Infrastructure/People

Isda publishes FpML 3.0 specs

The International Swaps and Derivatives Association has released the working draft of FpML 3.0, which aims to increase the coverage of the standardised, electronic language to cover foreign exchange over-the-counter contracts such as forex forwards and…

On a stronger footing

E-trading

Open practice

Profile

Rising levels of interest

Interest rate derivatives

Losses and lawsuits

LOSS DATABASE

The Risk 2002 commodity & energy derivatives rankings

Volatile energy markets, plummeting metals prices, September 11 and the implosion of Enron: 2001 was an eventful year for the commodity and energy derivatives markets. Kevin Foster and John Ferry introduce our annual rankings of dealers and brokers

Credit portfolio products proliferate

Large fixed-income investors want to take or shed sizeable diversified credit positions efficiently, without incurring lot cost or liquidity risk. Dealers are responding with a variety of new products. But which will succeed?

Awake at the wheel

While the markets worried that Dynegy could follow Enron into the abyss, Glenn Labhart’s risk management team helped to keep the trading firm out of trouble.

Job moves

QUOTE OF THE MONTH: - “I can’t get rid of the stupid thing” Lev Borodovsky, co-founder of Garp, describing difficulties negotiating a transfer of ownership Source: RiskNews, January 16

Lighting the fuse

China

Boom or bust?

In volatile markets, technology must enable managers to navigate these difficult conditions. Can the current systems feed the market?

In search of clarity and focus

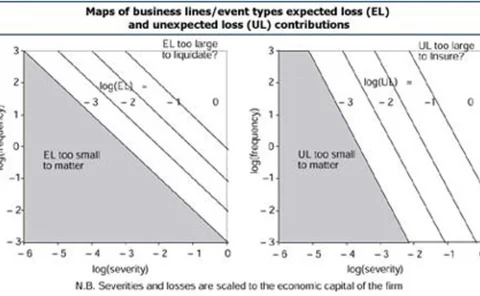

Greater precision is needed in defining operational risk, but the Basle regulators' latest thoughts are lost in generalities, says Jacques Pézier, in the final article of a three-part series.

Basel shortcomings: Danger lurks on the rocky road to Basel II

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

Approach with caution

Indicators of operational risk are not for the faint of heart, nor are they necessarily bearers of good news. But used properly and effectively, they can help businesses identify potential losses before they happen.

Basel II sets the pace for operational risk reform

Basel II is set to come into play in 2005, bringing a host of opportunities for vendors along with the new framework for banking supervision. Andrew Partridge examines the potential and some of the challenges for the suppliers and users of financial…

The Basel Accord: A tough nut to crack

Crafting a capital charge for operational risk has proven to be a project fraught with controversy. International regulators’ first attempt raised the industry’s hackles. David Keefe reports on recent – and further expected – compromises by the Basel…

2002 the year ahead

Market overview

Utilities: Enron’s ripple effect

Cover story

In search of clarity and focus

BASLE II UPDATE