Quant Guide 2017: Baruch College, City University of New York

New York City, USA

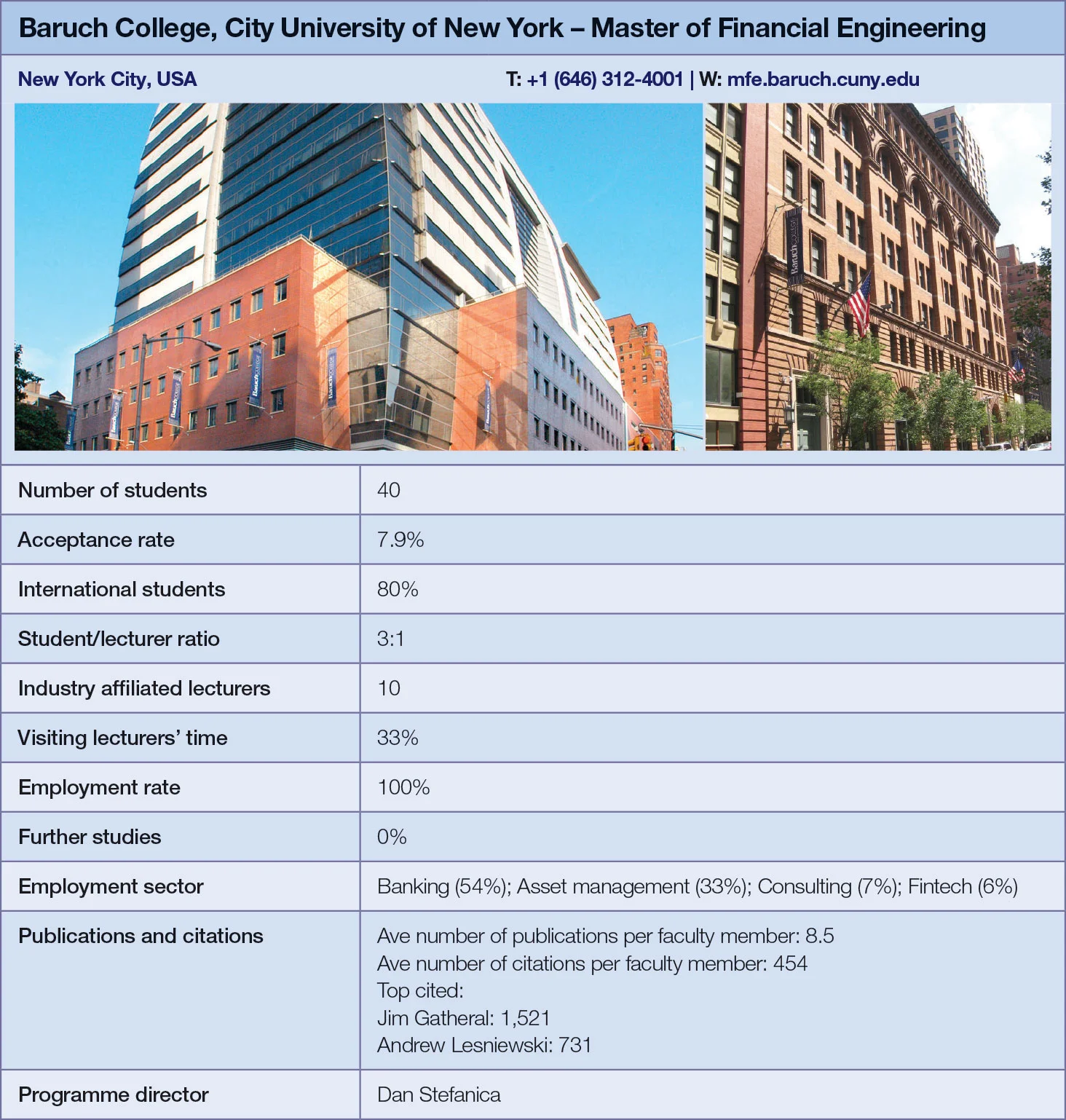

Master of Financial Engineering | metrics table at end of article

Baruch’s master of financial engineering programme was established in 2002. Dan Stefanica, the programme’s director, says admission remains fiercely competitive, thanks in part to the draw of having a number of seasoned industry practitioners on its staff.

In 2010, the mathematics department hired Jim Gatheral as a full-time tenured professor after 17 years as head quant at Merrill Lynch. Gatheral currently teaches elective modules on volatility surfaces and market microstructure models.

“What makes his classes very special to our students is the fact that Jim started as a trader at Bankers Trust. Bankers Trust was the first ever bank that got around the Glass-Steagall Act, and was able to do prop trading,” says Stefanica. “Once Gatheral teaches you, you understand what’s going on and you will not be surprised by what the markets are doing,” he adds.

Andrew Lesniewski, one of the co-creators of the stochastic alpha beta rho (Sabr) model for interest rate volatility, joined as a tenured professor in 2013, and is currently the programme’s curriculum director.

Nikos Rachmanis, who graduated in 2014 and currently works as an exotic equity derivatives trader at BNP Paribas in New York, says the programme’s strong focus on trading has already proved a boon in his career.

“Professors Lesniewski and Gatheral, with their professional and academic experience in quantitative finance, helped me understand where my interest lies. They tell you how things work on each trading desk.”

Since the programme was founded, 20 new courses have been added to the curriculum. Students are required to complete five compulsory modules: a quantitative introduction to pricing financial instruments; software engineering for finance; numerical methods for finance; probability and stochastic processes for finance; and a special project followed by a presentation.

The project asks the student to create a case study inspired by an existing problem in finance, to which they must apply mathematical techniques taught in the programme in search of a solution. Students are then required to present their analysis and conclusions to the faculty and their peers.

The programme prides itself on swiftly reacting to trends within the financial sector. A course on big data – something some universities have only just started to incorporate – has been available at Baruch for five years. The machine learning course has been available for four years, and this autumn a new natural language processing module will be added to the syllabus.

“You would not necessarily associate that with financial engineering; it’s about ways of determining trends in the market, based on news feeds and scraping information off the news,” says Stefanica.

Being able to integrate large datasets from various sources is becoming increasingly important in informing investment decisions.

Another alumnus, Muting Ren, who works as a senior fixed-income quantitative researcher at fund manager AB, says: “The quant profession is now less driven by how to price a specific instrument and more by how you think about a financial business problem. On the investment side, the basic problem we deal with is how to forecast returns on stocks or bonds. There are many different factors: macro factors, company-specific factors – how do you construct those factors, and how do you use them to generate a forecast? How do you think about the robustness of your analysis, and how do you get data? That’s going to be more and more important.”

Students can choose electives offered by the department of mathematics, as well as the university’s Zicklin School of Business. Examples of courses offered by the former include emerging markets and inflation modelling, structured securities valuation, and algorithmic trading. The business school offers electives on modern regression analysis, investment analysis, international financial markets, among others.

Extracurricular activities also play an important role in the overall student experience at Baruch. Students have successfully participated in the Rotman International Trading Competition in Toronto and the International Association for Quantitative Finance student competition.

The typical student intake is between 30 and 40, but the number of seats is not capped. “We admit everyone who is qualified. There are two rounds of interviews before we issue an admission offer,” says Stefanica.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director