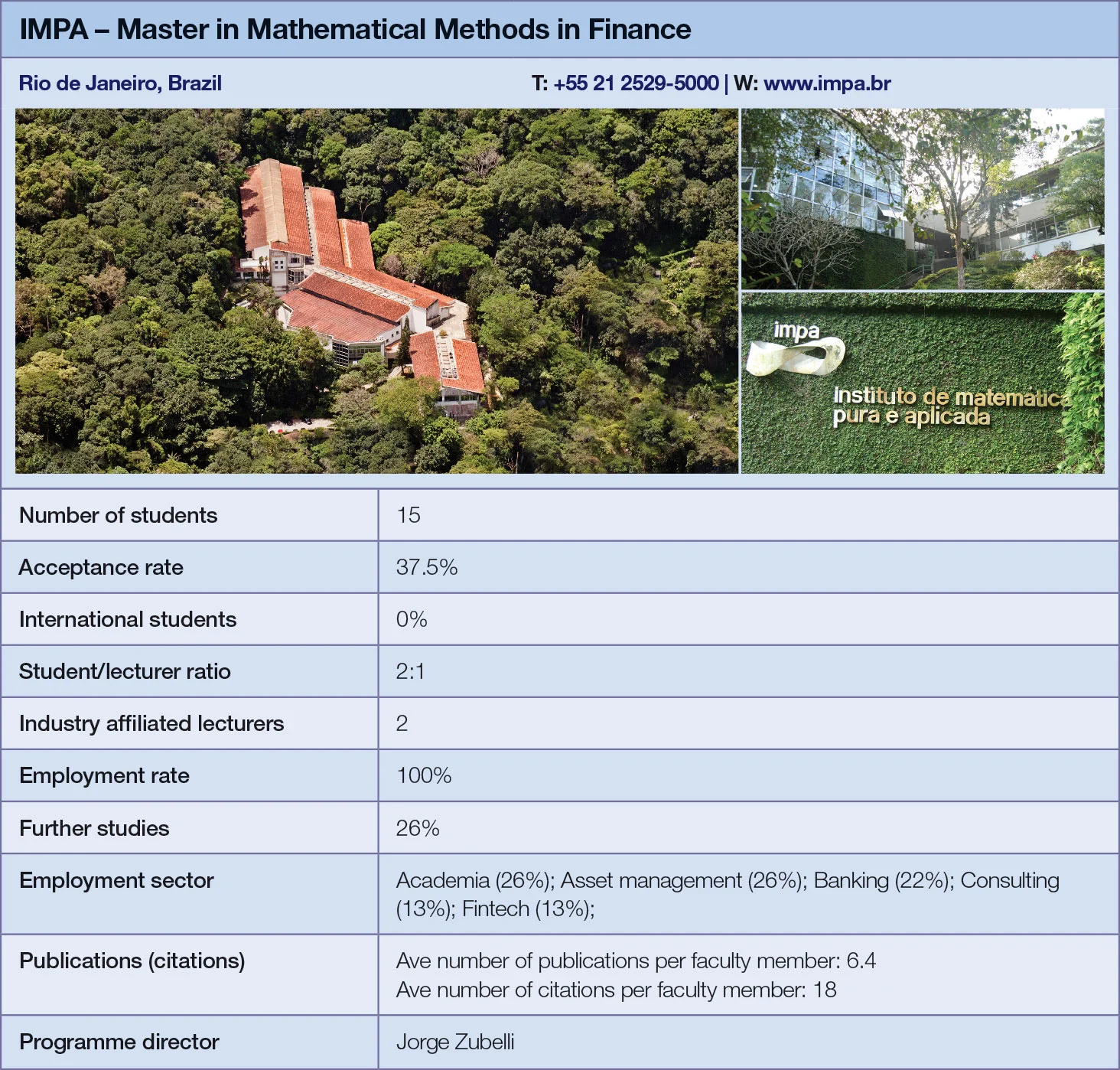

Quant Guide 2017: IMPA

Rio de Janeiro, Brazil

Master in Mathematical Methods in Finance | metrics table at end of article

IMPA, a mathematical institute in Rio de Janeiro, offers a two-year professional master’s course in mathematical methods in finance. Here, rigorous mathematics is given a unique Brazilian twist through its practical application to Brazil’s fixed-income and energy markets.

“The Brazilian market has a number of particularities, and in particular the fixed-income market is full of special details,” says Jorge Zubelli, director of the course. “We make sure we prepare the students for the fixed-income market in Brazil.”

As this market has expanded over the past few years, the use of complex derivatives by participants has increased. This is an evolution the IMPA course has been quick to accommodate. Hence its focus on extreme value problems, says Zubelli, which is where the institute’s statistical background allows it to excel.

However, IMPA has also taken inspiration from other internationally renowned programmes, including Nicole El Karoui’s at Pierre and Marie Curie University and Marco Avellaneda’s at New York University.

Both El Karoui and Avellaneda have gained acclaim for their contributions to mathematical finance – Avellaneda having received Risk’s Quant of the Year award in 2010. He acts as counsellor for the IMPA programme alongside Bruno Dupire; both were involved in planning the course.

The programme is structured to suit industry professionals, with courses taught at weekends and in the evenings. Indeed, most students’ projects are drawn from their own work experience: “It’s highly geared towards the industry, especially the financial industry and the energy industry, and most of our students when they come to the programme already have a job in the financial sector,” says Zubelli. The course therefore offers plenty of opportunities to network with fellow practitioners.

Smaller than most courses in Europe and the US, IMPA’s master’s programme typically receives 40 applicants a year, of whom around 10 are accepted, but the acceptance rate fluctuates with demand. Before the financial crisis, for instance, IMPA regularly accepted 20 students from a pool of 80 applicants.

Most students are Brazilian, and while scholarships for international students have existed in the past, none are currently available. Enrollees are typically drawn from graduates in engineering or mathematics.

IMPA hosts an annual conference on quantitative finance called ‘Research in Options’, now in its eleventh year, which attracts quants from around the world. Quant superstars Dupire and Chris Rogers are regular attendees, alongside practitioners from the Brazilian industry. Some years IMPA hosts additional workshops on specific subjects, such as the energy sector.

Bernardo Lima graduated from the master’s programme in 2007 and now works at Morgan Stanley in New York on the emerging markets desk, conducting quantitative analysis and building trading algorithms for traders. He was previously employed as a quant at Brazil’s Banco BBM.

The attraction of the IMPA course, he says, is the way it teaches its students to approach problems. “I don’t think it’s a very standard programme, in the sense that they spend quite some time going through the background of analysis and a lot of rigorous mathematics, which I imagine many of the other master’s in finance programmes don’t have, but that I do appreciate a lot. It gives you a good way of reasoning that I honestly had not seen before.”

He adds that machine learning and programming are the most important areas of study for aspiring quants today. At IMPA, although the computational module does not include machine learning, students can opt to take elective courses with the computer science group.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director