Basel III

WHAT IS THIS? Basel III is a set of bank soundness rules drawn up by the Basel Committee on Banking Supervision in response to the financial crisis. It hikes the minimum amount of capital banks must hold, introduces new leverage and liquidity ratios, and limits the use of internal models.

Basel closes in on IM offset for leverage ratio

US seen as obstacle to consensus; committee expected to allow netting of margin against PFE only

Basel set to update op risk and resilience principles

Op risk working group to issue core ‘indicators of resilience’ proposal as update to 2011 principles

Can European banks crack the capital allocation code?

Banks “stuck on the same feedback loop” due to sheer weight of capital rules

US banks’ liquidity buffers thinnest among G-Sibs

Mean LCR of US banks hits 122.5% in Q1

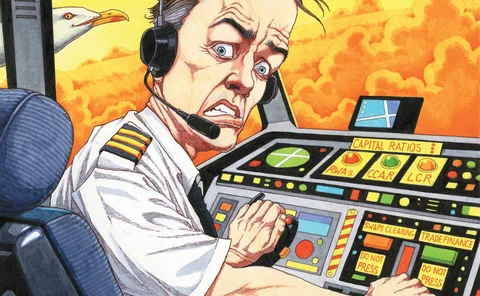

How capital rules overwhelmed bank strategy

Regulators shouldn’t run a bank – but Basel III and stress tests have put them in the cockpit

Fresh scrutiny for Europe’s SME capital carve-out

FSB’s Knot urges conformity with global standards

Capital allocation under the Fundamental Review of the Trading Book

Quants propose an allocation method for internal model capital charges

Basel Committee frets over poor member discipline

Tsuiki warns on fragmentation risk as countries delay NSFR, FRTB implementation

Eurozone systemic risk diminishes

Yet jumbo exposures to other banks dominate intra-system assets

Can bankers stop the trading book killer?

FRTB won’t obliterate your whole markets business any more, just some very specific parts

Fund-linked structured products face extinction under FRTB

Global market risk capital standards carry sky-high charges for fund derivatives

Banks rethink fund-linked trades ahead of FRTB

Some stop offering longer-dated structured products ahead of expected 2023 rules in EU

BoE to scrutinise banks’ op risk tolerance limits

Watchdog says banks must prove they can stick to tolerance limits; cyber stress test planned

Aussie banks crush IRRBB capital charges

‘Big Four’ cut IRRBB RWAs by A$23 billion year-on-year

Whose leverage ratio is it anyway?

Basel's capital backstop has been distorted out of shape by supervisory meddling

Final FRTB tweak ‘will kill correlation trading’, say dealers

Some European banks plan to lobby ECB for relief when rules are transposed to local law

ING offloads stake in Indian bank, bringing capital relief

Market RWAs drop €2 billion following asset sale

LCR surges at UBS as HQLA billows higher

Ratio of liquid assets to stressed cash outflows hits 154%

US swaps end-users cry foul over SA-CCR punch

Capital on non-margined trades jumps 90%, and energy firms face double hit

Basel NMRF changes don’t solve Asian data challenges

Isda AGM: Asian regulators may still need to soften FRTB standards locally, warn bankers

Goldman welcomes Basel’s rationalisation drive

Isda AGM: Praise for efforts to curb fragmentation, but EU official defends rollback of deference

EU G-Sibs add €2.7bn of op RWAs in 2018

Op risk charge anticipated to jump €21.5 billion under Basel III

Data gap leaves six foreign banks in US regulatory limbo

New Fed FBO proposal relies on an indicator that banks have not yet been reporting

US G-Sibs owned over $50bn of other banks' capital in 2018

BofA Securities held the most of the group at $10.9 billion