Technical paper/Exchanges

Sorridere alle convessità

Approfondimenti. Volatilità implicita

Forward thinking for backwardation

In certain settings it's reasonable to assume that the current futures price embodies the market expectations of the spot price. However, as Gary Dorris, Sean Burrows and Vena Kostroun explain, there are distinct situations when this assumption does not…

A matter of principal

Developing term structure models can be tricky, as unknown factors and non-observable variables can affect futures prices. But principal components analysis is useful in tackling these problems. Here, Delphine Lautier uses PCA to pin down price movements…

Caring competition

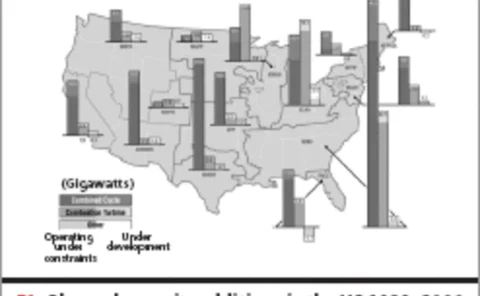

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…

Observations on the differences between operational risk regulatory and economic capital

In this article, Niklas Hageback takes a practical look at the difficulties in reconciling regulatory and economic capital calculation in the discipline of operational risk.

Trading techniques

Rankings 2004

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals.

Creating an op risk loss-collection framework

To meet the Basel II advanced measurement requirements and improve op risk management, firms must establish robust loss databases. Ulrich Anders and Jürgen Platz of Dresdner Bank in Frankfurt outline such a framework.

Exceptional operational risks: Three myths debunked

Are there common features among exceptional operational risks beyond their defining characteristics of rarity and severe consequences?

Pro-cyclicality in the new Basel Accord

Could Basel II worsen recessions? By backtesting the proposed capital rules to the last recession, D. Wilson Ervin and Tom Wilde argue that the increased risk sensitivity of loan portfolio regulatory capital in the new Accord could have unwelcome…