Commodities: Getting ahead of the curve

Traditional commodity indexes have posted poor returns in the past two years due to contango in the forward curves of various commodities. Among the casualties are products that link to them, such as certificates. But a new breed of indexes promises to introduce greater diversification and more attractive returns. Amanda Lee reports

Disappointing returns from structured investments linked to traditional indexes have left many retail investors high and dry. Disgruntled investors, including those in Germany who bought certificates linked to the performance of Goldman Sachs Commodity Index (GSCI) or the Dow Jones AIG Commodity Index (DJ AIG), have been complaining about poor performance and demanding a quick fix.

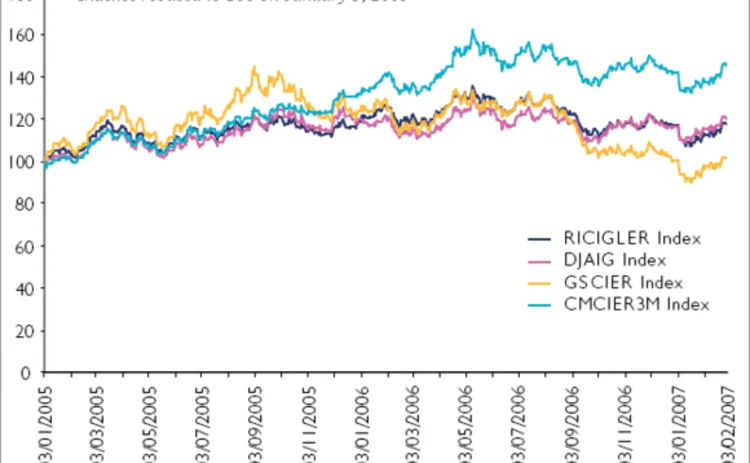

While the daily papers continue to report on the high price of oil, actual returns from the indexes are falling. The GSCI, for example, was down by about 15% in the fourth quarter of 2006.(see chart overleaf).

Commodities indexes such as the GSCI are comprised of rolling short-term futures contracts, so returns on them depend not only on movements in commodity spot prices, which are often reported in the media, but also on the income or losses from the rolling forward of expiring futures contracts. The market is in so-called 'backwardation' if the future price of a commodity is lower than the spot price, whereas 'contango' exists if the future price of a commodity is higher than the spot price.

Due to their large energy sector weightings, traditional commodities indexes are currently experiencing significant negative roll yields because the forward market has been in contango, notably towards the end of 2004 and the start of 2005. The monthly roll, which involves the sale of a maturing contract at one price and purchase of another contract at a later date and a higher price, results in a loss for investors each time it is executed. The steeper the futures curve, the bigger are the roll losses.

Following the sale of Goldman Sachs' flagship GSCI series to Standard & Poor's last month, structured products providers that have issued certificates linked to the GCSI in the past, such as Swiss investment bank UBS, have launched their own benchmarks to minimise roll losses and introduce a range of maturities for different commodities.

Market participants contacted by Structured Products say it is difficult to estimate how much investors have lost in bonus and express certificates linked to the GSCI and the DJ AIG. But it is clear that those who complained did not fully understand how the underlying mechanism worked before they purchased the products.

"Both types of certificate belong to the class of path-depending derivatives. This makes it impossible to compare performance," says Holger Wasem, a Frankfurt-based sales director at UBS Risk Management Products. Roll losses apply to all types of certificates, Wasem says.

Rollover losses

"Certificates that track indexes such as the GSCI (Total Return and Excess Return) don't track the spot performance of the underlying commodities, but rather the performance of rolling futures contracts on those commodities," says Jorg Kukies, Frankfurt-based managing director and head of structured products for Germany at Goldman Sachs. "The difference in performance between spot prices and rolling futures can be significant."

However, retail investors tend to focus on spot prices, Kukies says. "For several commodities it was the case in 2006 that although prices reported in the press were rising, the index did not move, or even fell. We explained to our clients how the indexes work and fewer people complained. We have noticed that understanding of contango and backwardation issues has improved due to the efforts of issuers and journalists."

Dutch bank ABN Amro has also issued a certificate linked to the GSCI in Germany. "If one compares all the current commodity indexes in the market, one sees that all of them have suffered as a result of the decline in the commodity market," says Oender Ciftci, ABN Amro's Frankfurt-based head of public distribution for Germany and Austria.

"Returns on all the indexes have been negative. However, returns linked to the Rogers International Commodity Index (RICI) have not fallen as much, and when the markets go back up it outperforms all the commodities certificates, including those that are linked to the GSCI, DJ AIG and Commodity Research Bureau Commodity Index," Ciftci says. "While the GSCI has lost around 18% since the beginning of last year, the RICI has lost around 7%. This is due to the RICI's diversification, while the GSCI is weighted about 70% to Brent crude oil."

