Opinion/Regulation

Validating EPE

Empirical validation of trading credit exposure simulation models is clearly essential. David Rowe points out, however, that the process must differ significantly from traditional back-tests of VAR models

Editor's letter

Comment

Editor's letter

Editorial

Plain English please

Complaints are reaching me about the way in which the US regulators have released the notice of proposed rulemaking (NPR). My sources point out that the advance notice of proposed rulemaking – released way back in those halcyon days of August 2003 – came…

The arrogance of hindsight

Some governments are reportedly becoming more active in using derivatives to manage their debt and funding costs. While arguably quite sensible, public distrust and sensationalist journalism present special dangers, argues David Rowe

Editor's Letter

Comment

Legal Spotlight

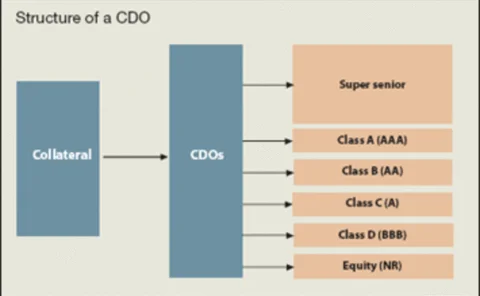

US Congress is considering new legislation that could enable CDO issuers to sell greater chunks of their CDOs to pension plan investors. Todd Garvelink and Howard Mulligan explain

The pragmatists fight back

Editor's letter

Awakening giant?

Some circumstances endure long enough to become embedded in the unexamined assumptions of a generation. In the case of the Japanese economy, these assumptions could prove costly, argues David Rowe

Editor's Letter

Comment

Home-host conflict

Despite structural attempts at supervisory co-ordination, international banking groups need to foster bilateral understanding with their subsidiaries' host regulators, argues David Rowe

Editor's letter

Editorial

Back to basics

We take you back to the credit basics to review everything you thought you already knew but were too afraid to ask... Rob Pomphrett, head of structured product syndicate at RBC Capital Markets in London, explains how CDOs work

The Pandora's box of transparency

Editor's letter

Dangerous perfection

Risk Analysis