India

Building the blocks for energy risk management in India

The concept of using derivatives for risk management is still relatively new to utilities in India and viewed with caution by market regulators. Katie Holliday talks to market experts about how they expect the discipline of risk management to develop

Focus on India: Power market regulation

Despite a growing will to liberalise power markets in India, progress has been slow so far. However, regulatory changes are finally moving the market towards better transparency and competition, finds Katie Holliday

Energy Risk: What's coming next?

Energy Risk brings you a snapshot of what's moving and shaking the markets with a special look at the Indian energy derivatives sector.

India woos foreign investment with CDM project reforms

Government to push through more CDM projects

Indian CDM: does it have a future?

The CDM market in India has boomed since its 2007 inception, but its development has been dogged by both domestic and international regulatory uncertainty. Katie Holliday looks at the challenges faced by the Indian CDM market and asks whether it has a…

India woos foreign investment with CDM reforms

The Indian government is proposing a set of reforms to Kyoto Protocol standards for Clean Development Mechanism (CDM) projects, which involve scrapping further charges to developers, to push through more CDMs and keep investment flows alive, the Indian…

Energy Risk: What's coming next?

Energy Risk brings you a snapshot of what's moving and shaking the markets.

Riding out the rise

Stakeholders in the Asian recovery have a nervous eye on the region’s central banks for signs as to when interest rates will rise this year – something that could weigh on equity returns and devalue the portfolios of bondholders. Changes in rates…

Indian power market faces increased regulation

India’s Central Electricity Regulatory Commission (CERC) issued Power Market Regulations for 2010 this week as part of the Electricity Act passed in 2003.

Hub hubbub

New rules coming into force in many jurisdictions in Asia are challenging the ability of global financial institutions to operate a hub-and-spoke business model for their derivatives businesses. By Jacqueline Low, Jing Gu and Keith Noyes

India finds some forward momentum

The global financial crisis could easily have sounded the death knell for India’s nascent structured products market. But as the country’s equity markets have resumed their upward trend, dealers say equity-linked structures are catching on fast.

New Indian Commodity Exchange to go live within a week

India's fourth national commodity exchange, the Indian Commodity Exchange (ICEX), is set to go live in less than a week's time, Reuters have reported

China's smoke signal

World leaders will congregate in Copenhagen next month in a bid to thrash out a replacement to the Kyoto protocol for climate change. While the outcome is still far from clear, new policy stances from Asian nations are already having a fundamental effect

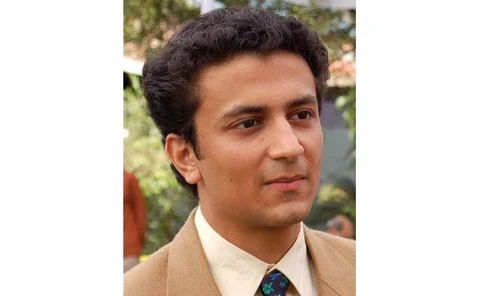

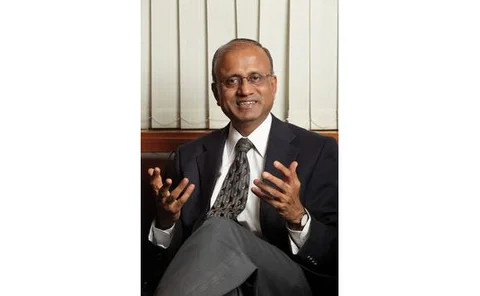

Interview with NCDEX's CEO Ramalingam Ramaseshan

Katie Holliday talks to Ramalingam Ramaseshan, NCDEX’s CEO, about his perception of the future of commodity trading in India and the role of regional exchanges

Open for hedges

India’s insurance sector has long been hamstrung by its inability to use equity derivatives. This is about to change with the country’s insurance regulator set to relax the rules on derivatives. But are India’s insurers ready for synthetic instruments?…

India’s energy efficiency scheme won't impact CDM, say experts

India’s plans for a domestic energy efficiency cap-and-trade scheme have raised concerns over how the market for Clean Development Mechanism (CDM) projects will be affected.