Solvency II

A case for convergence?

Bank capital

A matter of state

State pensions

Pillars of wisdom

Capital assessment

Making progress

Basel II

RiskNews

RiskNews

Prospectus prospects

The European Union's Prospectus Directive is meant to provide a single regulatory framework for structured products across Europe. Some dealers believe it is already having a positive effect on the Italian market. Others remain cynical. By John Ferry

A pillar of solvency

Paul Sharma, head of policy for banking, insurance and securities at the UK's Financial Services Authority, talks about life at the sharp end of insurance reform. Nicholas Dunbar reports

Clash of the regulators

As the pace of the Solvency II process to reform European insurance supervision quickens, British and French regulators have clashed over the use of market-consistent solvency requirements, to the alarm of proponents of risk-based supervision.

Making progress

The recovery in Japan’s banking sector means that country’s banks are closer to meeting the minimum capital adequacy requirements of Basel II than was anticipated even 12 months ago. However, challenges remain, particularly with regards to data. By John…

No quick fix for US pensions

US Pension Reform

Louis Hagen

Profile

More moves towards MiFID implementation

REGULATORY UPDATE

A pillar of solvency

Regulator Q&A: Paul Sharma

Prospectus prospects

Regulation

A step up the ladder

Following Barclays' acquisition of Absa in July, the South African bank has decided to implement the advanced internal ratings-based approach to Basel II. Other banks have decided to follow suit. By Laurence Neville

Mixed signals for derivatives

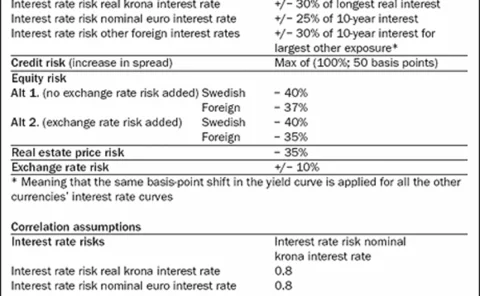

New solvency regulations in Sweden will force life insurers and occupational pension funds to mark their liabilities to market and stress test their positions under a new 'traffic light' regime. While the final result is unclear, the new rules look set…

More IT for MiFID

MiFID's success hinges on IT prospects, write Choongo Moonga and Phil Craig . But many in the industry are balking at the costs involved

A step up the ladder

Basel II

Mixed signals for derivatives

Solvency reform

UK Treasury proposes delay for MiFID

REGULATORY UPDATE

Direct access

Hedge funds

A step up the ladder

Basel II