Research conducted by UBS suggests that investors may have expected commodities indexes to behave in the same way as equities indexes, and the bank says most people who bought certificates linked to the GSCI were in fact traditional equities investors.

The UBS research reveals that, unlike traditional fixed-income investors, who are familiar with the term structures, equity investors tend to expect commodities indexes to behave like equity indexes. For traditional equity investors, the effect of measuring commodity returns based on spot rolling commodity futures is similar to the effect of dividends on a pot price of stock.

However, the commodities returns associated with the spot contract price rising and falling are not replicable in practice because they derive from the price comparison of two independent instruments, futures contracts and forwards of different maturities.

"I don't think the rollover losses have damaged investors' confidence in commodities indexes," says Ralph Stemper, product manager, derivatives public distribution at Commerzbank in Frankfurt. Stemper says the bank has issued certificates linked to the GSCI. "But it's something that investors haven't thought about," he adds. "It's supposed to be a new asset class for private investors. This means the rollover problem is also something new. Some investors were surprised at the end of the year because the certificates didn't perform as well as the good performance of commodities led them to expect. But I wouldn't say customers were disappointed, or that they wouldn't buy more of this kind of product."

Old versus new

The GSCI has attracted criticism for its heavy weightings towards the energy sector. "The forward curves of most energy markets have been in contango for almost all time periods in the past few years. Losses resulting from contango have been particularly pronounced in the natural gas market," says Kukies at Goldman Sachs.

To introduce more diversification to the indexes and minimise rollover losses, ABN Amro has launched the CYD Commodity Index Certificate, an actively managed index certificate that considers futures curves. "On the one hand the commodities markets have cooled down and prices of the goods are falling constantly. On the other hand, you have the rollover problems," says Ciftci.

Two versions of the certificate are available - the CYD Long Only Index Certificate and the CYD Long Short Index Certificate. The CYD Commodity Index Certificate, dubbed 'the next generation of commodity investments', is managed by the CYD Research company, a German research firm that specialises in the analysis of economic value drivers on commodity futures markets.

The CYD Commodity Indexes include both hard and soft commodities but exclude financial futures on commodities such as gold and silver because the forwards curves of these commodities are always in contango, and hence the contracts reflect mainly financing and storage costs.

"The indexes look for any futures contract that is in backwardation and roll into this contract to avoid roll losses," says Ciftci. "For the long-only version of the certificate, if there are no futures contracts that are in a backwardation, then it will invest in cash. The long-short version goes long on contracts in backwardation and short contracts in contango." Each index has a quanto version to protect against foreign exchange risk.

ABN Amro is not the only issuer to develop new indexes. UBS claims that it is the first to launch a commodity index that covers a broad range of commodities and has a time dimension. The UBS Bloomberg Constant Maturity Commodity Index (CMCI), launched last month, introduces a time dimension by providing access to a range of different investment maturities for each of these commodities.

"The GSCI was designed to reflect the fundamentals of the commodities markets and initally generated positive roll yields for investors," says Jerome Drouin, London-based executive director of commodity index trading at UBS. "This worked well at first, but during the past few years changes in the market have worked against the initial concept."

Drouin is confident that the CMCI will attract investors' attention despite some of their bad experiences with the GSCI, and expects competitors to replicate the index. The index comprises a basket of 28 commodity futures from the energy, precious metals, industrial metals, agricultural and livestock sectors. Investors can choose between constant maturities of three, six and 12 months, and two-to-five-year maturities for certain commodities. This can be done either selectively for individual commodities to diversify over time or collectively for all those included in the index to diversify both across commodities and over time.

The current contango is especially steep at the short end of the market, where most traditional index futures are located, and UBS says the CMCI allows futures exposure at more favourable sections of the futures curve and keeps the exposure there. This prevents the investment slipping into the steeper part of the curve and incurring the associated higher roll costs.

The CMCI keeps the maturity of each component commodity fixed at a specific interval at all times. Constant maturity is achieved by a continuous rolling process in which a weighted percentage of contracts are swapped daily for longer-dated contracts. This enables a more continuous form of exposure and provides a better balance of forward price behaviour than traditional indexes.

UBS's Wasem says the index can be licensed and has attracted interest from structured products providers since its launch in February. "We will offer delta-1 products on the new index in March," he adds.

Commodity bubbles

The amount of capital invested by German investors in index-linked certificates has increased by 16.5% in 2006 compared to the previous year, according to figures provided by Derivate Forum.

What's more, commodities indexes have gained in popularity as an underlying for structured products over the past few years and received formal recognition just over a year ago when the Committee of European Securities Regulators acknowledged their eligibility for the purposes of undertakings for collective investments in transferable securities (Ucits) III.

