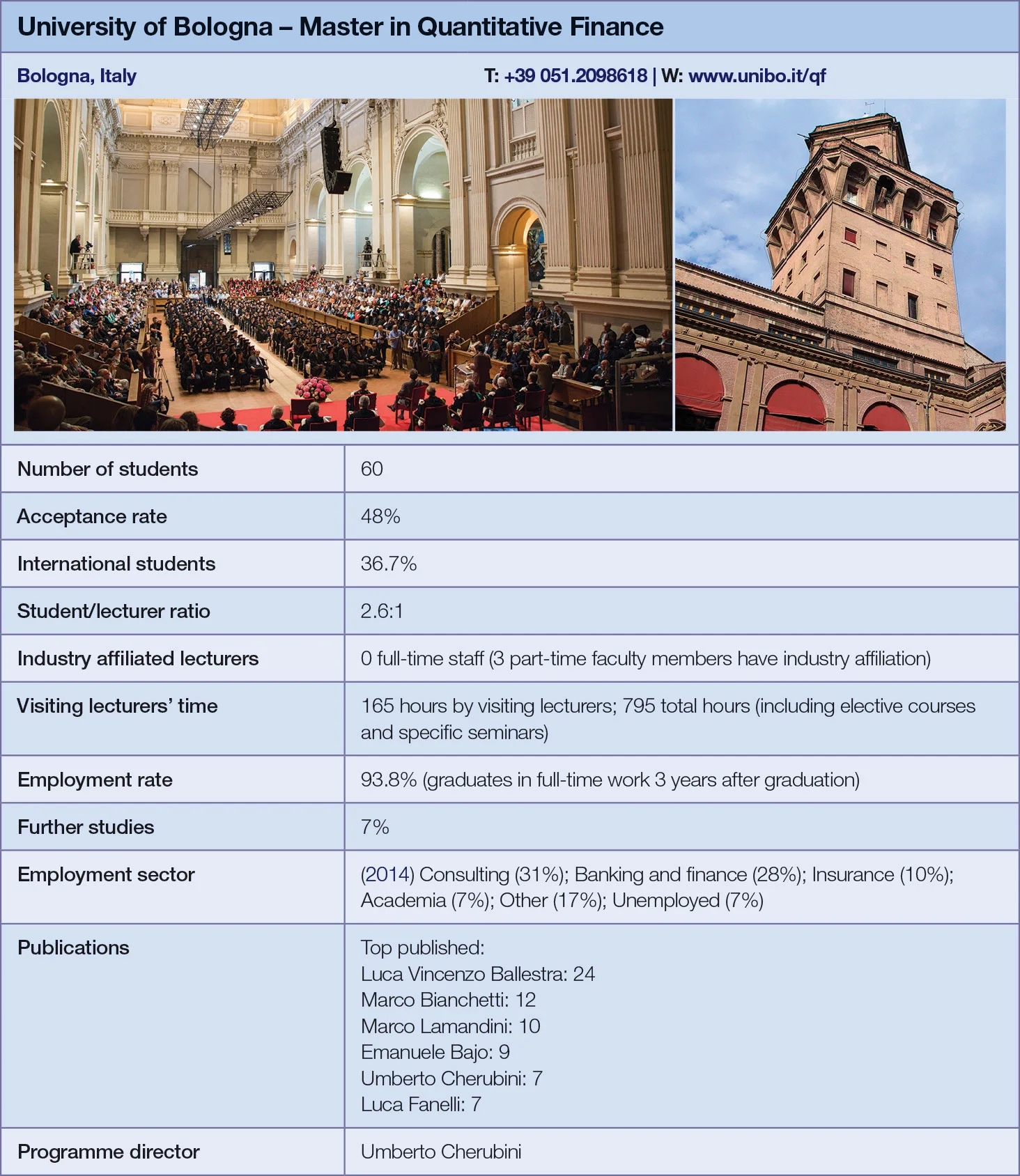

Quant Guide 2017: University of Bologna

Bologna, Italy

Master in Quantitative Finance | metrics table at end of article

In designing its English-language master’s in quantitative finance, the University of Bologna put practitioners at the heart of the process from the start. Their advice led to the introduction of four career-based tracks when the course was launched in 2010: students can specialise either in the pricing of financial products, asset management, risk management – including hedging and capital allocation – or insurance products and actuarial risks.

This year, 43 organisations, including banks, insurers and regulators, contributed their views on how the two-year programme should evolve. They proposed a new module on energy management, which will be launched in the 2017–18 academic year.

The current teaching staff includes three practitioners, among them Marco Bianchetti, head of global fair value policy at Intesa Sanpaolo, who teaches a course on interest rate models. As a result of regular contact with the financial industry, graduates gain skills they can take directly from the classroom to the office.

Jacopo Gardenghi graduated in 2011 with the risk management specialisation and joined KPMG’s financial risk management unit. “I specialised in credit risk at KPMG and my master’s thesis was on credit risk in sovereign bonds and pricing, so it came in very useful,” he says. Gardenghi now works as a portfolio manager and quantitative analyst on the corporate bond desk at Eurizon Asset Management.

Students on the master’s can also gain first-hand experience of the financial industry via an internship.

The programme organisers stress the intercultural environment created by teaching staff from foreign universities, as well as from the University of Bologna. A sizeable share of students – 22 out of 60 in the 2016–17 intake – are from abroad. Students can also spend one or two semesters at a partner university abroad: Ludwig-Maximilians in Germany; Université d’Evry-Val-d’Essonne in France; Karol Adamiecki University of Economics in Poland; and University of Applied Sciences BFI in Austria. UCL Louvain in Belgium may be added in the future.

The Quantitative Finance Alumni Association (QFAA) brings together the programme’s alumni, as well as academics and businesses. Members keep the faculty informed about job and internship opportunities and give presentations about their professional experience. The QFAA LinkedIn group has 155 members and the first reunion of past graduates is planned for 2018.

There is no cap on the total number of students on the master’s but the non-EU intake is limited to 40. The largest proportion of students have backgrounds in economics and finance, followed by students who have studied statistics, and business administration.

“We realised some of them needed stronger preparation in probability and statistics, so we added crash courses starting two weeks before the beginning of classes,” says Margherita de Rogatis, the programme co-ordinator.

There are also crash courses in economics and finance for those who studied mathematics, as well as in computer programming to prepare students for classes in programming languages C++ and MatLab and the Mathematica software.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show