Energy

Dodd-Frank special report

Energy Risk looks in detail at the US Dodd-Frank Act and its implications for commodity and energy market participants

Risk & Energy Risk Commodity Rankings open for voting

Vote now in the 2014 Risk & Energy Risk Commodity Rankings

Liquidity seen as top concern for energy risk managers

Falling over-the-counter energy volumes in Europe and the US push liquidity to top of risk management agenda

Dodd-Frank commodity option rules sow confusion among energy firms

Confusion over CFTC rules is tying US energy firms in knots, as they struggle to determine whether their physically settled commodity options need to comply with critical rules issued under the US Dodd-Frank Act. Alexander Osipovich reports

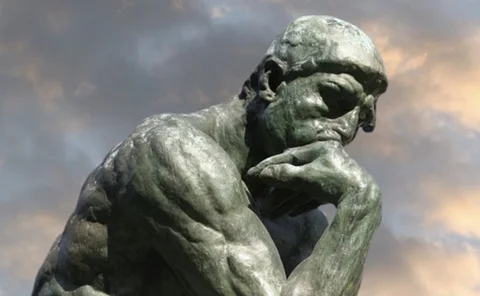

An anatomy of financial and energy market bubbles

Despite differences in the detail, the mechanics that unfold during episodes of financial and energy market hype are the same. To avoid repeating the errors of the past, companies and individuals should bear them in mind, argues Vincent Kaminski

Energy Risk Asia Awards 2013

The Energy Risk Asia Awards showcase excellence in commodity and energy markets across the region. We present the winners

npower encompass offers an integrated approach to risk and energy management

Advertisement feature: npower

Energy firms find Emir thresholds too close for comfort

The European Market Infrastructure Regulation will force non-financial counterparties to clear trades in over-the-counter derivatives once they reach a set of notional thresholds. And despite their original expectations, many energy companies could be…

Energy should be exempt from benchmark rules, argues EC official

Benchmark indexes in energy markets are already well regulated and do not need further oversight, argues EC director-general for energy

Energy Risk Canada: Rules on derivatives dealers need work, regulator says

Alberta securities regulator acknowledges proposals on derivatives dealer registration have alarmed energy firms

Futurisation dooms energy swap execution facilities

The US Dodd-Frank Act envisioned a new type of trading venue for over-the-counter derivatives, known as swap execution facilities (Sefs). But in the energy markets, at least, it appears Sefs are dead and traditional futures exchanges have emerged…

Canadian regulators respond to energy firms’ concerns on derivatives

Updated OTC derivatives rules satisfy concerns of energy traders, but inconsistencies with Dodd-Frank remain

Black River Commodity Trading Fund: Black River Asset Management

13th Annual European Single Manager Awards 2013

Uneconomic trading, market manipulation and baseball

Regulators, including the US Federal Energy Regulatory Commission, are aggressively targeting uneconomic trading in a crackdown on potential market manipulation. Such moves have striking parallels in the history of baseball - some of which might prove…

Ferc ruling raises hope of greater regulatory certainty

Ferc and turf

Ferc won’t appeal Hunter ruling, says Wellinghoff

Ferc chairman says agency won’t appeal ruling against it, but will seek to persuade Congress to change the law

Collateral and commodity market dynamics in the new normal

The new normal

Energy firms scramble to avoid swap dealer label

Switching to futures and rewriting corporate websites could help reluctant energy companies avoid having to register as swap dealers under Dodd-Frank, reports Alexander Osipovich

Risk & Energy Risk Commodity Rankings 2013 – energy

Kinetic energy

Futurisation forces hundreds of traders to sit exams

Swaps-to-futures switch at Ice – plus hedge fund regulatory changes – behind threefold jump in numbers taking futures trading exam

The art of creating a corporate energy hedging programme

The philosophy of corporate hedging