Supply shortage hits bond investors

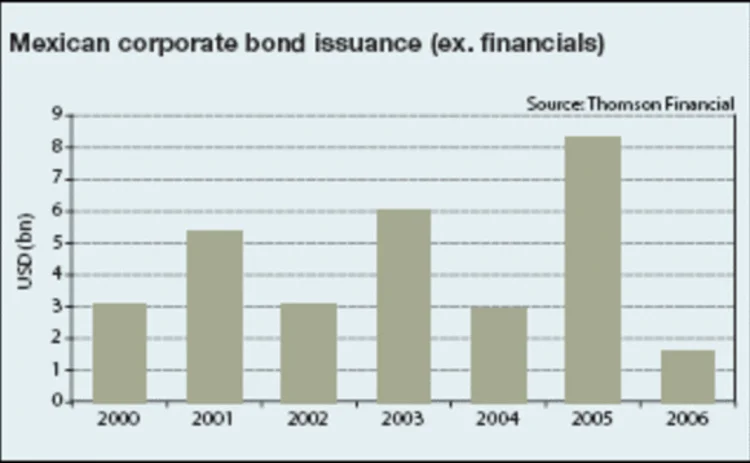

Stringent rules preventing Mexican pension funds from investing in non-investment grade corporate bonds and a limited pool of issuers capable of achieving high-grade ratings have led to a damaging supply/demand imbalance in Mexico's bond markets. Alan McNee reports

Mexico has come a long way since the 'Tequila Crisis' of 1994-95, when a sudden devaluation in the peso spelled disaster for the recently privatised banking sector. The recapitalisation of the sector has been achieved by allowing foreign players to buy up or take stakes in Mexican banks. This economic liberalisation has led to a period of impressive financial stability and capital markets growth.

Initial fears that the new government of President Felipe Calderon would face a constitutional crisis

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Printing this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. Copying this content is for the sole use of the Authorised User (named subscriber), as outlined in our terms and conditions - https://www.infopro-insight.com/terms-conditions/insight-subscriptions/

If you would like to purchase additional rights please email info@risk.net

More on Economics

Webinar – Nowcasting the US economy

Join CME Group Chief Economist, Blu Putnam, as he shares insights using alternative data and nowcasting to monitor developments in the US economy.

Fed Funds Futures in a Post-ZIRP World

As the FOMC returns to more active management of its key target rate, Federal Funds futures have experienced dramatic growth.

Challenging economic pessimism: an optimistic note

A contrarian, upbeat view of the long-term economic outlook

Economists, like hedge fund traders, need open minds

Economists, risk managers and traders must learn the lessons of crisis, says Kaminski

Fed wrong not to start QE tapering, says UBS economist

The surprise decision by the Federal Reserve last month not to scale back its quantitative easing programme will create more volatility, says economist

IMF's Blanchard warns Europe could drag world economy down

IMF chief economist says ‘three-speed’ global economy could be dangerous

Most read

- Top 10 operational risks for 2024

- Japanese megabanks shun internal models as FRTB bites

- Market for ‘orphan’ hedges leaves some borrowers stranded