RiskMetrics

Performance of value-at-risk averaging in the Nordic power futures market

The authors investigate the performance of various value-at-risk (VaR) models in the context of the highly volatile Nordic power futures market, examining whether simple averages of models provide better results than the individual models themselves.

Commodity value-at-risk modeling: comparing RiskMetrics, historic simulation and quantile regression

The authors of this paper investigate the risk modeling of commodities. They note that return distributions differ widely across different commodities, both in terms of tail fatness and skewness.

Risk USA: Regulators need different focus to risk managers, says SEC risk adviser

Different approaches taken by regulators and risk managers are justified, according the SEC’s Gregg Berman

Stressed VAR questioned by risk managers

Basel 2.5 capital charge incoherent and challenging to implement, say risk managers

RiskMetrics: Z-Metrics credit analysis tool

RiskMetrics: Z-Metrics credit analysis tool

Can reputational risk be measured

Reputational risk will often come hand in hand with operational risk, but it has yet to be taken as seriously, if it is even considered at all. David Benyon finds out why, and asks what might be done to resolve this situation

Kjaer joins RiskMetrics as president

Knut Kjaer, former chief executive of Norges Bank Investment Management - a division of the Norwegian central bank that oversees the $370 billion Government Pension Fund of Norway and the country's foreign reserves - has been appointed president of New…

Measure for measure

Compliance Tools

From Basel II to Basel III

Financial institutions face major challenges in modelling credit portfolio risk, particularly in the field of CDOs. Walter Schulte-Herbrüggen and Gernot Becker argue that the main challenge will be in model testing, due to the increasingly customised…

EBRD selects S&P portfolio risk tool

The European Bank for Reconstruction and Development (EBRD) has chosen Standard & Poor’s (S&P) portfolio risk tracker (PRT) tool for its treasury operations. The move represents a blow to rivals Moody’s KMV and RiskMetrics, whose product, CreditManager,…

RiskMetrics’ re-capitalisation tops venture capital deal table

A cash injection into RiskMetrics Group of $122 million by private equity investors last month was the largest venture capital deal of the second quarter.

Reporting: a better performance measure

Past performance is no guarantee of future returns. RiskMetrics' John Matwey says more and more investors will therefore inevitably demand third-party reporting of risk positions taken by hedge funds.

RiskMetrics' head of quant research joins Clinton Group

RiskMetrics' head of quantitative research, Allan Malz, has left to join New York investment company the Clinton Group, said a RiskMetrics spokesman.

Summit Systems names prominent hires in New York

Software vendor Summit Systems has made a number of appointments for its New York office. The hires include the return of co-founder Kathy Perrotte to the vendor after a one-year sabbatical.

Risk transparency without position transparency

When high-profile blow-ups hit the headlines, calls for greater transparency come to the fore. By Peter Davies, vice-chairman, RiskMetrics Group

RiskMetrics sees demand growing for ASP platforms

The adoption of application service provider (ASP)-based financial risk management systems is increasing rapidly, according to RiskMetrics.

Trying to model reality

Credit Risk

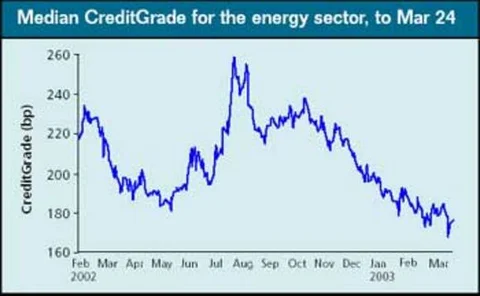

Credit watch

In this month’s analysis of energy firms’ credit quality via Riskmetrics’ CreditGrades tool, Williams and El Paso are among those with tighter spreads

RiskMetrics acquires on-line technology from JP Morgan Chase Private Banking

New York-based risk technology vendor RiskMetrics has acquired Arrakis, the technology platform developed by JP Morgan’s Private Banking Group in 1999 to support the bank’s online site for clients, Morgan OnLine.

Pension fund risk systems advance

Vendors seeking to cater to pension fund clients are rolling out a new breed of asset/liability risk analysis tools to complement risk reporting and benchmarking systems, all tailored to the unique needs of these institutions.

SEI links with RiskMetrics to improve hedge fund risk reporting

SEI Investments, an alternative investment fund service based in Pennsylvania, has teamed up with New York-based risk analytics company RiskMetrics in a bid to solve the discrepancy between investors seeking accurate risk reporting from hedge funds and…