Having a buy-side voice heard on the Isda board

Enter Isda

As with block trades, many of the changes being introduced in the OTC market affect all of its participants – buy-side firms, trading venues, CCPs and dealers in their executing and clearing roles – so making the market work requires co-operation and co-ordination between the various stakeholders. Isda recognised the problem and, in 2009, broke with 24 years of tradition by asking three buy-side firms to join its board – Axa Investment Managers, DE Shaw and Pimco. A fourth, BlackRock, was added the following year.

That was not a simple step to take, says Bob Pickel, Isda’s New York-based chief executive. “For a long time, the view was that dealers play a different role in the market – I wouldn’t claim they’re neutral, but they are larger and more central to the business, so there was an argument they should be the ones making the decisions at board level that affect the industry. But, over time, people realised that was a difficult position to defend and, while including buy-side firms might lead to more challenging debates, it was better to include them and have those debates, rather than trying to just force something on the market,” he says.

The buy-side board members recognise the shift was not an easy one for the association – and welcome it. “Isda has continued to evolve as the market has changed. The addition of buy-side members to the board means it has become more balanced in how it addresses issues that affect the entire industry – given its historical background of being sell side only, this is a big step forward,” says Pimco’s De Leon.

“Isda was predominantly a dealer-oriented organisation – the board of directors was solely a dealer group. That changed just over two years ago when myself and two other buy-side representatives joined the board. So Isda has been actively working to bring the buy side into the dialogue – to be the voice of the industry, rather than the voice of one part of the industry,” says DE Shaw’s Macdonald.

That was not necessarily an altruistic move. If Isda had remained an organisation run by dealers, it could have found its influence and relevance limited in a world where a single trade may involve organisations playing at least eight different roles – executing broker and client, trading venue, trade affirmation, clearing broker, clearing house, repository, and regulator.

“There was a realisation that the market is moving towards more interconnected, sophisticated and complex business models where you need different market participants at the table to tackle issues that impact everybody,” says BlackRock’s Vedbrat. BlackRock is represented on the Isda board by Stuart Spodek, a managing director and member of the firm’s fixed-income executive committee, but Vedbrat represents the company on Isda’s industry clearing committee, a new body the association created last year that brings together dealers, asset managers, hedge funds and CCPs to help speed up the adoption of central clearing.

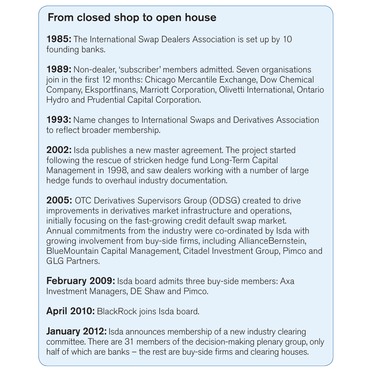

A cynic might say the association recognised it had a credibility problem in an environment where politicians, press and public – rightly or wrongly – see derivatives as a cause of the financial crisis, and had to involve the buy side or be ignored. Not Isda’s Pickel – he argues the association had been moving in this direction for some time (see box, From closed shop to open house).

But BlackRock’s Vedbrat says buy-side voices tend to be heard more readily in the current environment. “My sense is that politicians and regulators want to hear from all market participants directly in order to have a credible, consensus-driven solution. Part of the agenda for the regulation is customer protection – and the buy side is the customer. So, when we’re voicing our concerns about potential gaps in protections that have been defined for us, regulators listen to that,” she says.

Pickel concedes that Isda’s engagement with regulators takes a different tone when buy-side firms are involved. He gives the example of a series of meetings with the chairman of the CFTC, Gary Gensler. “About a year ago, chairman Gensler contacted me and other groups in other organisations and wanted to start a discussion about implementation issues for all the rules they were working on, particularly related to clearing, but also other things like transparency and trading. So we had a series of meetings and we brought in not just the dealer firms, but also several asset managers and other buy-side representatives. And, frankly, more of the discussion was led by the buy-side guys, who wanted to emphasise that some of these decisions were going to have significant effects on their business. It was very effective to be there with both the buy side and sell side when discussing the issues,” he says.

Working together

It is not always a happy marriage. While the various protagonists in the OTC market have a common interest in ensuring it works efficiently, fundamental decisions still need to be made about which actors will bear risk, how much risk they will take, and how they are compensated for doing so. Those discussions can be painful. The prime example is the so-called give-up agreement, a joint venture between Isda and the Futures Industry Association.

The agreement was an attempt to create legal clarity around the post-execution and pre-clearing responsibilities of an executing broker, a client and the client’s clearing member for transactions that are not executed on a trading platform. It laid out what the parties needed to do – and how long they had to do it – when confirming details of a trade. It also described remedies if a trade failed to clear, including a possible compensatory payment by one counterparty to the other.

Dealers believe clearing fails will most often be the result of a client discovering – post-execution – that it has run out of credit with its clearing member, so the agreement included an optional annex in which the clearing member could also be liable to pay compensation in the event of a fail. However, it was able to manage that risk by pre-agreeing limits for its client with a number of different executing brokers.

The document caused a storm after it was published in June last year, with buy-side groups arguing the annex was a sneaky way of enabling clearing members to steer business towards their affiliated trading desks, and for the big dealers to limit the ability of clients to spread their execution business around a broader swath of the market. The CFTC accepted those arguments, rushed out a rule prohibiting elements of the annex, and – at a meeting in March this year – voted to adopt that rule. But the discussions that led to the publication of the agreement were just as stormy, and the inclusion of the annex – giving the market two very different options – was essentially because the two sides of the debate had been unable to compromise.

“I’d say the buy and sell sides were gridlocked on this for close to 14 months. We started talking about it at the end of 2009 and, in the end only agreed as it accommodated terms for each market participant – although still not everyone was completely happy with the outcome,” says BlackRock’s Vedbrat.

“There was clearly a difference of view and, if things are truly at loggerheads and you can’t get consensus, all you can do is give the market an option and leave it up to the counterparties to agree,” says Isda’s Pickel. “A similar thing can sometimes happen with comment letters, where you end up reflecting two different views. That’s not particularly persuasive when you send it to a regulator, but it’s the most honest way to reflect the diverging views of the membership.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…