Basel Committee

Credit model evaluation

Technical

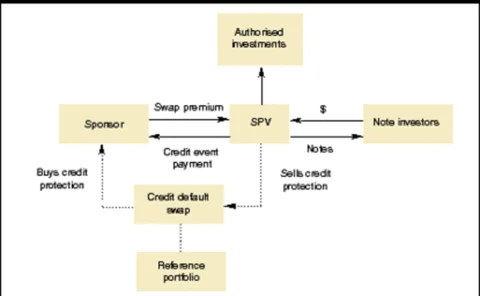

A new twist to ABS

Synthetic securitisation

The Basle II capital accord: op risk proposals in brief

BASLE II UPDATE

Risk financing might solve doubts over op risk insurance

BASLE II UPDATE

IT and staff quality seen as key as India adopts Basle II

BASLE II UPDATE

Weary recognition of gross income as Basle IIop risk measure

BASLE II UPDATE

Job moves

QUOTE OF THE MONTH: - “I can’t get rid of the stupid thing” Lev Borodovsky, co-founder of Garp, describing difficulties negotiating a transfer of ownership Source: RiskNews, January 16

Insurance industry moving too slowly on op risk

Insurance companies are failing to move quickly enough to offer operational risk regulatory capital charge protection coverage, according to Philip Martin, director of HSBC’s operational risk consultancy. Speaking at Risk magazine’s OpRisk Europe 2002…

ABN’s Mulder calls for faster op risk implementation

Bankers were urged to accelerate implementation of operational risk management practices to better serve their institutions ahead of Basel II by Herman Mulder, senior executive vice-president for group risk management at Dutch bank ABN Amro, during a…

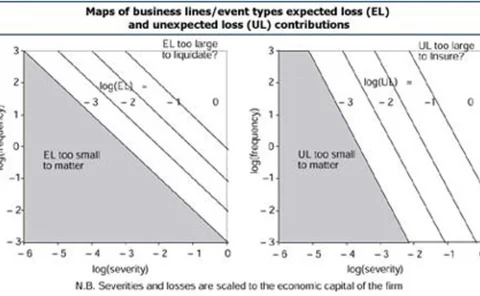

Basel II - Rules and Models

The proposed operational risk charge remains one of the most contentious areas of the new Basel Accord. Carol Alexander reviews the current proposals in the context of various simple models, and argues that practical implementation will require the use…

Linear, yet attractive, Contour

Banks’ Potential Future Exposure models are at the core of the advanced EAD (Exposure At Default) approach to capital requirements for credit risk considered in the New Basel Capital Accord. Juan Cárdenas, Emmanuel Fruchard and Jean-François Picron look…

Basel II may not suit emerging economies, says US central banker

Washington - Rules embodied in the Basel II banking accord may be inappropriate for banks in emerging-market economies because a country may have unique circumstances, a senior US central banker said in December.

In search of clarity and focus

Greater precision is needed in defining operational risk, but the Basle regulators' latest thoughts are lost in generalities, says Jacques Pézier, in the final article of a three-part series.

Basel shortcomings: Danger lurks on the rocky road to Basel II

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

Regulators want active dialogue on op risk

BASEL - Active dialogue between banks and their supervisors is the key to the continued development of approaches to managing operational risk, global banking regulators said in a much-delayed paper on op risk sound practices issued in December.

SME debate delays next Basel II paper

The Basel Committee on Banking Supervision has delayed its next consultative paper for Basel II, the new rules that will determine the amount of regulatory capital internationally active banks put aside against risk.

The Basel II capital accord: op risk proposals in brief

This summary has been updated to include the revisions to the Basel II op risk proposals contained in the Working Paper on the Regulatory Treatment of Operational Risk issued in September, 2001 and available on the Bank for International Settlements'…

Sound practices paper gets positive response

Bankers generally responded positively to the guidance on sound practices for managing operational risk issued by global banking regulators in December.

European timetable threatened by CP3 delay

The European Union's timetable for bringing new risk-based bank capital adequacy rules into effect is in jeopardy following the decision of global banking regulators to delay publication of a key consultative paper.

Thai regulators plan Basel II impact study

Chiang Mai, Thailand - Thai banking regulators plan to conduct a full analysis in 2002 of the likely impact of applying the Basel II capital adequacy accord to Thailand's banks.