Quant Guide 2017: Boston University

Questrom School of Business, Boston, USA

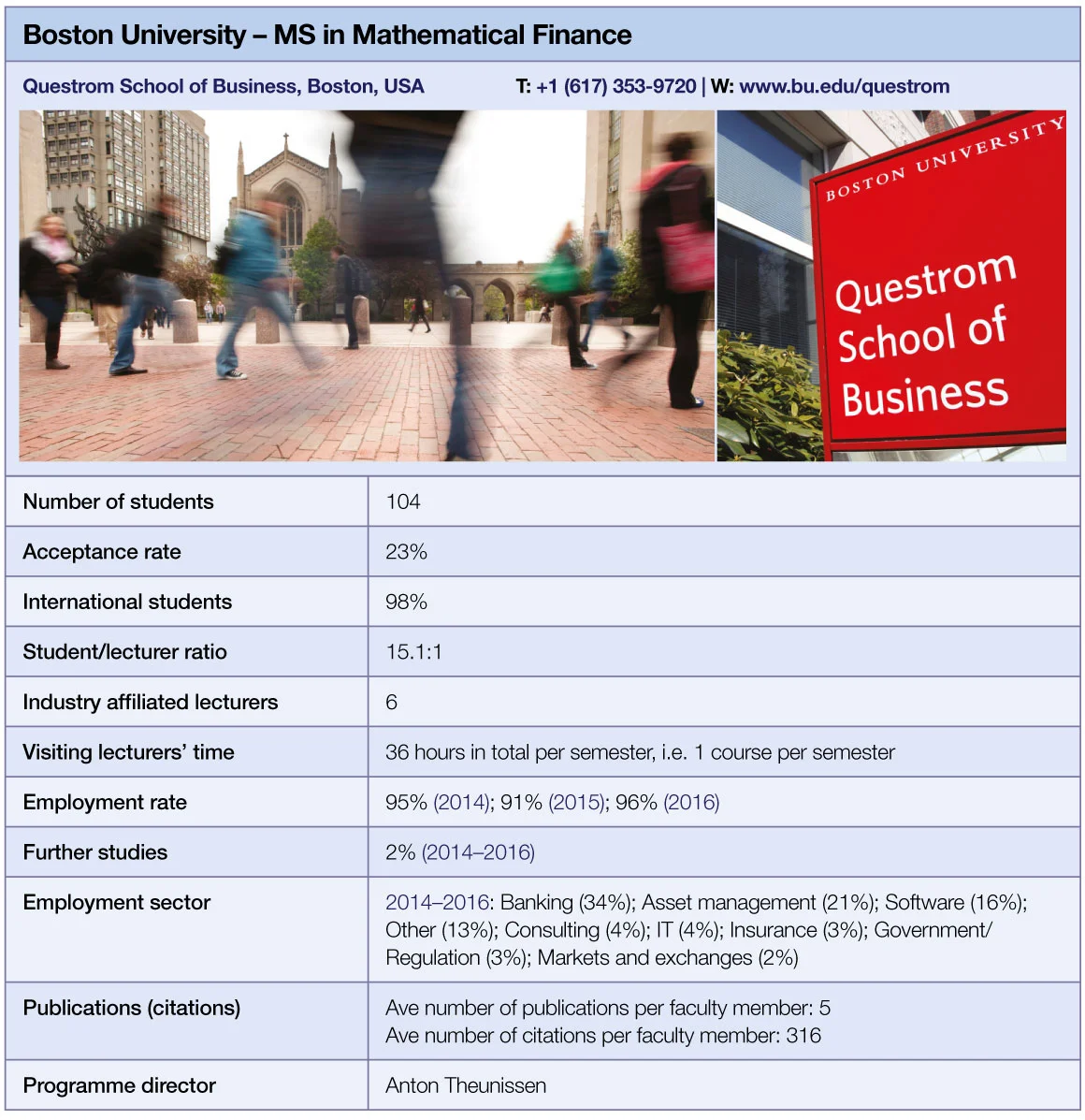

MS in Mathematical Finance | metrics table at end of article

Originally established in 1999, Questrom’s mathematical finance master’s programme offers four distinct tracks: quantitative analytics, asset management, risk management, and analytics and research. The new structure was launched in 2015.

This 17-month degree is a mix of mathematics, finance and computer science which aims to train future traders, quantitative analysts, portfolio and asset managers as well as risk analysts, says programme director Anton Theunissen.

In the first three concentrations, all students cover the same four modules in the first semester: fundamentals of finance – a module that spans financial markets, asset valuation, market completeness and risk measures; programming for mathematical finance, where students learn C++ and Python; statistics for mathematical finance; and methods for asset pricing, which focuses on developing tools from measure-theoretic probability theory and stochastic calculus.

For students on the analytics and research track, the fundamentals of finance module is replaced with a series of doctoral seminars, where they gain a grounding in financial economics.

The programme started with just three students in 1999, but this number rapidly grew and has reached 104 in the 2016 intake. Next year it will accommodate up to 120 students but, due to physical space constraints, there will not be any further expansion in the foreseeable future.

Whereas quantitative analytics and risk management seem to be the most popular tracks with students, the asset management concentration also attracts a high number of applicants.

“Boston is very much a wealth management town, Fidelity are based here,” notes Theunissen.

The business school’s location makes it easier to foster links with the industry. Charles River Development, a financial software vendor, is a major industry partner that often recruits Questrom’s graduates. Students are also frequently approached by Citizens Bank and State Street.

Some 30% of the applicants come from economics and business backgrounds. Unlike many of his peers in academia, Theunissen doesn’t hold any preconceptions about bachelor’s degrees in economics.

“Economics programmes in the US, at least the top 100, do a very good job of preparing students in terms of mathematics. Economics has become increasingly mathematical, even more so than finance,” says Theunissen. He warns, however, that students from traditional business backgrounds might find the transition rather challenging.

Students applying for this programme are required to have prior knowledge of calculus, linear algebra and differential equations as well as basic programming skills. Successful applicants are recommended to complete a maths refresher course, which includes a review of matrix algebra, an examination of the role of calculus in comparative static analysis, unconstrained and constrained optimisation, and dynamics, as well as differential equations of various complexities.

“It’s a mathematical finance programme, so mathematical rigour is what sets us apart. We really do try to attract folks who are looking to carve out careers on the mathematical end of the spectrum,” says Theunissen.

The programme is frequently reviewed and updated to reflect the demands of the financial sector, he adds.

“We have an algorithmic and high-frequency trading course that is relatively new; it’s becoming an integral component in finance. What we’ve been doing in our computational methods course has steadily been changing to reflect ongoing advances in data analysis and machine learning. In the third teaching semester, students can take a course in advanced computational methods and it brings them right up to the cutting edge of machine learning.”

The programme’s administrators aim to ensure that most students gain some practical experience of working in industry, even if they don’t manage to secure an internship; Questrom has launched a summer industry project programme that will allow industry practitioners to give students assignments to work on during the summer break.

International competitions are encouraged, and even sponsored by the business school. This autumn, for example, two teams of students will participate in a portfolio management challenge at McGill University in Montreal.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2026

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch, Princeton cement duopoly in 2026 Quant Master’s Guide

Columbia jumps to third place, ETH-UZH tops European rivals

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director