Feature/Commodities

Basel shortcomings: Danger lurks on the rocky road to Basel II

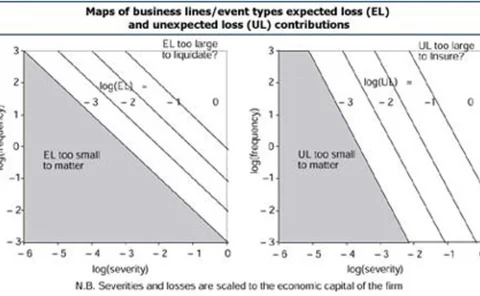

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

Regulators want active dialogue on op risk

BASEL - Active dialogue between banks and their supervisors is the key to the continued development of approaches to managing operational risk, global banking regulators said in a much-delayed paper on op risk sound practices issued in December.

Basel II sets the pace for operational risk reform

Basel II is set to come into play in 2005, bringing a host of opportunities for vendors along with the new framework for banking supervision. Andrew Partridge examines the potential and some of the challenges for the suppliers and users of financial…

2002 the year ahead

Market overview

Utilities: Enron’s ripple effect

Cover story

Regulators want active dialogue on op risk

BASLE II UPDATE

The silver lining

Enron’s collapse could ironically give a boost to the telecoms market, as Enron Broadband Services bows out of the limelight. By Laurence Neville

Job moves

QUOTE OF THE MONTH: - “The FSA has successfully put the fear of God into senior managers” Simon Gleeson, a partner in the regulatory group at Allen & Overy in London, on the FSA’s new unlimited liability rules for risk management errors Source: RiskNews,…

Race to replace Enron in freight

Sarfraz Thind talks to firms with the potential to take up the slack following Enron’s departure from the freight derivatives market

Fallout for energy markets

Enron’s collapse led to short-lived increases in electricity and natural gas volatility. As the markets settle down, the question now is who will fill Enron’s shoes? By Kevin Foster

Software survey 2002 |

Some online risk management products failed to live up to expectations last year, but software vendors forge ahead, developing products that support fast-growing markets such as credit derivatives and CDOs, and tools to help banks meet Basel II…

Enron and systemic risk

Regulators worry that concentrating derivatives market-making in a few major dealers poses severe systemic risk issues. Could one big player’s failure break the whole system? David Rowe says Enron is an ideal test case, with some encouraging indications

Brokers allocate $4.6 million WTC disaster relief

The world’s seven leading interdealer brokers have determined which charity funds will receive the $4.6 million they raised as disaster relief for victims of the World Trade Center terrorist attacks on September 11.

Kiodex set to lose EnronOnline deal

Kiodex, the Web-based risk management solutions firm, is steeling itself to lose its co-marketing agreement with EnronOnline, following the US energy company's filing for bankruptcy protection.

ICE moves into UK gas and power market

Atlanta-based electronic energy and commodities trading exchange, the Intercontinental Exchange (ICE), is introducing its trading platform into the UK gas and power markets.

Japan's non-performing loans undermining economy

Tokyo could be in danger of losing its standing as a top financial centre, unless efforts are made to restructure the economy and cure Japanese banks' vast non-performing loans problem, warned Bank of Japan official Hiroshi Nakaso, speaking at Risk…

Algo includes S&P for Basel II

Algorithmics is strengthening its credit risk management offering as demand grows for more comprehensive credit solutions. It is integrating a number of Standard & Poor’s credit data products with its analytical tools and developing a new module to help…