So it's no surprise that other structured products providers are vying for investors' attention by tapping the commodity indexes market. Deutsche Bank, for example, is also focusing on commodities, says Stefan Armbruster, director, certificates and warrants structuring and marketing at the bank in Frankfurt.

Deutsche Bank has issued index and bonus certificates in Germany linked to the its Liquid Commodity Index, which was was launched in 2003. In May 2006, an Optimum Yield version of the index was launched to address the dynamic nature of commodities term structures. Instead of rolling futures contracts on a pre-defined schedule, contracts are rolled into a futures contracts over the coming 13-month period, which either maximises positive roll yields in backwardation or minimises negative roll yields in contango. The Deutsche Bank commodity indexes have six underlyings: sweet light crude oil, heating oil, gold, aluminium, corn and wheat.

"Our observations show that energy prices have been volatile," Armbruster says. "The Liquid Commodity Index is weighted less towards the energy markets, so the effects of contango and backwardation are less severe than is the case in traditional indexes. But I'm not saying things will stay this way forever."

Demand for commodities has been strong but barriers to investment remain high. And even though methods of investing in commodities include structured products linked to a basket of futures or stocks, some issuers are still keen on launching certificates linked to commodities indexes, according to index provider Deutsche Borse.

The CX index, launched at the end of 2006, charts the performance of 19 commodities in five classes: agricultural products, energy, precious metals, industrial metals and livestock. Sub-indexes have also been created for each class that contains a range of commodities.

According to Heiko Geiger, issuer data and analytics at Deutsche Borse in Frankfurt, a major reason for developing the CX index was to combat the fact that commodities indexes are often associated with certain issuers. For example, the CRB is closely linked to Societe Generale and the RICI is used exclusively by ABN Amro. "We started to market the CX index at the end of last year," Geiger says. "We expect the first certificate to be issued on the index in the first quarter of this year."

The CX index and its five sub-indexes are calculated in dollars and euros, and also as spot return, excess return and total return indexes. The spot return indexes portray only the performance of commodities prices. Excess return indexes also include any income from the futurescontracts, such as the roll return generated when futures positions from an expired contract are rolled over to a new contract. Total return indexes also include interest income on the capital deposited as collateral.

According to Deutsche Borse, back-testing has shown that the dynamic rolling mechanism used by the CX index outperforms both the GSCI and the DJ AIG. "Many issuers are trying to soften the roll losses. For example, Goldman Sachs offers a dynamic roll version of the GSCI, which is apparently similar to the CX Index," Geiger says.

"The difference is that the GSCI dynamics are a black box, whereas CX is strongly rules-based and fully transparent. Nobody knows what they are doing. I think the various investment strategies that are used in the equities and fixed-income markets will be replicated in the commodities market," Geiger says.

David Blitzer, New York-based managing director and chairman of the index committee at Standard & Poor's, says there are no immediate plans to change the GSCI's methodology. "It's a good house, we don't want to tear it down," he says.

Meanwhile, Goldman Sachs is about to launch another benchmark for commodities. "Together with Standard & Poor's, we have constructed a new index consisting of companies with significant exposure to the liquefied natural gas business," says Goldman's Kukies.

Kukies says now is the right time to launch the index. "Natural gas is a more carbon dioxide-efficient energy source than oil and coal and gas-powered stations. The global demand for energy, especially from emerging economies such as China and India, will directly reflect the demand for natural gas," he says. "Instead of pipelines, LNG is a liquid with a high energy density that can be shipped overseas. Due to the new technological standards, the high costs of transporting natural gas can now be reduced."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Commodities

Energy Risk Asia Awards 2025: The winners

Winning firms showcase the value of prudent risk management amid challenging market conditions

Data and analytics firm of the year: LSEG Data & Analytics

Energy Risk Awards 2025: Firm’s vast datasets and unique analytics deliver actionable insights into energy transition trends

OTC trading platform of the year: AEGIS Markets

Energy Risk Awards 2025: Hedging platform enhances offering to support traders and dealers in unpredictable times

Electricity house of the year: Natixis CIB

Energy Risk Awards 2025: Bank launches raft of innovative deals across entire electricity supply chain

Voluntary carbon markets house of the year: SCB Environmental Markets

Energy Risk Awards 2025: Environmental specialist amplifies its commitment to the VCM

Sustainable fuels house of the year: Anew Climate

Energy Risk awards 2025: Environmental firm guides clients through regulatory flux

Weather house of the year: Parameter Climate

Energy Risk Awards 2025: Advisory firm takes unique approach to scale weather derivatives markets

Hedging advisory firm of the year: AEGIS Hedging

Energy Risk Awards 2025: Advisory firm’s advanced tech offers clients enhanced clarity in volatile times