Cover story

Package deals

Banks have been choosing off-the-shelf fully integrated systems for energy trading and risk management. But some feel the available software still falls short

The power of association

Cover Story

To build or not to build

Europe needs more power. But a lack of clear pricing signals and the unknown impact of new environmental legislation is making risk forecasting difficult, and could hinder new plant construction

Takaful takes root

Cover Story

The great divide

Cover Story

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

The evolution of variance

Cover story

US retail in the firing line

Cover Story

Taking the screen test

Screen trading is spreading faster than ever in the energy markets and market dynamics are changing as a result. Do interdealer brokers in the market see this advance as a threat or an opportunity? Stella Farrington finds out

A difference of opinion

CMS spread options have been just about everywhere this year, with investors keen to take a view on the shape of the yield curve. But a wide variation in pricing has sparked speculation that some banks may not be modelling these products accurately. By…

Pieces of a puzzle

To get enterprise-wide risk management to work, a firm needs to piece together the right models, processes and software – and the right attitude. US utility Allegheny Energy has done just that, finds Oliver Holtaway

Filling the ratings void

Cover story

Balancing the capital structure

Cover story

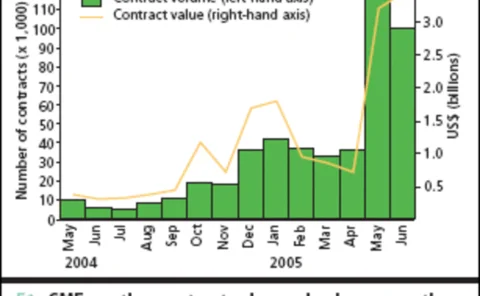

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

The CDO detectives

Cover Story

Emissions education

As the European carbon market continues to grow, so too do some unique challenges: not least the gap between retail and wholesale players and the problem of counterparty credit risk. Oliver Holtaway reports

Surfing the Sipps new wave

Cover story

The curious incident of the disputed CDO

Cover Story

Freight looks forward

Freight derivatives are increasingly seen as a key risk management tool. Banks and hedge funds are also trading them. But will the growth in liquidity continue, or is this another false start for the market? Stella Farrington reports

A love-hate relationship

Cover story

Crisis of correlation

Cover Story

Peaking patterns

Energy Risk Annual Awards

Always look under the bonnet

Cover story

All bases covered

Emissions Trading