to eurozone increase $93 billion in third quarter of 2018

Optimism fades to uncertainty on banks’ CECL proposal

As crunch FASB meeting approaches, most decline to speculate on outcome

A tenth of users ‘don’t know’ if Libor death affects them, survey finds

Respondents blame low industry preparedness on lack of standardisation in treatment of fallbacks

AIIB risk chief on steering China’s World Bank rival

Martin Kimmig on the Asian Infrastructure Investment Bank’s challenge of overcoming patchy credit data

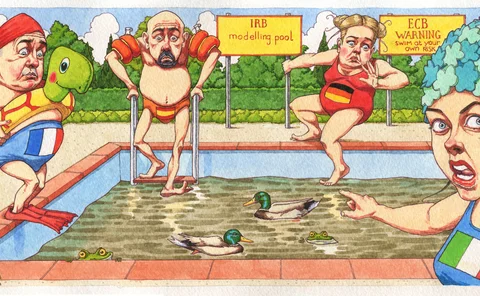

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

Italian banks lead EU on cutting soured loans

Intesa Sanpaolo, Banco BPM, UniCredit shed most NPLs in H1

Italian banks hold most of Europe's loan reserves – EBA

Italy accounts for €84 billion of stage 3 allowances alone