Economic capital

US focus: Economic evolution

Economic evolution

On the use of t-copulas for economic capital calculations

Research Papers

Op risk appetite: Do firms have a balanced diet?

A balanced diet?

Vote in the 2010 Risk magazine technology rankings

Vote for the top vendor in a variety of risk management and derivatives trading technology categories.

If it's broke..

Economic capital models

BIS speaks out on economic capital calculation

Daily news headlines

The liquidity link

Liquidity risk

A unifying approach

Economic capital

What's happening at JP Morgan Chase?

Recently, many have come forward to ask me what is going on within JP Morgan Chase's risk management division. Over the past year, a number of people have left the operational risk team, both at the corporate and business unit levels. Risk executives in…

Time for multi-period capital models

Several financial institutions use single-period models to determine their credit portfolio loss distribution, calculate their loss volatility and assign economic capital. Here, Kevin Thompson, Alistair McLeod, Panayiotis Teklos and Shobhit Gupta…

Time for multi-period capital models

Several financial institutions use single-period models to determine their credit portfolio lossdistribution, calculate their loss volatility and assign economic capital. Here, Kevin Thompson,Alistair McLeod, Panayiotis Teklos and Shobhit Gupta…

The 'benefits' of smoothing

For a specific with-profits life insurance model, this article considers the amount of economic capital that is required to back smoothing benefits for a with-profits life insurance firm

Take the SunGard survey on Basel II perceptions and economic capital and you will be entered in a draw to win a lobster meal for two

SunGard is surveying Basel II perceptions and economic capital.

Estimating economic capital allocations for market and credit risk

Value-at-Risk (VAR) measures often are used as a basis for setting so-called"economic capital" or buffer stock measures of equity capitalization requirements.VAR measures do not account for the time value of money or theequilibrium required return…

Sponsor's Article > Managing Capital in Financial Institutions

Capital is key to any financial institution. Companies in other industries need capital to buy property and production equipment. For financial institutions, the primary function of capital is to cover unexpected credit and market risks losses, because…

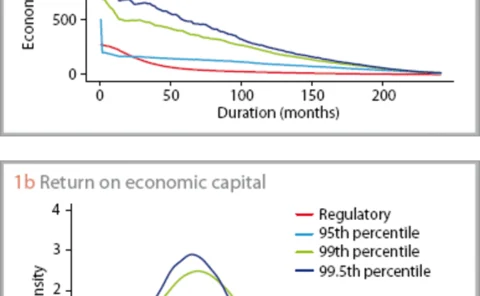

Observations on the differences between operational risk regulatory and economic capital

In this article, Niklas Hageback takes a practical look at the difficulties in reconciling regulatory and economic capital calculation in the discipline of operational risk.

Economic capital – how much do you really need?

Economic capital is becoming the language of risk. While market, credit and operational risk have different determinants and use different methodologies, the levels of risk can all be summarised in a common dimension – the amount of economic capital…

Unexpected recovery risk

For credit portfolio managers, the priority is to properly incorporate recovery rates into existingmodels. Here, Michael Pykhtin improves upon earlier approaches, allowing recovery rates todepend on the idiosyncratic part of a borrower's asset return, in…